June 26, 2024

In its recent coverage of Metals Australia Limited (ASX:MLS), Australian analyst firm Vested Equities’ has given Metals Australia a valuation of approximately 4.7 cents per share, reflecting a compelling proposition. This valuation, based on a comparative assessment of graphite peers and the intrinsic value of the Lac Rainy resource, does not yet account for the full potential of the company's expansive exploration portfolio, the Vested report indicates. With the anticipation of further exploration unlocking substantial value, Metals Australia presents an attractive investment opportunity with significant upside potential, it adds.

Metals Australia stands out as a formidable player in the battery minerals sector with its robust portfolio of exploration and development projects. Strategically situated in the premier mining jurisdictions of Quebec, Canada and Western Australia, MLS showcases a suite of projects rich in sought-after battery metals such as lithium and graphite. Amidst China's tightening graphite export controls, MLS's assets gain geostrategic importance, offering a non-Chinese source of premium battery-grade graphite crucial for the North American lithium-ion/EV battery market.

“Metals Australia Limited is strategically positioned to experience a re-rating of its share price, driven by a confluence of catalysts,” the report states, citing MLS's strategic positioning, resource base and proactive management team as collectively form a compelling investment narrative.

Report Highlights:

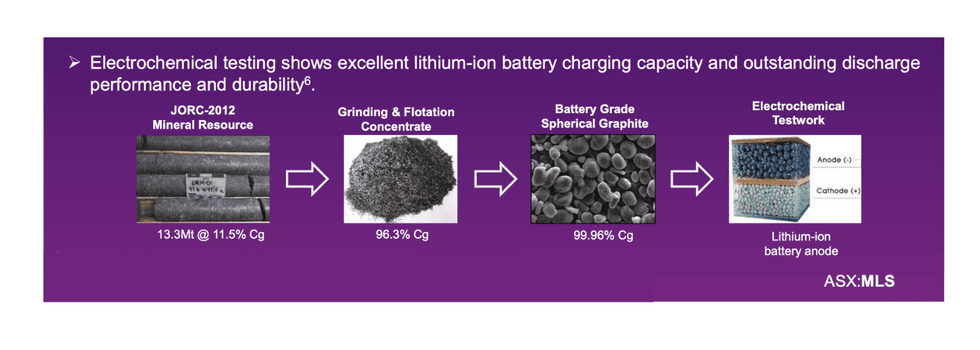

- The Lac Rainy project, a cornerstone of MLS's portfolio, boasts a JORC 2012 Mineral Resource of 13.3 million tons at 11.5 percent graphitic carbon. This includes a high-grade indicated resource and an inferred resource with significant economic potential confirmed by a completed scoping study. With recent contracts aimed at expanding and enhancing the resource, alongside plans for a flake graphite concentrate plant, the project's potential is yet to be fully tapped, promising substantial upside.

- Aggressive exploration programs for lithium and gold. The discovery of a new LCT pegmatite within the Corvette South Lithium trend in Quebec, parallels the significant findings by Patriot Battery. This, along with the gold prospects in the southeastern tenements and the lithium-bearing pegmatites in the Manindi project, highlight the company's dynamic exploration strategy. Furthermore, the acquisition of copper and gold tenements through Payne Gully Gold adds another layer of prospective value to the company's assets.

- The leadership of MLS, with the recent appointment of CEO Paul Ferguson, is poised to leverage extensive industry experience to accelerate the exploration and development activities. The company's financial health is robust, with cash reserves surpassing its market capitalization, indicating a strong financial position to sustain its ambitious growth plans.

Click here for the full report

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

MLS:AU

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Metals Australia (MLS:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Graphite Project Links to Quebec's Critical Minerals Plan

Metals Australia (MLS:AU) has announced Graphite Project Links to Quebec's Critical Minerals PlanDownload the PDF here. Keep Reading...

18 December 2025

High Copper Anomalies Show Deeper Potential at Warrego East

Metals Australia (MLS:AU) has announced High Copper Anomalies Show Deeper Potential at Warrego EastDownload the PDF here. Keep Reading...

16 December 2025

Titanium-Vanadium-Magnetite Discovery Extended over 1km

Metals Australia (MLS:AU) has announced Titanium-Vanadium-Magnetite Discovery Extended over 1kmDownload the PDF here. Keep Reading...

05 November 2025

Drilling the Manindi Vanadium-Titanium-Magnetite Discovery

Metals Australia (MLS:AU) has announced Drilling the Manindi Vanadium-Titanium-Magnetite DiscoveryDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00