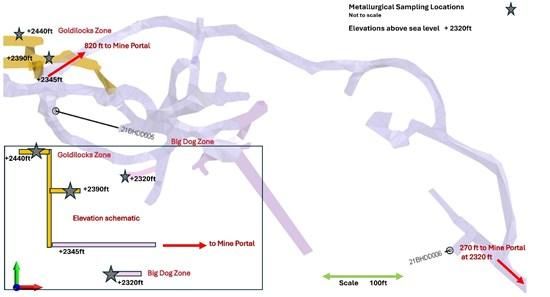

Bayhorse Silver Inc, (TSXV: BHS,OTC:BHSIF) (OTCQB: BHSIF) (FSE: 7KXN) (the "Company" or "Bayhorse") is undertaking an approved "run of mine" metallurgical bulk sample of the Bayhorse Silver Mine's critical and strategic silver, antimony, copper and zinc mineralization from three established "ready to commence mining from" working faces located within the western extent of the underground workings over a vertical extent of up to 38 m (125 feet), a width of 15.25m (50 feet), and a strike length of 50m (165 feet), as shown in the following schematic.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5015/275720_630f2483f4f0ea0c_001full.jpg

One sample will be taken from the newly established Big Dog Zone working face as reported in the Company's news releases, BHS2022-05 and BHS2022-08 and two samples will be taken from the middle and top of a 30.5m (100 ft raise) up into the Goldilocks Zone where, at the top, Silver King Mines in 1984 mined high grade rounds grading up to 3110 g/t Ag (100oz/Ag) per ton, and in the middle where the Company drill intersected 3.65 meters (12 feet) of 844 g/t (24.67 oz/t) silver of which the highest grade interval was 0.6 m (2 feet) of 2,180 g/t (63.65 oz/t) silver, as reported in the Company's news release, BHS2021-19.

The approved 25 ton representative run of mine metallurgical sample will be taken from these three zones, sampled for assaying and crushed to minus 25 mm (1") before shipping to the Company's fully permitted flotation mill in Payette, Idaho. The sample will then be Ore-Sorted though the Company's Steinert KSS100 XRT Ore-Sorter and separated into three portions. The Ore-Sorter Select, the Ore-Sorter Reject, and the under 8 mm fines that are pre-screened off before passing through the Ore-Sorter.

The Ore-Sorter Selects will then be assayed to determine the Ore-Sorter upgrade for silver and other critical and strategic mineral content for milling and producing a flotation concentrate. The Ore-Sorter Reject will be assayed to determine the suitability for mine backfill for permitting purposes and the Sorter pre-screened fines will be assayed to determine whether it also can be milled and floated or can be rejected as it has insufficient metals content.

The bulk sample assay analysis will be conducted under NI-43-101 standards and form part of the geochemical analysis required for the Bayhorse Silver Mine Operating Permit.

The metallurgical analysis will also establish, through the milling and flotation process, mill recoveries, tailings percentages, and necessary waste water remediation to allow proper disposal of the waste water from the milling process.

The Company believes the flotation mill operates efficiently, as evidenced by four XRF field analyses measurements taken on 6.5 kg float concentrate samples reported in the Company's news release BHS2025-28.

Bayhorse CEO, Graeme O'Neill, comments, "while the original sampling, Ore-Sorting and milling/flotation was conducted on Mine development material, this bulk sample will mimic potential mining operations and give a clear indication of the Ore-Sorter select silver upgrade, and what the final grades and recoveries likely will be when full-scale mining is resumed. We were very pleasantly surprised with the very high percentages of copper, antimony, and zinc recovery in the concentrate along with the silver from the development material processing. With this 25 ton bulk sample, plus the sorted Mine development material ready to mill and float at the Payette mill, we look forward to determining the tonnage and grade of the resulting float concentrate."

O'Neill further comments, "in the event that the antimony leaching test results currently underway are positive, all the critical metals will be freed for further processing or sale. With the new refining technologies available, we are exploring the potential for producing our own silver bars at the mill."

When mining is permitted, the mineralised "run of mine" material mined at the Bayhorse Mine will be crushed to 1 inch minus (25 mm) and then fed through our Steinert Ore-Sorter where roughly 80% of the run of the mine material will be rejected as waste. The sorted material will then be trucked to our mill in Payette where it will be crushed further to minus 0.12 inches (3 mm) then passed through the ball mill, floated, and the concentrate produced will be bagged and readied for further processing/smelting/leaching.

The dominant Bayhorse mineralization is primarily tetrahedrite, (see the Company's news release BHS2020-12) that is comprised of the critical and strategic minerals in an antimony sulfide of silver, copper, zinc and iron in veins and stockworks with minor gold present, and is refractory in nature.

Extracting the silver from refractory minerals presents several challenges as the complex mineral structures often leads to lower recovery rates compared to free-milling minerals. Processing refractory minerals also requires high energy inputs, making it cost-prohibitive in some cases. Leaching permits the cost-effective separation of the antimony and sulphur and significantly increases recoveries of the silver, copper and zinc for processing separately.

The silver, antimony, copper and zinc at the Bayhorse Silver Mine are all recognized as "critical and strategic minerals" in the United States.

The Bayhorse exploration model holds that the silver-copper-antimony rich mineralization at the Bayhorse Silver Mine extends across to the adjacent Pegasus porphyry copper prospect and could have its source in an underlying shallow pluton(s) that may host porphyry copper mineralization similar to what Hercules Metals has reported 40 km north of the Bayhorse Silver Mine.

Cautionary statement

The Company is not basing any decision to produce on a feasibility study of mineral reserves demonstrating economic and technical viability and advises there is an increased uncertainty and specific economic and technical risk of failure with any production decision. These risks include, but are not limited to, (i) a drop in price of commodities produced, namely silver, copper, lead and zinc, from the pricing used to make a production decision; (ii) failure of grades of the produced material to fall within the parameters used to make the production decision; (iii) an increase in mining costs due to changes within the mine during development and mining procedures; and (iv) metallurgical recovery changes that cannot be anticipated at the time of production.

All statements herein, other than statements of historical fact, including, without limitation, plans for and intentions with respect to the Company's capitalization, preparation of technical reports, proposed work programs, budgets and proposed expenditures, permitting, construction and production timing are forward-looking statements. While the Company believes such statements are reasonable, no assurance can be given that any expectations will prove to be correct and the forward-looking statements are not guarantees of future results or performance and that actual results may differ materially from those in the forward-looking statements. Readers should not place undue reliance upon forward-looking statements and the Company undertakes no obligation to re-issue or update any forward-looking statements as a result of new information or events after the date hereof or as may be required by law. All forward-looking statements and information herein are qualified by this cautionary statement.

This News Release has been prepared on behalf of the Bayhorse Silver Inc. Board of Directors, which accepts full responsibility for its content. Mark Abrams, AIPG, a Qualified Person and Director of the Company has prepared, supervised the preparation of, or approved the technical content of this news release.

On Behalf of the Board.

Graeme O'Neill, CEO

866-399-6539

About Bayhorse Silver Inc.

Bayhorse Silver Inc. is an exploration and production company with a 100% interest in the historic Bayhorse Silver Mine located in Oregon, USA with a National Instrument 43-101 inferred resource of 292,300 tons at a grade of 21.65 opt (673 g/t) for 6.3 million ounces of silver. (Turner et al. 2018) and the Pegasus Project, a highly prospective porphyry copper prospect, in Washington County, Idaho. The Bayhorse Silver Mine and the Pegasus Project are 44 km southwest of Hercules Metals' porphyry copper discovery. The Bayhorse Mine is a minimum environmental impact facility capable of processing at a mining rate up 200 tons/day that includes a state of the art 40 ton per hour Steinert Ore-Sorter that reduces waste rock entering the processing stream by up to 85%. The Company has established an up to 60 ton/day mill and standard flotation processing facility in nearby Payette County, Idaho, USA with an offtake agreement in place with Ocean Partners UK Limited. The Company has an experienced management and technical team with extensive mining expertise in both exploration and building mines.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275720