November 27, 2024

Asara Resources Limited (ASX: AS1; Asara or Company) is pleased to announce that it has recommenced exploration activities at its flagship asset, the Kada Gold Project in Guinea (Kada).

HIGHLIGHTS

- Relogging of core samples.

- Drone survey to identify additional mineralisation recently undertaken.

- Geological and structural mapping of new drone imagery and fieldwork.

- Planning for the commencement of a drill program in early 2025 to upgrade the existing Mineral Resource Estimate.

- Community engagement to strengthen relationships with local communities.

- Preparation for commencement of environmental studies.

Managing Director, Tim Strong commented:

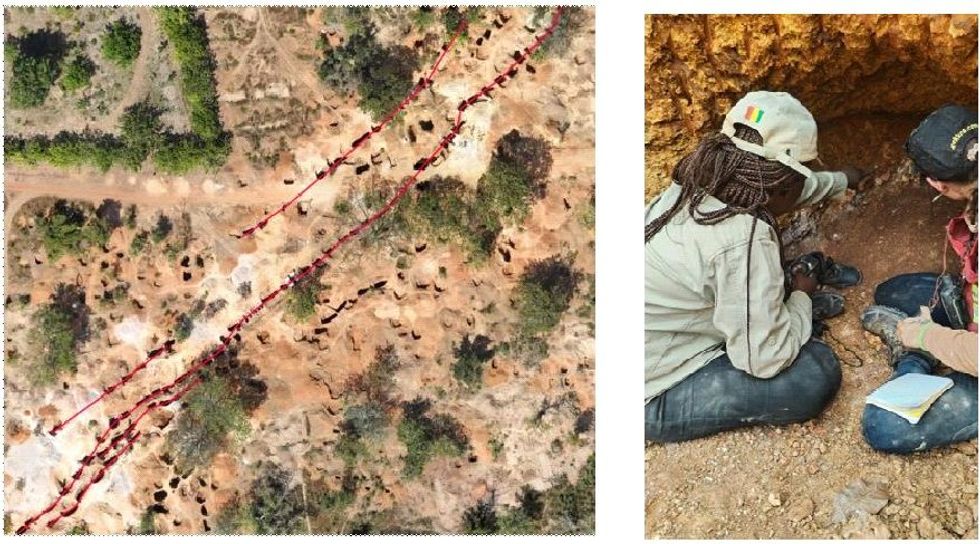

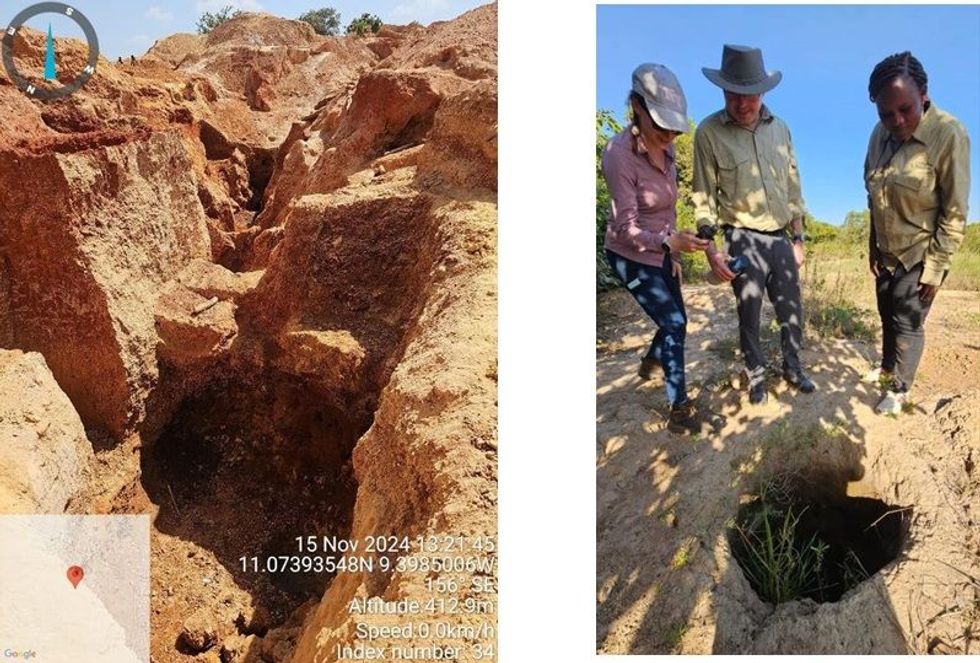

“We are excited to recommence work at Kada following a pause in field activities throughout 2024. Our team is back on the ground, refurbishing camp facilities, re-logging core samples, undertaking geological and structure mapping in the Massan area and establishing important community relationships. In addition, we have deployed a drone to assist in determining the structural orientation of historical work undertaken and identify potential areas of gold mineralisation that may not have been previously recognised.

Looking ahead, we expect drilling to begin in the March quarter of 2025. The drilling program will focus on upgrading portions of the Massan Mineral Resource to the Measured category, as well as testing additional structures that are not currently included in the Mineral Resource Estimate.’’

KADA GOLD PROJECT

Exploration Activities

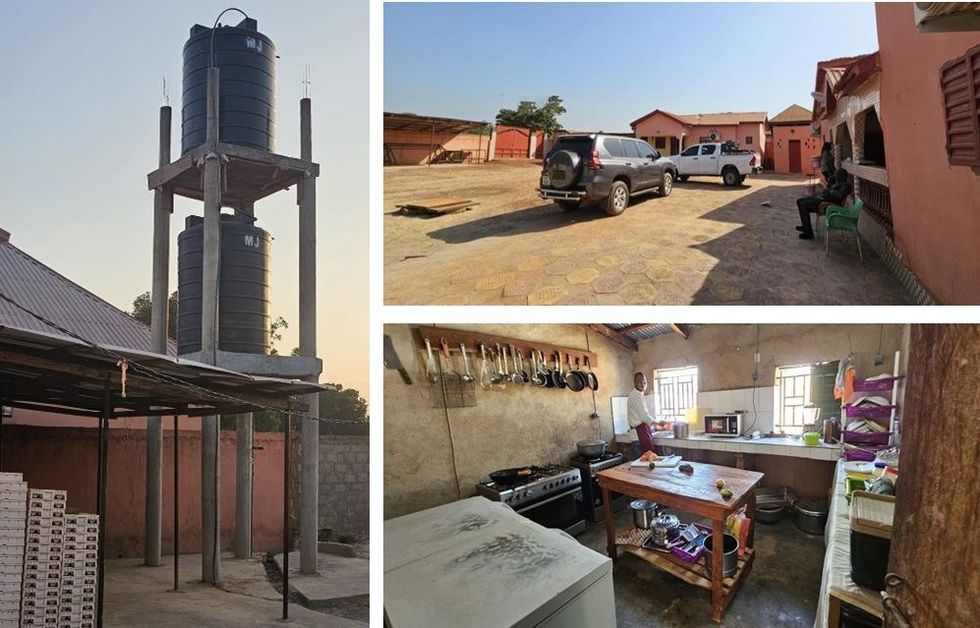

Activities at Kada recommenced during October with the installation of a new water borehole and a 10,000 litre capacity water tower at the Niandankoro Camp. All camp areas were connected to the new water system providing running water throughout.

The camp has undergone a detailed inventory, and store areas have been prepared in readiness for the commencement of fieldwork and then drilling.

Geological and structural mapping of the workings have commenced. This is a combination of desktop interpretation of recent drone imagery and fieldwork.

Community and Environment

The Company recognises the importance of engaging the local community, strengthening working relationships and to share information and understand local expectations and resolve any issues as and when they arise. To that end, work has commenced to establish social and environmental baselines. Over the last month, meetings were held with Company representatives, local elders, the Mayor of Niandankoro and Sous-Prefet which were beneficial and greatly appreciated by all attendees.

A weather station has been installed at Asara’s Niandankoro Camp giving vital baseline data for the environmental studies that will commence in 2025.

Burkina Faso

As announced on July 14, 2024, the Company entered into a binding Share Purchase Agreement (SPA) with Bic West Africa Limited (BIC) for the sale of its non-core Kouri and Babonga gold projects for total consideration of US$2.2m cash. The Company is continuing to work towards satisfying the Conditions Precedent outlined in the SPA, having recently obtained approval from the Tax Office with approval of the transaction by the Minister of Mines the final step. Following approval from the Tax Office, BIC made an advance payment of US$550,000 (against the final Completion Payment of US$1.1m). It is expected that the final payment of US$550,000 will be made by BIC once the Mininter of Mines has approved the transaction. It is expected that this approval will be obtained by the end of the December 2024 quarter.

Click here for the full ASX Release

This article includes content from Asara Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Asara Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

07 July 2025

Asara Resources

Advancing the next West African gold camp from the heart of Guinea’s prolific Siguiri Basin

Advancing the next West African gold camp from the heart of Guinea’s prolific Siguiri Basin Keep Reading...

1h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

22h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

22h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

23h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

23h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

05 March

Oreterra Metals

Get access to more exclusive Gold Investing Stock profiles here Keep Reading...

Latest News

Sign up to get your FREE

Asara Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00