November 05, 2024

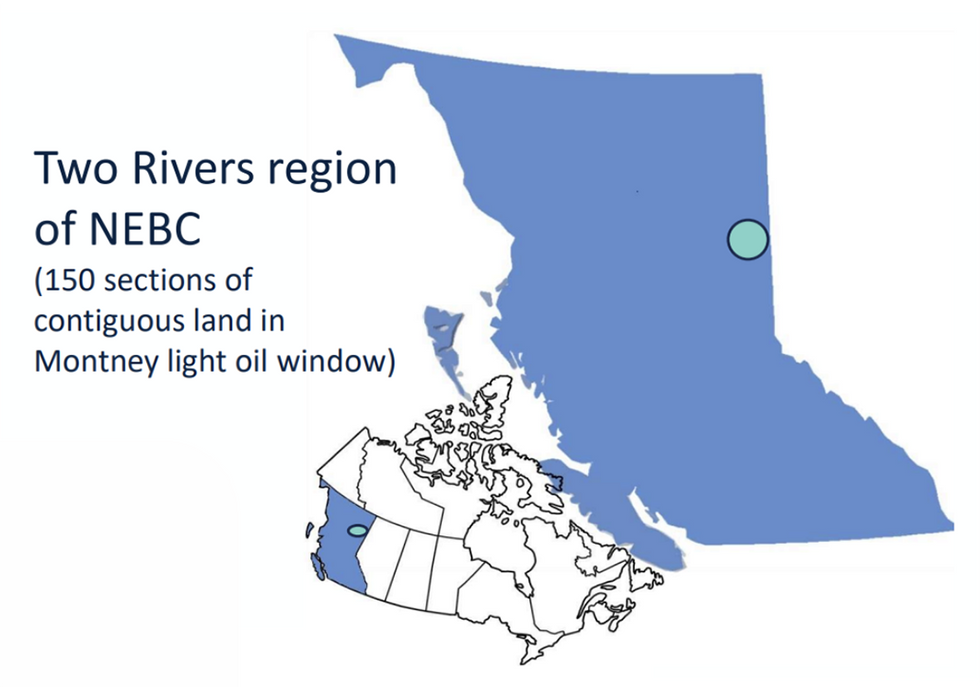

Coelacanth Energy (TSXV:CEI) is a junior oil and natural gas exploration and development company exploring the prolific Montney region in northeastern British Columbia, Canada. Coelacanth is strategically positioned to harness the potential of one of the most resource-rich natural gas basins in North America with a substantial landholding of approximately 150 net sections in the Two Rivers area of Montney.

The company is in the process of deploying $ 80 million to facilitate the smooth transition from exploration to production. Coelacanth’s financial health is further evidenced by its $64.4 million in working capital as of Q2 2024.

Coelacanth’s landholdings are strategically located in the Two Rivers area of Montney, giving it access to a highly productive portion of the basin. Unlike many junior exploration companies, Coelacanth is drill-ready, positioning it favorably among its peers. By securing significant infrastructure and landholdings, Coelacanth ensures its ability to tap into the natural gas and oil resources that lie beneath its properties, a key advantage in the competitive Montney region.

Company Highlights

- The company holds approximately 150 net sections of land in the Two Rivers area, a prolific oil and liquids rich natural gas region.

- Coelacanth is fully permitted and financially secure, with $64.4 million in working capital as of Q2 2024 and a $52 million credit facility with its main lender.

- The company is spending approximately $80 million to construct pipeline and facility infrastructure to bring production on in April 2025.

- The company’s strategic location in Montney places it near major producers like ARC Resources, Tourmaline Oil Corp, Shell, and ConocoPhillips.

- Two Rivers East, its primary project, boasts 1,532 (thousand barrels of oil equivalent) mboe per well in proved and probable reserves.

This Coelacanth Energy profile is part of a paid investor education campaign.*

Click here to connect with Coelacanth Energy (TSXV:CEI) to receive an Investor Presentation

CEI:CC

Sign up to get your FREE

Coelacanth Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

23 January

Coelacanth Energy

Light oil and natural gas exploration and production in the prolific Montney region in British Columbia

Light oil and natural gas exploration and production in the prolific Montney region in British Columbia Keep Reading...

06 March

Syntholene Energy Corp. Announces Completion of Conceptual Design Report and Technoeconomic Analysis

Report Validates Pathway to Industrial Scale Synthetic Fuel Production Targeting Cost Competitiveness with Fossil FuelsSyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) ("Syntholene" or the "Company") announces the completion of its Conceptual Design Report ("CDR") and integrated... Keep Reading...

06 March

Angkor Resources Announces Closing of Evesham Oil and Gas Sale

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 6, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of all final payments and closing of the sale of its 40% participating interest (the "Assets") in the Evesham Macklin oil and gas... Keep Reading...

05 March

Oil Prices Surge as Iran Conflict Halts Tanker Traffic Through Hormuz

Oil and gas prices extended their sharp climb this week as the escalating conflict between the US, Israel and Iran disrupts shipping through one of the world’s most critical energy chokepoints.Crude oil futures surged again on Thursday (March 5), with the US benchmark climbing roughly 3.5... Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

02 March

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

Latest News

Sign up to get your FREE

Coelacanth Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00