May 15, 2025

Athena Gold Corporation (CSE:ATHA)(OTCQB:AHNRF) ("Athena" or the "Company") is pleased to report additional results from its 2024 regional prospecting and sampling program at the 100%-owned Excelsior Springs project in Nevada's Walker Lane Trend. The program proved successful in providing new geologic interpretations and defining new, untested zones of prospective mineralization. On the back of this program, the Company expanded its landholdings by approximately 68 hectares.

"One of the drivers behind the Fall 2024 program was to confirm whether prospective ground exists outside the Buster Trend, which to date, has been the main target of focus at Excelsior Springs. We are happy to report the identification of the new Rhino Zone, in addition to the high-grade silver and antimony potential revealed at the Blue Dick Trend. Importantly, both these targets remain untested by the drill bit. We believe a larger-scale program is warranted in order to adequately explore such a target-rich project," stated Koby Kushner, President & CEO of Athena Gold.

Highlights:

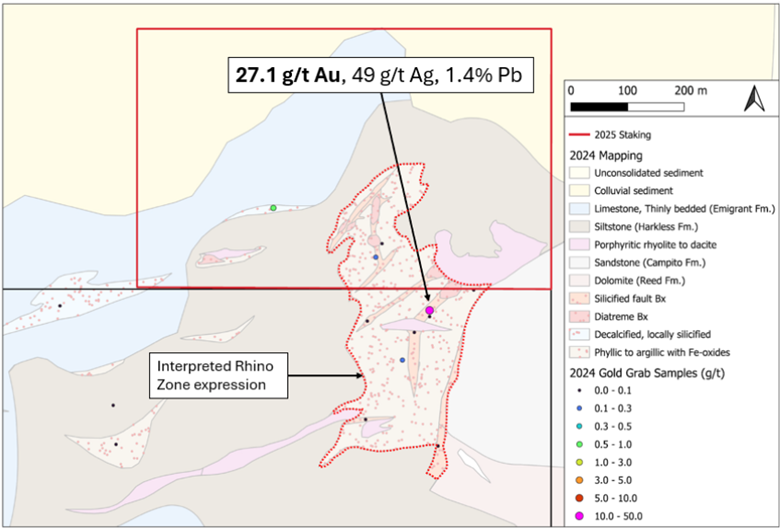

- The newly defined Rhino Zone, located to the northeast of the project area, returned high-grade gold on surface, with grab sample assays returning up to 27.1 g/t Au, 49 g/t Ag, and 1.4% Pb (see Figure 2).

- Results from Blue Dick, as previously reported, returned up to 6,630 g/t Ag (Sample K024547; refer to the Company's press release dated January 23, 2025). In addition, the remaining analytical results from this sample returned high-grade antimony of 1.53% Sb.

- Antimony is designated as a critical metal by both the United States and Canada due to its essential role in national security, energy infrastructure, and industrial manufacturing.

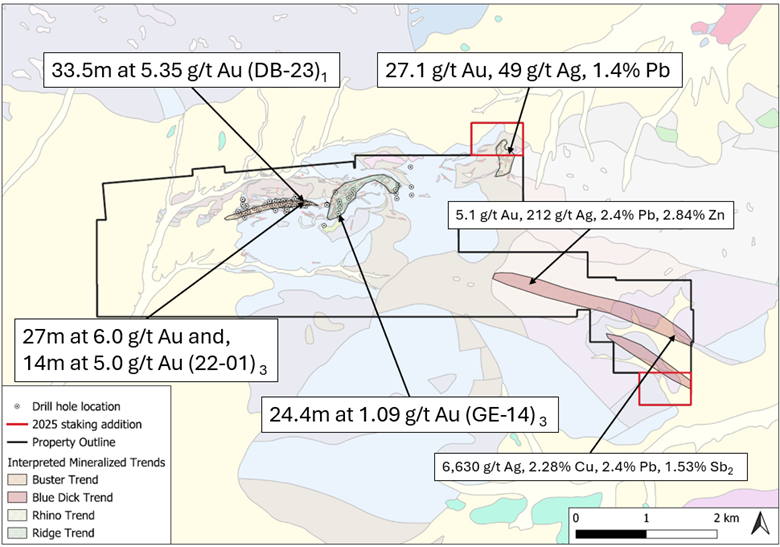

- On the back of the successful 2024 exploration program, the Company recently expanded its land position through staking, increasing the project footprint by 68 hectares to better capture the Rhino and Blue Dick Trends (see Figure 1).

- The Company continues to receive third-party interest regarding potential joint venture partnerships and earn-in agreements across its Nevada portfolio.

Figure 1: Map of the Excelsior Springs project highlighting the various mineralized trends, historic drilling, additional staking, and recent sampling completed by Athena Gold Corporation in November 2024.

Figure 2: Map of the Rhino Zone showing recent sampling, the approximate outline of the Rhino Zone, and the area of newly acquired ground.

A total of 95 surface grab samples were collected during the recent mapping and prospecting program, conducted by Big Rock Exploration in November. Results from the program have highlighted that the Excelsior Springs project is host to various styles of mineralization, lending itself to varying exploration targets ranging from narrow vein, high-grade targets to low-grade, bulk-tonnage targets.

Buster Trend: This target area is host to the vast majority of the historical exploration work at Excelsior Springs to date, with most activity focused on the historic underground Buster Mine, which averaged >40 g/t Au of past production. Drilling at the easternmost extension of this trend returned 5.35 g/t Au over 33.5 m from hole DB-23 in the Western Slope Zone, approximately 400 m east of the historic workings at Buster (refer to the Company's press release dated June 29, 2022).

Ridge Trend: Mineralization in this region has a distinct intrusion-related signature with elevated As-Bi-Mo-Cu-Hg-Te. The Ridge Trend represents a potential low-grade, high-tonnage target. Historic drilling has returned up to 24.4 m at 1.09 g/t Au (GE-14) starting at only 7.6 m below surface (refer to the Company's press release dated Sept 14, 2023).

Rhino Trend: This newly recognized trend has similar characteristics to the Ridge Trend in that it is a low-grade, high-tonnage target with potential for high-grade Au values within the broader target area. No known drilling has been completed in this area, and additional staking has been completed in 2025 to secure the zone.

Blue Dick Trend: The Blue Dick area represents a series of Au-Ag-Cu-Pb-Sb-Zn epithermal vein systems. Several historic workings are documented in the area including the Blue Dick Mine, however no known drilling has been conducted in the area. In November of 2024, Athena returned samples of up to 6,630 g/t Ag, 2.28% Cu, 2.4% Pb, and 1.53% Sb along with 5.1 g/t Au, 212 g/t Ag, 2.4% Pb, and 2.84% Zn (refer to the Company's press release dated January 23, 2025). Recent staking expanded the Blue Dick Trend to capture historical high-grade samples.

QA/QC

Analytical work for rock samples was completed by ALS Laboratories, and sample preparation and geochemical analyses were completed in Elko, Nevada. Samples were crushed before a 250-gram split was pulverized to better than 85%, passing 75 microns. Rock samples were analyzed for gold by fire assay using a 50-gram charge with an atomic absorption spectroscopy finish. If assay results exceed 10.0 g/t gold, the sample rejects are analyzed by 50-gram fire assay with a gravimetric finish. Sampling and analytical procedures are subject to a Quality Assurance and Quality Control program that includes duplicate samples and analytical standards.

Qualified Person

Technical information in this news release has been reviewed and approved by Benjamin Kuzmich, P.Geo., a geoscientist and qualified person for the purposes of National Instrument 43-101.

About Athena Gold Corporation

Athena is engaged in the business of mineral exploration and the acquisition of mineral property assets. Its objective is to locate and develop economic precious and base metal properties of merit and to conduct additional exploration drilling and studies on its projects across North America. Athena's Laird Lake project is situated in the Red Lake Gold District of Ontario, covering over 4,000 hectares along more than 10 km of the Balmer-Confederation Assemblage contact, where recent surface sampling results returned up to 373 g/t Au. This underexplored area is road-accessible, located about 10 km west of West Red Lake Gold's Madsen mine and 34 km northwest of Kinross Gold's Great Bear project. Meanwhile, its Excelsior Springs Au-Ag project is located in the prolific Walker Lane Trend in Nevada. Excelsior Springs spans over 1,500 hectares and covers at least three historic mines along the Palmetto Mountain trend, where the Company is following up on a recent shallow oxide gold discovery, with drill results including 5.35 g/t Au over 33.5 m.

For further information about Athena Gold Corporation, please visit www.athenagoldcorp.com.

On Behalf of the Board of Directors

Koby Kushner

President and Chief Executive Officer

For further information, please contact:

Athena Gold Corporation

Koby Kushner, President and Chief Executive Officer

Phone: 416-846-6164

Email: kobykushner@athenagoldcorp.com

CHF Capital Markets

Cathy Hume, Chief Executive Officer

Phone: 416-868-1079 x 251

Email: cathy@chfir.com

Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities laws. All statements, other than statements of historical fact, included herein, including, without limitation, statements regarding future exploration plans, future results from exploration, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: "believes", "will", "expects", "anticipates", "intends", "estimates", ''plans", "may", "should", ''potential", "scheduled", or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this press release, the Company has applied several material assumptions, including without limitation, that there will be investor interest in future financings, market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future exploration and development of the Company's projects in a timely manner.

The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various risk factors as disclosed in the final long form prospectus of the Company dated August 31, 2021.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this press release or incorporated by reference herein, except as otherwise stated.

ATHA:CNX

The Conversation (0)

09 January 2025

Athena Gold

High-grade gold exploration in Ontario and Nevada

High-grade gold exploration in Ontario and Nevada Keep Reading...

5h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

17h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

18h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

18h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

19h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

19h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00