March 28, 2023

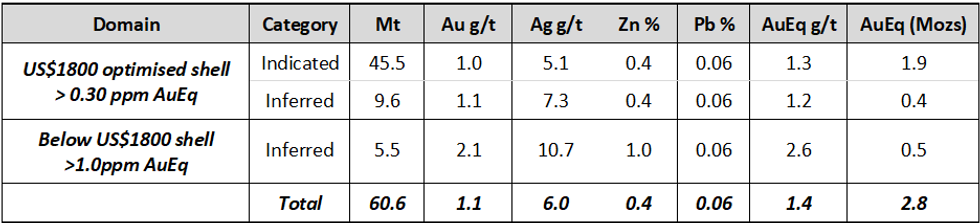

Challenger Exploration (ASX: CEL) (“CEL” the “Company”) is pleased to announce an upgraded Mineral Resource Estimate (MRE) which is reported according to JORC (2012) for the Company's flagship Hualilan Gold Project, in San Juan Argentina. This upgraded 2023 MRE is a significant increase in both total ounces and the high-grade component of the MRE. Total ounces have increased from2.1 million ounces gold equivalent to 2.8 million ounces gold equivalent as shown in Table 1.

Highlights

- Upgraded Mineral Resource Estimate (MRE) increases to 2.8 million ounces (AuEq)1 at CEL's flagship Hualilan Gold Project (refer Table 1).

- Significant increase in the high-grade component of this MRE conveyed by the comparison of the 2022 MRE to the higher grade 2.1 Moz AuEq component in the 2023 MRE1 (Table 2):

- Upgraded 2023 MRE: 2.1 Moz at 3.1 g/t AuEq1 (1.0 g/t AuEq cut-off)

- Maiden 2022 MRE: 2.1 Moz at 1.4 g/t AuEq1 (0.25 g/t AuEq cut-off)

- Upgraded 2023 MRE: 2.1 Moz at 3.1 g/t AuEq1 (1.0 g/t AuEq cut-off)

- Majority of the MRE now in Indicated Category (1.9 Moz AuEq1)

- Upgrading most of the MRE to Indicated Category is a crucial step to progress the current Scoping Study and allow the option to move directly from Scoping to a Prefeasibility Study.

- 1.9 Moz AuEq1 in Indicated Category represents 81% of the 2.3 Moz AuEq1 "pit constrained" component of the MRE prepared for the Scoping Study.

- Resource remains open in most directions with some of the more significant intersections outside the MRE remaining open, including (refer Table 4):

- 13.0m at 15.5 g/t AuEq1 (FHNV10-02): 600 metres south of the MRE

- 4.0m at 5.8 g/t AuEq1 (GNDD-308e): 600m vertically below the MRE

- 42.0m at 5.9 g/t AuEq1 (GNDD-711): open below this intersection

- 32.5m at 3.5 g/t AuEq1 (GNDD-790): open below this intersection

1 Reported as Gold Equivalent (AuEq) values – for requirements under the JORC Code see page 2

- 13.0m at 15.5 g/t AuEq1 (FHNV10-02): 600 metres south of the MRE

Commenting on the resource, CEL Managing Director, Mr Kris Knauer, said

“I would like to congratulate our Hualilan Exploration team for this outstanding result. This updated mineral resource estimate contains a core of 2.1 million ounces at a grade of 3.1 g/t AuEq compared to our previous resource of 2.1 million ounces at 1.4 g/t AuEq.

In addition to significant lift in total ounces we have added material high-grade ounces with the upgraded MRE including a higher-grade component of 1.6 million ounces at 5.0 g/t AuEq providing significant flexibility as we progress down the path towards mining.

Mineralisation remains open in most directions, and we expect this resource to continue to grow, however, with a total of 2.8 million ounces gold equivalent Hualilan now has critical mass to support development. Our exploration focus will now switch to exploring the previously untouched 25 kilometres of prospective strike that we hope will contain several more Hualilans.

The Company is most pleased with the significant increase in the high-grade component of MRE. This significant increase in the grade, and the quality of the updated 2023 MRE is evident when the higher grade 2.1 Moz AuEq in 2023 MRE is compared to the 2022 MRE.

- 2022 MRE: 2.1 million ounces at 1.4 g/t AuEq (reported at a 0.25 g/t AuEq cut-off)

- 2023 MRE: 2.1 million ounces at 3.1 g/t AuEq (reported at a 1.0 g/t AuEq cut-off)

Importantly the upgraded MRE now contains a high-grade core of 1.6 million ounces at 5.0 g/t AuEq (reported at a 2.0 g/t AuEq cut-off) which will drive economics and provide significant flexibility.

Upgrading a significant portion of the Mineral Resource to Indicated Category is a crucial part of progressing the Scoping Study. The 2023 MRE was based on an additional 92,000 metres of diamond core drilling of which approximately 50% (45,000 metres) comprised infill drilling. This change in strategy to significantly increase the amount of infill drilling was successful with 81% (1.9 million ounces AuEq of the current 2.3 million ounces AuEq) of the in-pit component of the MRE now in Indicated Category. A total of 67% of the 2.8 Moz upgraded MRE is in the Indicated category compared to 38% of the 2022 MRE. This will provide the Company the option to move seamlessly from Scoping Study to a Prefeasibility Study (PFS).

Mineralisation remains open in most directions and there is clear potential for the MRE to continue to grow via extension drilling.

Note: Some rounding errors may be present

Click here for the full ASX Release

This article includes content from Challenger Exploration, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CEL:AU

The Conversation (0)

14 February 2022

Challenger Exploration

Gold and Copper Exploration Across Known and Untapped Sources

Gold and Copper Exploration Across Known and Untapped Sources Keep Reading...

9h

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

11h

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00