November 05, 2024

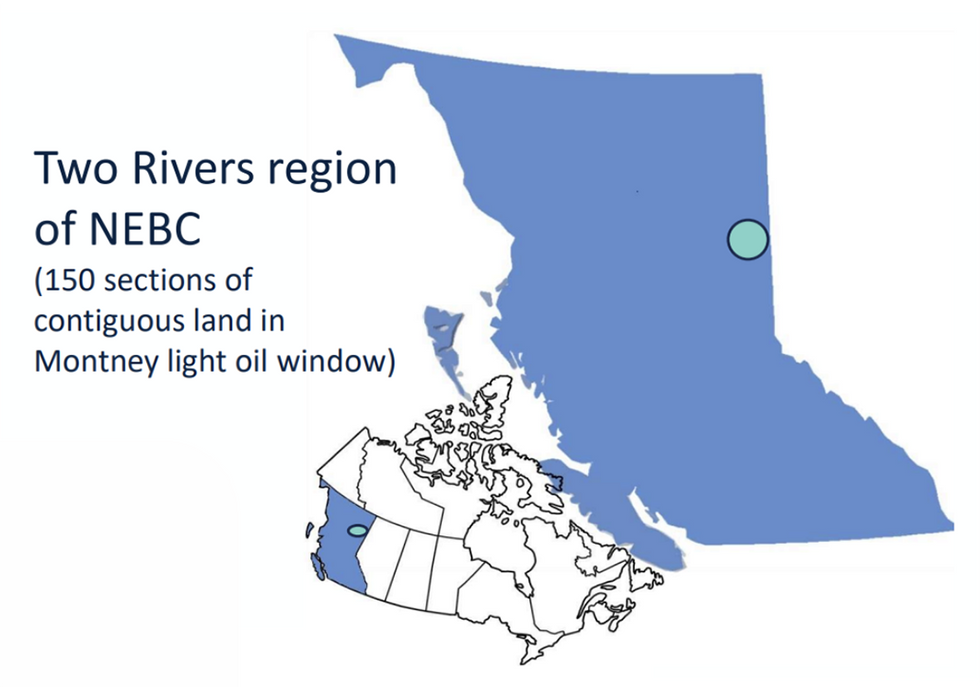

Coelacanth Energy (TSXV:CEI) is a junior oil and natural gas exploration and development company exploring the prolific Montney region in northeastern British Columbia, Canada. Coelacanth is strategically positioned to harness the potential of one of the most resource-rich natural gas basins in North America with a substantial landholding of approximately 150 net sections in the Two Rivers area of Montney.

The company is in the process of deploying $ 80 million to facilitate the smooth transition from exploration to production. Coelacanth’s financial health is further evidenced by its $64.4 million in working capital as of Q2 2024.

Coelacanth’s landholdings are strategically located in the Two Rivers area of Montney, giving it access to a highly productive portion of the basin. Unlike many junior exploration companies, Coelacanth is drill-ready, positioning it favorably among its peers. By securing significant infrastructure and landholdings, Coelacanth ensures its ability to tap into the natural gas and oil resources that lie beneath its properties, a key advantage in the competitive Montney region.

Company Highlights

- The company holds approximately 150 net sections of land in the Two Rivers area, a prolific oil and liquids rich natural gas region.

- Coelacanth is fully permitted and financially secure, with $64.4 million in working capital as of Q2 2024 and a $52 million credit facility with its main lender.

- The company is spending approximately $80 million to construct pipeline and facility infrastructure to bring production on in April 2025.

- The company’s strategic location in Montney places it near major producers like ARC Resources, Tourmaline Oil Corp, Shell, and ConocoPhillips.

- Two Rivers East, its primary project, boasts 1,532 (thousand barrels of oil equivalent) mboe per well in proved and probable reserves.

This Coelacanth Energy profile is part of a paid investor education campaign.*

Click here to connect with Coelacanth Energy (TSXV:CEI) to receive an Investor Presentation

CEI:CC

Sign up to get your FREE

Coelacanth Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

23 January

Coelacanth Energy

Light oil and natural gas exploration and production in the prolific Montney region in British Columbia

Light oil and natural gas exploration and production in the prolific Montney region in British Columbia Keep Reading...

06 February

Syntholene Energy Corp. Announces $2.0 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it intends to complete a non-brokered private placement of... Keep Reading...

05 February

Angkor Resources Celebrates Indigenous Community Land Titles and Advances Social Programs, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 5, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") is pleased to announce that nine Indigenous community land titles have been formally granted to Indigenous communities in Ratanakiri Province, Cambodia, following a... Keep Reading...

05 February

Syntholene Energy Corp Strengthens Advisory Board with Former COO of Icelandair Jens Thordarson

Mr. Thordarson brings two decades of expertise in operations, infrastructure development, and large-scale business transformation in the aviation industrySyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces the nomination of Jens... Keep Reading...

04 February

The Future of Aviation is Synthetic: Syntholene CEO Highlights Growing Demand for E-Fuel

The global aviation industry is entering a period of rapid transition as airlines seek low-carbon fuel alternatives that meet both performance and regulatory demands. It’s a market Syntholene Energy (TSXV:ESAF,OTCQB:SYNTF) is aiming to supply through its breakthrough synthetic fuel, or... Keep Reading...

Latest News

Sign up to get your FREE

Coelacanth Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00