December 18, 2023

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to report significant widths of visible copper mineralisation have been intersected at very shallow depth at the El Quillay Prospect, Fortuna Project (the Project), Chile.

HIGHLIGHTS

- Broad zone of shallow visible copper mineralisation intersected over 40m from 15m downhole in CMEQD002 and over 23m from 20m downhole in CMEQD001.

- Intersected copper mineralisation in both diamond holes remains open in all directions.

- Expands potential of the El Quillay corridor where outcropping copper mineralisation and historical mining is present over a strike length >3km.

- Samples to be dispatched for laboratory analysis, with assay results expected in January 2024.

Culpeo Minerals’ Managing Director, Max Tuesley, commented:

“It is a fantastic result to immediately intersect visible copper so near to surface with our first two diamond holes at El Quillay North. This validates our initial work and confirms the prospectivity of this very exciting target. It also highlights the vast potential of the extensive El Quillay mineralised corridor, dominated by a wide, approximately 3km long zone, of outcropping copper mineralisation, the majority of which remains undrilled.”

We were always excited by what we saw on the ground at El Quillay North, which is now confirmed by the multiple zones of visible copper mineralisation in the drill core. Mineralisation is spatially associated with specular haematite and albite alteration, interpreted to be the part of an Iron Oxide Copper-Gold (IOCG) hydrothermal system.”

EL QUILLAY NORTH DRILLING PROGRAM

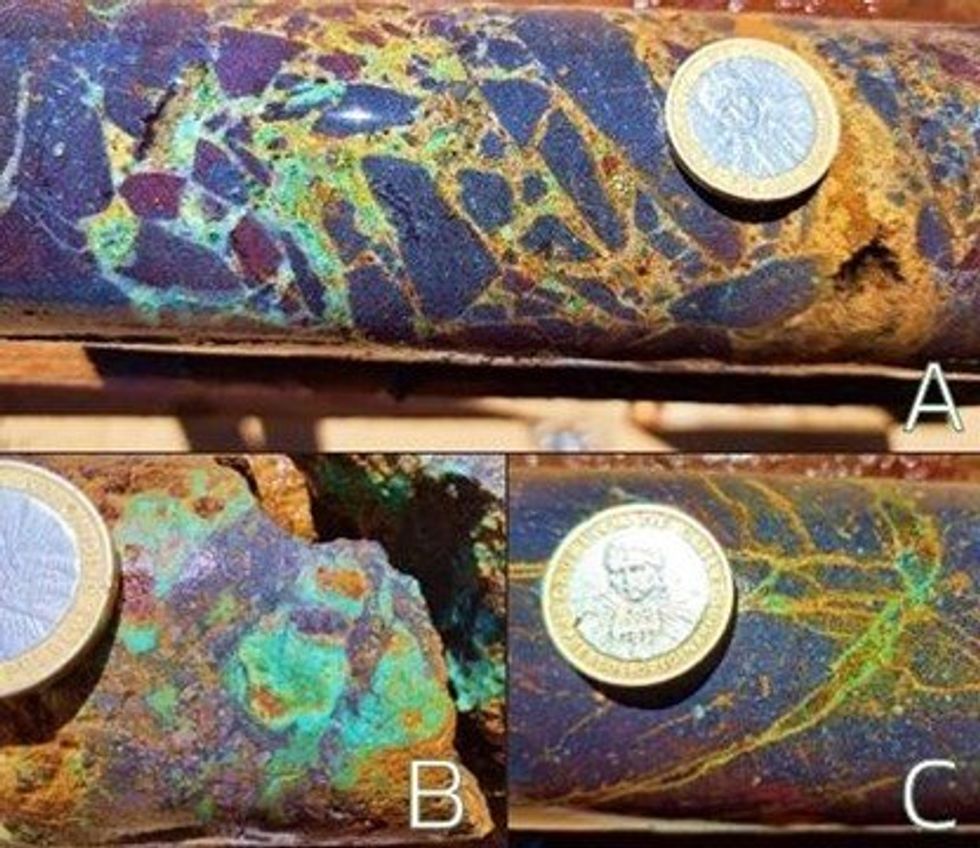

Broad 40m zone of copper mineralisation has been intersected from 15m, including an approximate 25m downhole zone of very strong copper sulphide mineralisation from 30m (CMEQD002). This provides visual confirmation that the high-grade copper-gold mineralisation recognised from historic underground sampling (refer ASX announcement 11 September 2023) extends down plunge and remains open in all directions.

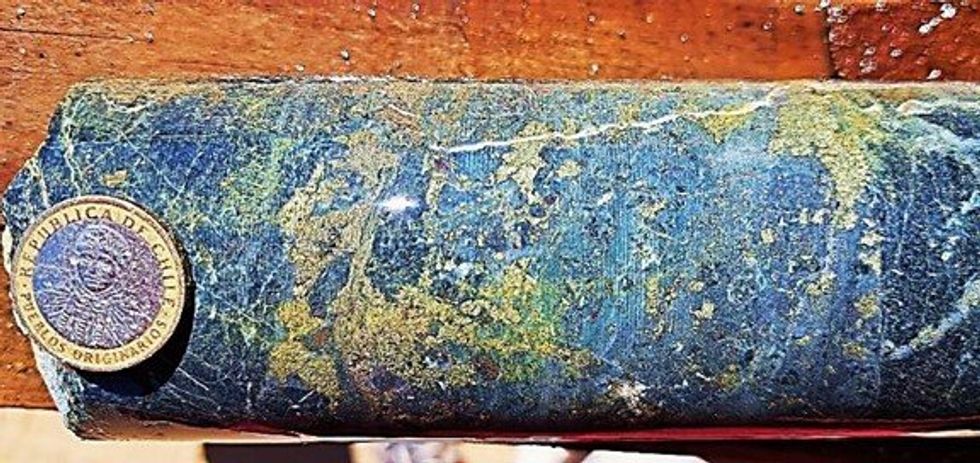

Visual estimates of copper sulphides logged in CMEQD002 are presented in Table 1 (photos presented in Figures 2 and 3).

Culpeo notes this is based on a visual inspection only and the samples are yet to be assayed or analysed. The Company anticipates the release of assay results in respect of the visual estimates to occur on or around mid-January 2024.

Note: In relation to the disclosure of visual mineralisation, the Company cautions that visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Assay results are required to determine the actual widths and grade of the visible mineralisation. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations.

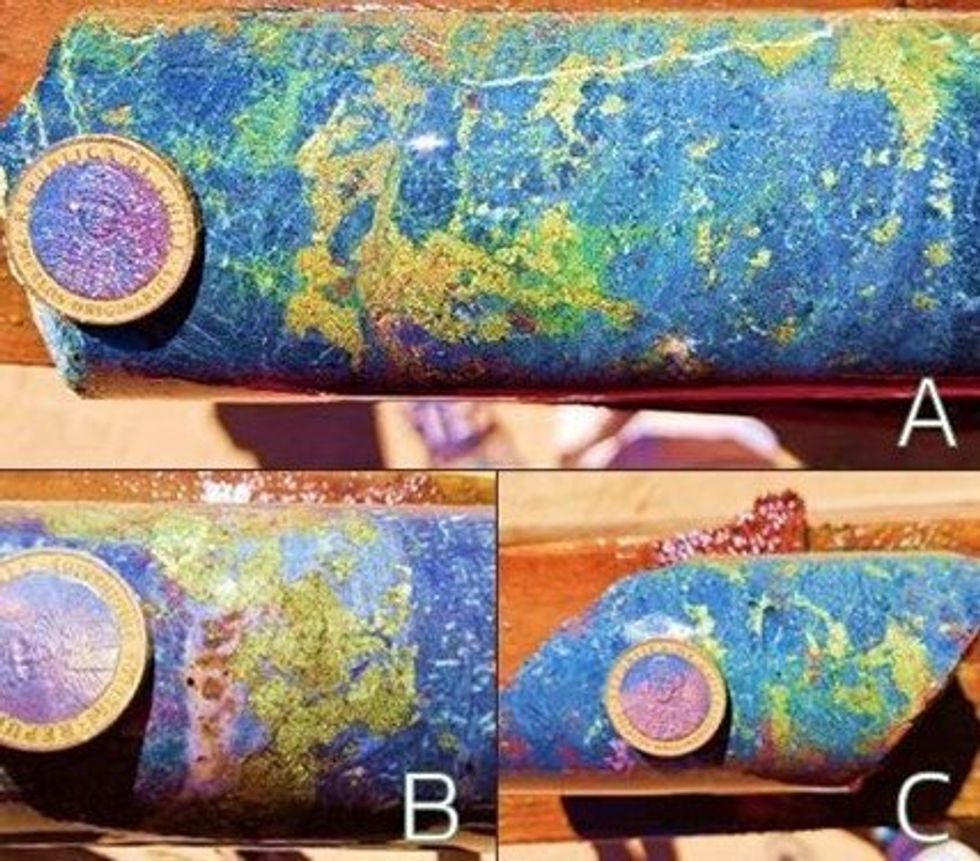

A 23m zone of copper mineralisation from 20m down hole has also been intersected in diamond hole CMEQD001. Post mineralisation faulting was logged at 36m downhole and future drilling will target offsets to mineralisation to the east and west. Visual estimates of copper sulphides logged in CMEQD001 are presented in Table 2.

In both holes the near surface mineralisation was dominated by malachite and chrysocolla. In the primary zone the main copper mineralisation was in the form of chalcopyrite and to a lesser extent bornite.

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CPO:AU

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

18h

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00