August 29, 2024

Carbonxt Group Ltd (ASX:CG1) (‘‘Carbonxt” or “the Company”) has released its Appendix 4E Preliminary Final Report.

- Revenues for the group were essentially stable (decreased by 2.2% in FY24 compared to FY23). During the year, the team was able to renegotiate multiple of its current powdered carbon contracts to increase pricing, much of which will be realised in the next fiscal year.

- In May 2024, the group announced a forward sale for $4.2M to a major utility provider and Carbonxt’s largest AC pellet customer, with the cash received prior to year-end.

- Adjustments to optimise existing operations across the group’s two production facilities at Arden Hills and Black Birch, along with forward-looking production planning, have reduced the average cost of production with savings expected to flow through to future periods

- Logistics efforts with carriers and shipping vendors resulted in improvements in shipping rates with additional shipping lanes.

- Annual gross margin was 38%, compared to 30% in FY23.

- Underlying EBITDA for FY24 was a loss of $2.7m, compared to FY23 EBITDA of a $2.3m loss.

- Post balance-date in July 2024, the Company made another material revenue announcement with confirmation of a 4-year, $24m contract extension with a major waste to energy provider.

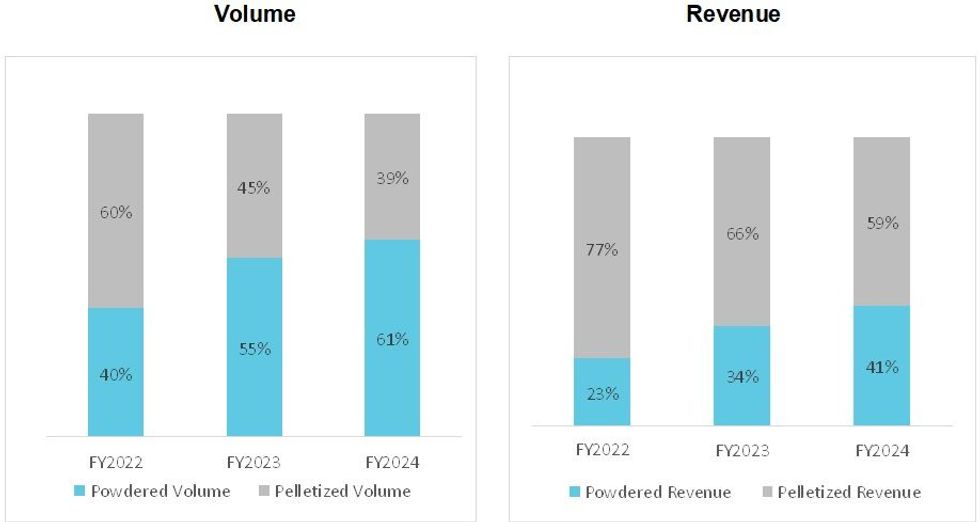

- In line with strong market conditions for Powdered Activated Carbon (PAC) products in the US market, PAC sales made up an increased percentage of group revenues for the third straight year

Activated Carbon Pellets

- Pellet sales represented 59% of revenue in FY24, down from 66% of revenue in the prior period.

- This decrease was driven by the strategic decision to reduce production of vapor phase CTC pellets, as the forthcoming commissioning of the Kentucky JV facility will be able to produce AC pellets at higher margins for the business in the near future.

- Tolling activities remained strong for the fiscal year, as a result of the management team’s ability to optimize production efficiencies and increase selling volumes of this product line by over 59% from the previous fiscal year.

Powdered Activated Carbon

- The utilization of recovered wood-based char material from local Georgia based lumber sawmills to create a renewable powdered activated carbon continues to support strong margins in our powdered carbon business.

- Powdered carbon sales accounted for 41% of revenue and 61% of sales volume, both an increase from the previous reporting period (34% and 55% respectively).

- The group was able to extend a growing contract with a major waste to energy provider which is expected to see in excess of 25% increase in annualized group revenue, commencing in October 2024. In addition, the group renegotiated multiple of its current powdered carbon contracts to increase pricing, much of which will be realised in the next fiscal year.

- The group is looking in 2025 to invest in additional redundancy for the present mill to provide capacity for up to 5,000 tons per annum of incremental PAC volume. Additionally, renegotiations of the Carbon Concepts lease agreement are ongoing and expect to be concluded in 1H25.

FY24 GROWTH OPPORTUNITIES

Company Outlook

Growth from existing operations will be underpinned by the new contract win with a major waste-to-energy provider, which is expected to see an increase of over 25% in annualized revenue. This does not include any additional contribution from the commencement of the Kentucky investment mentioned below. We expect gross margins to exceed 40% as the portfolio-wide price increases and operational improvements flow through. In turn, with the commencement of the Kentucky plant, we expect to see a step change in the scale of Carbonxt’s business in FY25.

Update on Kentucky JV – NewCarbon Processing LLC.

The construction of the new activated carbon plant in eastern Kentucky, USA is nearing completion. The plant will have an initial capacity of 10,000 tons per annum, with the ability to expand to 20,000 tons per annum for a small additional investment.

The investment in NewCarbon Processing, LLC (“NewCarbon”), is alongside our US partner KCP. Carbonxt currently holds a 35.5% ownership interest in NewCarbon, with options to invest a further USD $4.5m to move to 50% ownership interest.

Click here for the full ASX Release

This article includes content from Carbonxt Group, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CG1:AU

Sign up to get your FREE

Carbonxt Group Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

24 July 2025

Carbonxt Group

Purpose-built advanced carbon for healthier communities

Purpose-built advanced carbon for healthier communities Keep Reading...

27 February

Half Yearly Report and Accounts

Carbonxt Group (CG1:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

27 February

HY26 Results Announcement

Carbonxt Group (CG1:AU) has announced HY26 Results AnnouncementDownload the PDF here. Keep Reading...

24 February

Carbonxt Secures $500,000 Convertible Note Funding

Carbonxt Group (CG1:AU) has announced Carbonxt Secures $500,000 Convertible Note FundingDownload the PDF here. Keep Reading...

30 January

Q2 FY26 Quarterly Activities Report & Appendix 4C

Carbonxt Group (CG1:AU) has announced Q2 FY26 Quarterly Activities Report & Appendix 4CDownload the PDF here. Keep Reading...

04 January

Placement to Fund Further Investment in New Carbon

Carbonxt Group (CG1:AU) has announced Placement to Fund Further Investment in New CarbonDownload the PDF here. Keep Reading...

04 March

Funding to Advance 2026 Development Milestones

Provaris Energy (PV1:AU) has announced Funding to Advance 2026 Development MilestonesDownload the PDF here. Keep Reading...

02 March

Trading Halt

Provaris Energy (PV1:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

25 February

Acquisition of Critical Infrastructure Services Platform

European Green Transition plc (AIM: EGT) announces that in line with its strategy set out at IPO, EGT has entered into a share purchase agreement ("SPA") to acquire an established, EBITDA profitable onshore wind turbine operating, maintenance, repairing, and remote monitoring business (the "O&M... Keep Reading...

25 February

CHARBONE confirme de nouvelles commandes en hydrogene UHP et une premiere commande en oxygene UHP aux Etats-Unis

(TheNewswire) Brossard, Quebec, le 25 février 2026 TheNewswire - CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

25 February

CHARBONE Confirms New UHP Hydrogen Orders and its First UHP Oxygen Order in the United States

(TheNewswire) Brossard, Quebec, February 25, 2026 TheNewswire - Charbone CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) ("Charbone" or the "Company"), a North American producer and distributor specializing in clean Ultra High Purity ("UHP") hydrogen and strategic industrial gases, is... Keep Reading...

Latest News

Sign up to get your FREE

Carbonxt Group Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00