November 25, 2022

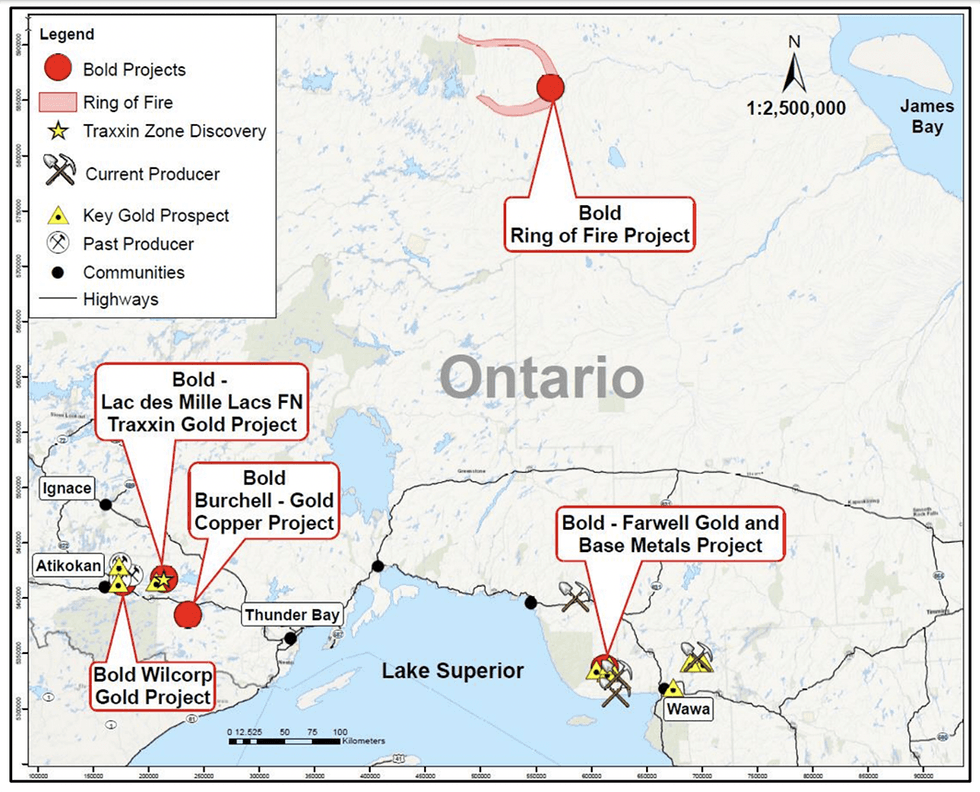

Bold Ventures (TSX.V:BOL) focuses on precious and critical mineral assets in Northwestern Ontario demonstrating dual focus on precious metals and critical minerals, to create consistent value with gold and meet the growing demand for battery and critical metals. Bold Ventures’ projects are located within three active regions throughout Ontario: Thunder Bay West, Wawa West and the Ring of Fire camp located in the James Bay Lowlands. The Thunder Bay West projects contain gold and copper mineralization, while Wawa West and James Bay have assets with copper, nickel, zinc, silver and PGE mineralization.

The Traxxin gold project, west of Thunder Bay, has hosted numerous high-grade gold intersections in drilling. The most recent of which intersected 3.6 g/t gold over 12.3 meters. The project is a joint venture between Bold Ventures, as the operator, and Lac des Milles First Nation, where the joint venture can earn up to 100 percent of the property. The company’s additional assets include projects known for gold and for base metals needed for the growing clean energy market.

Company Highlights

- Bold Ventures is a Canadian mineral exploration company focused on exploring and developing its precious and critical mineral projects in Northern Ontario.

- The company owns and operates several projects throughout three key regions of Ontario: Thunder Bay West, James Bay Lowlands-Ring of Fire and Wawa West.

- The Traxxin gold project is a notable joint venture partnership between Lac des Milles First Nation and Bold Ventures, with the partners earning up to a 100 percent ownership of the property. Bold Ventures is the operator of the agreement.

- The Koper Lake Project is located 300 meters from the Ring of Fire Metals’ (formerly Noront and then Wyloo) flagship Eagle’s Nest Nickel-Copper deposit. It hosts a large chromite resource and attractive nickel potential.

- Bold Ventures’ management team has decades of experience within the mining sector. The management and technical team have participated in three world-class discoveries and have the right experience to guide the company toward its goals.

This Bold Ventures Inc. profile is part of a paid investor education campaign.*

Click here to connect with Bold Ventures (TSX.V:BOL) to receive an Investor Presentation

BOL:CA

Sign up to get your FREE

Bold Ventures Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

06 November 2025

Bold Ventures

Developing precious and critical mineral assets in mining-friendly Ontario

Developing precious and critical mineral assets in mining-friendly Ontario Keep Reading...

9h

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

10h

Precious Metals Price Update: Gold, Silver, PGMs Stage Recovery After Crash

It's been a wild week of ups and downs for precious metals prices.Gold, silver and platinum have already recorded new all-time highs in 2026. But this week, the rally reversed course — only briefly, but in a big way, as is the case with such highly volatile markets.Let’s take a look at what got... Keep Reading...

12h

Centurion Minerals Ltd. Announces Revocation of MCTO

CENTURION MINERALS LTD. (TSXV: CTN) ("Centurion" or the "Company") announces that the British Columbia Securities Commission ("BCSC") has revoked the management cease trade order ("MCTO") previously issued on December 1, 2025 under National Policy 12-203 - Management Cease Trade Orders.The... Keep Reading...

03 February

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

03 February

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

03 February

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold (TSX:ELD,NYSE:EGO) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that will create a larger, diversified gold and copper producer with two major development projects that are set to enter production in 2026.Following completion under a... Keep Reading...

Latest News

Sign up to get your FREE

Bold Ventures Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00