May 29, 2025

Description

Cobre Limited (ASX:CBE) is gaining attention for its expansive exploration efforts across highly prospective copper and quartz tenements in Botswana and Western Australia. A recent report by Independent Investment Research (IIR) highlights Cobre’s growing potential in the copper sector, especially within the underexplored yet mineral-rich Kalahari Copper Belt.

Key Highlights from the IIR report:

Botswana: High-grade Copper in Elephant Country

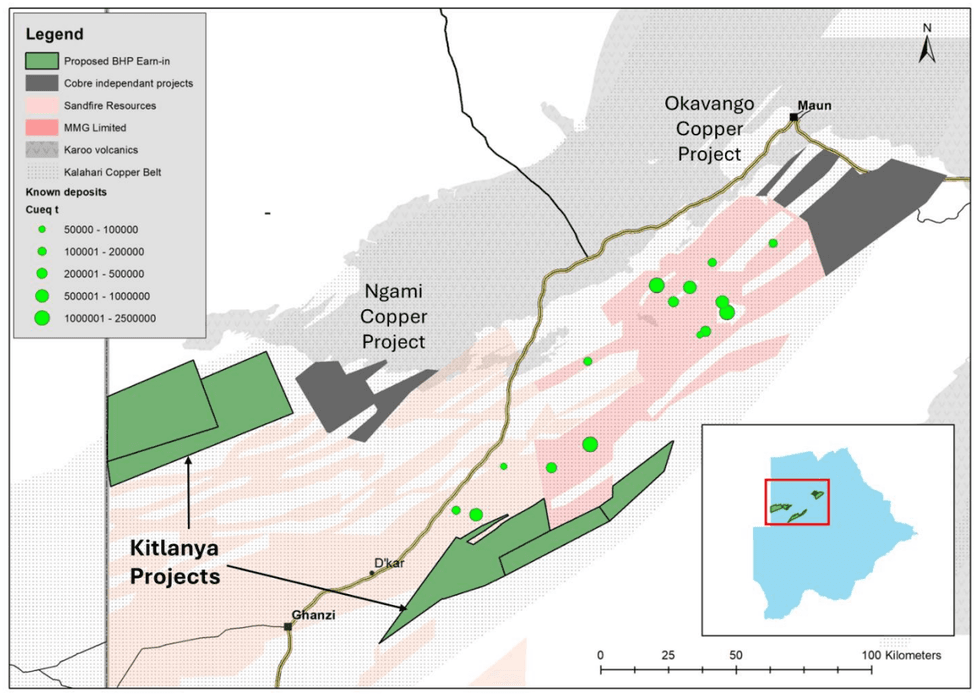

At the core of Cobre’s portfolio is its 100 percent owned Kalahari copper project (KCP) in northwestern Botswana, an emerging global copper hotspot. The project spans 5,393 sq km across four key tenement blocks – Ngami, Okavango, Kitlanya East and Kitlanya West. It sits adjacent to major producing assets owned by Sandfire Resources and MMG, which together hold 7 million tonnes of copper and nearly 300 million ounces of silver in resources.

- BHP Joint Venture: A US$25 million, 8-year earn-in agreement gives BHP up to 75% of the Kitlanya East and West projects, with Cobre retaining operatorship during the earn-in phase.

- Ngami ISCL Opportunity: At Ngami, Cobre is targeting an in-situ copper leach (ISCL) development. Testwork has returned copper recoveries of up to 82 percent, with exploration targets of up to 167 Mt @ 0.45 percent copper.

- Okavango Upside: Limited drilling has shown promising signs, along strike from MMG’s Khoemacau operation.

Western Australia: High-purity Quartz (HPQ) for the Energy Transition

At Perrinvale, Cobre is exploring a quartz unit with grades up to 99.6 percent silica, which is critical for electronics, solar photovoltaics and semiconductors. A published exploration target of up to 28.3 Mt and encouraging metallurgical results have attracted early interest from potential partners, including Malaysian group GK Silica.

Strategic Position and Financial Snapshot

Cobre remains well-positioned financially, with approximately AU$3 million in cash and investments as of March 2025. The company’s shareholder base is tightly held, with insiders owning over 7 percent and cornerstone investor Strata Investment Holdings controlling nearly 20 percent.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

CBE:AU

The Conversation (0)

28 January

Quarterly Activities/Appendix 5B Cash Flow Report

Cobre Limited (CBE:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

13 November 2025

Trading Halt

Cobre Limited (CBE:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Cobre Limited (CBE:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 October 2025

Sinomine Becomes a Substantial Shareholder in Cobre

Cobre Limited (CBE:AU) has announced Sinomine Becomes a Substantial Shareholder in CobreDownload the PDF here. Keep Reading...

14 October 2025

In-Situ Copper Recovery Environmental Permitting Update

Cobre Limited (CBE:AU) has announced In-Situ Copper Recovery Environmental Permitting UpdateDownload the PDF here. Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

26 February

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00