June 07, 2024

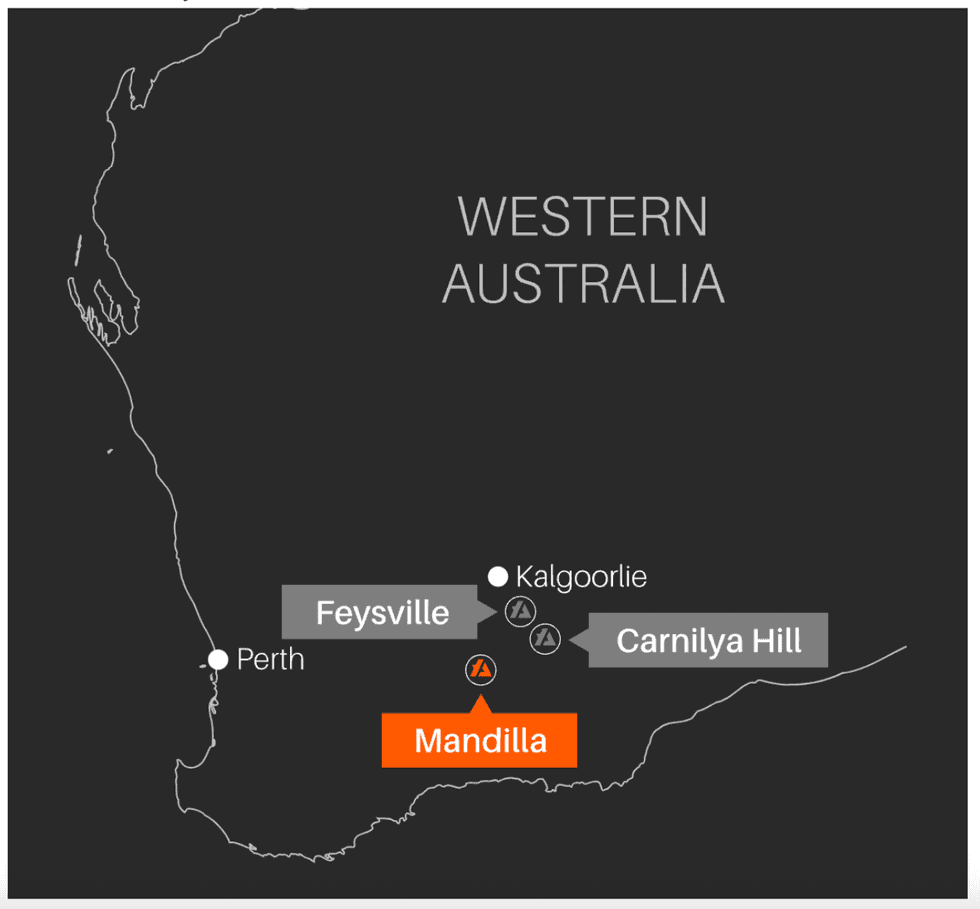

Astral Resources (ASX:AAR) is a gold mineral exploration company focusing on three assets are the Mandilla gold project, the Feysville gold project, and the Carnilya Hill gold project. Astral is advancing its flagship Mandilla gold project, with a mineral resource estimate of 37 Mt at 1.1 g/t gold for 1.27 Moz. The 100 percent owned Feysville is another key project that hosts a mineral resource estimate of 3 million tons (Mt) at 1.3 grams per ton (g/t) gold for 116,000 ounces (oz) of contained gold.

The scoping study completed at Mandilla highlighted the Theia deposit, which accounts for 81 percent of the total Mandilla mineral resource estimate. The deposit hosts a mineral resource estimate of 29 Mt at 1.1 g/t gold for 1.02 Moz of contained gold in one large open pit. The scoping study indicates a mine life of 11 years with an annual production of 100,000 oz in the first seven and a half years, dropping to 41,000 oz for the remaining three and a half years. The study outlines compelling financial metrics, including NPV@8 percent of AU$442 million, free cash flow of AU$740 million, and a payback period of nine months.

Astral continues to advance exploration and resource expansion efforts at Mandilla with plans to commence a pre-feasibility study. The company completed a six-hole 1,832 metre drilling program at Theia deposit last year. The assay results have been released and indicate a high potential for the conversion of inferred resources to higher confidence indicated resources. The assay results include: 39 metres at 5.4 g/t gold, 29 metres at 2.8 g/t gold, 28 metres at 1.4 g/t gold, 8 metres at 8.8 g/t gold.

Company Highlights

- Astral Resources is an ASX-listed gold exploration company in the Kalgoorlie region of Western Australia, a tier 1 jurisdiction and a mature mining region with successful development history and granted mining leases.

- The company has three assets - the Mandilla gold project, the Feysville gold project, and the Carnilya Hill gold exploration project.

- The focus is on advancing its flagship Mandilla gold project, with a mineral resource estimate of 37 Mt at 1.1 g/t gold for 1.27 Moz.

- The scoping study at Mandilla highlights the project’s robust economics with a mine life of 11 years, NPV@8 percent of AU$442 million, and free cash flow of AU$740 million.

- Mandilla’s cornerstone Theia deposit, which comprises 81 percent of the project’s resources, contains 29 Mt at 1.1 g/t gold, with 1.02 Moz of contained gold in one large open pit.

- Feysville project hosts a mineral resource estimate of 3 Mt at 1.3g/t gold for 116 koz of contained gold. The project could potentially become a source of satellite ore feed to Astral’s flagship Mandilla gold project.

- The company is led by an experienced team with a proven track record of advancing projects to development and M&A.

This Astral Resources profile is part of a paid investor education campaign.*

Click here to connect with Astral Resources (ASX:AAR) to receive an Investor Presentation

AAR:AU

The Conversation (0)

12 January

Quarterly Activities & Cashflow Report

Astral Resources (AAR:AU) has announced Quarterly Activities & Cashflow ReportDownload the PDF here. Keep Reading...

10 December 2025

Strongly Supported $65m Placement to Advance Mandilla

Astral Resources (AAR:AU) has announced Strongly Supported $65m Placement to Advance MandillaDownload the PDF here. Keep Reading...

08 December 2025

Trading Halt

Astral Resources (AAR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

01 December 2025

Theia Grade Control Confirms Geological Interpretation

Astral Resources (AAR:AU) has announced Theia Grade Control Confirms Geological InterpretationDownload the PDF here. Keep Reading...

17 November 2025

Theia In-fill - Multiple High-Grade Zones of Gold

Astral Resources (AAR:AU) has announced Theia In-fill - Multiple High-Grade Zones of GoldDownload the PDF here. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00