August 28, 2025

Cobre (ASX:CBE) is advancing copper-silver exploration in Botswana’s Kalahari Copper Belt, one of the world’s most prospective yet underexplored sediment-hosted copper provinces. Holding a 5,348 sq km land position, its near-term focus is the Ngami Copper Project (NCP), where a maiden JORC resource at the Comet deposit establishes an initial copper-silver resource with strong in-situ copper recovery (ISCR) development potential.

Cobre’s growth strategy balances district-scale discovery with development-ready assets. Backed by up to AU$40 million (US$25 million) in BHP funding, the company is accelerating exploration at Kitlanya while directing its own capital toward advancing the Ngami Copper Project through technical, environmental and permitting milestones.

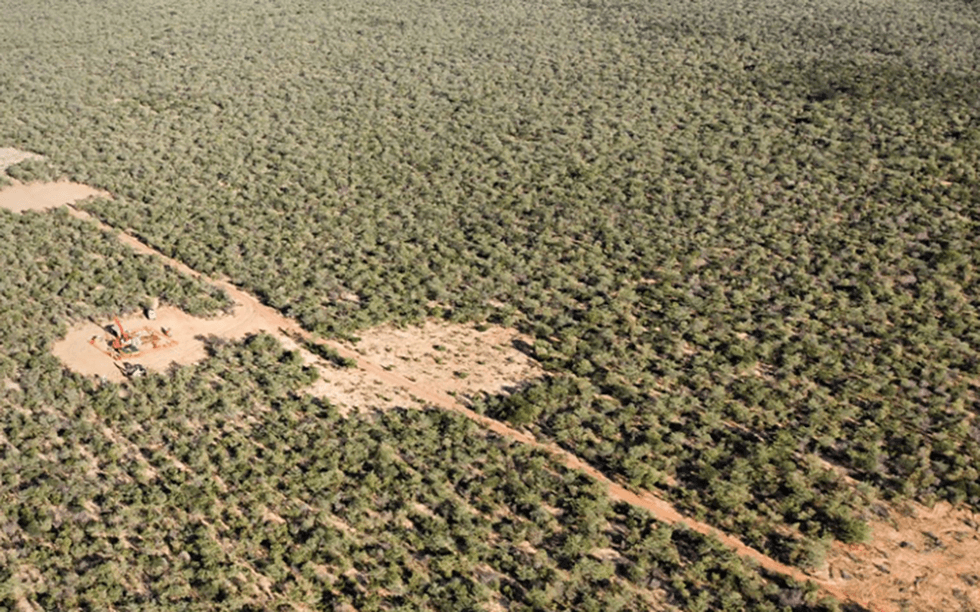

Cobre’s project location in the Kalahari Copper Belt

Cobre’s project location in the Kalahari Copper BeltIn parallel, Cobre maintains strategic exposure to high-purity quartz and volcanogenic massive sulphide (VMS) opportunities in Western Australia. This diversified, capital-light approach is designed to drive shareholder value through discovery, de-risking and development optionality.

Company Highlights

- Dominant land position – ~5,348 sq km across Botswana’s Kalahari Copper Belt (KCB), the second largest tenement package in the districtInvestor

- Maiden JORC Mineral Resource – Comet deposit (Ngami copper project): 11.5 Mt @ 0.52 percent copper and 11.6 grams per ton (g/t) silver (60.3 kt copper; 4.3 Moz silver), incl. 1.1 Mt indicated @ 0.59 percent copper and 12.8 g/t silver

- BHP partnership – Eight-year earn-in across Kitlanya East & West, allowing BHP to earn 75 percent by providing up to US$25 million for exploration expenditure, while Cobre retains exposure

- BHP Xplor cohort – Selected in 2024, securing US$500,000 non-dilutive funding and technical support

- Multi-jurisdiction exploration portfolio – Botswana (copper-silver), Western Australia (VMS, high-purity quartz)

This Cobre Limited profile is part of a paid investor education campaign.*

Click here to connect with Cobre Limited (ASX:CBE) to receive an Investor Presentation

CBE:AU

The Conversation (0)

28 January

Quarterly Activities/Appendix 5B Cash Flow Report

Cobre Limited (CBE:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

13 November 2025

Trading Halt

Cobre Limited (CBE:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Cobre Limited (CBE:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 October 2025

Sinomine Becomes a Substantial Shareholder in Cobre

Cobre Limited (CBE:AU) has announced Sinomine Becomes a Substantial Shareholder in CobreDownload the PDF here. Keep Reading...

14 October 2025

In-Situ Copper Recovery Environmental Permitting Update

Cobre Limited (CBE:AU) has announced In-Situ Copper Recovery Environmental Permitting UpdateDownload the PDF here. Keep Reading...

06 February

After Major Gold Payout, Bian Ximing Turns Bearish Sights on Silver

A Chinese billionaire trader known for profiting from gold’s multi-year rally has turned sharply bearish on silver, building a short position now worth nearly US$300 million as the metal's price slides. Bian Ximing, who earned billions riding gold’s multi-year rally and later turned aggressively... Keep Reading...

03 February

Silver Supply Tight, Demand Rising — What's Next? First Majestic's Mani Alkhafaji

Mani Alkhafaji, president of First Majestic Silver (TSX:AG,NYSE:AG), discusses silver supply, demand and price dynamics, as well as how the company is positioning for 2026.He also shares his thoughts on when silver stocks may catch up to the silver price: "You've got to give it a couple of... Keep Reading...

03 February

Rio Silver’s Path to Near-Term Cashflow

Rio Silver (TSXV:RYO,OTCPL:RYOOF) President and CEO Chris Verrico outlines the company’s transition into a pure-play silver developer. With the silver price reaching historic highs, Rio Silver is capitalizing on its strategic position in Peru — the world’s second largest silver producer — to... Keep Reading...

02 February

When Will Silver Stocks Catch Up to the Silver Price?

The silver price remains historically high despite a recent pullback, and many silver stocks haven't kept pace. Silver's strong performance over the past year is the result of a perfect storm of factors, including an entrenched supply deficit, growing industrial demand, a weakening US dollar and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

4h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00