March 28, 2024

AM Resources Corporation (“AM Resources” or the “Company”) (TSXV: AMR) (Frankfurt: 76A), a dynamic junior mining company focused on the exploration and development of high-potential pegmatite lithium deposits, is pleased to announce the discovery of 49 new pegmatites within an area of 12,32 km2. These pegmatites consolidate the Company’s strategic position in one of Austria’s most prospective lithium areas.

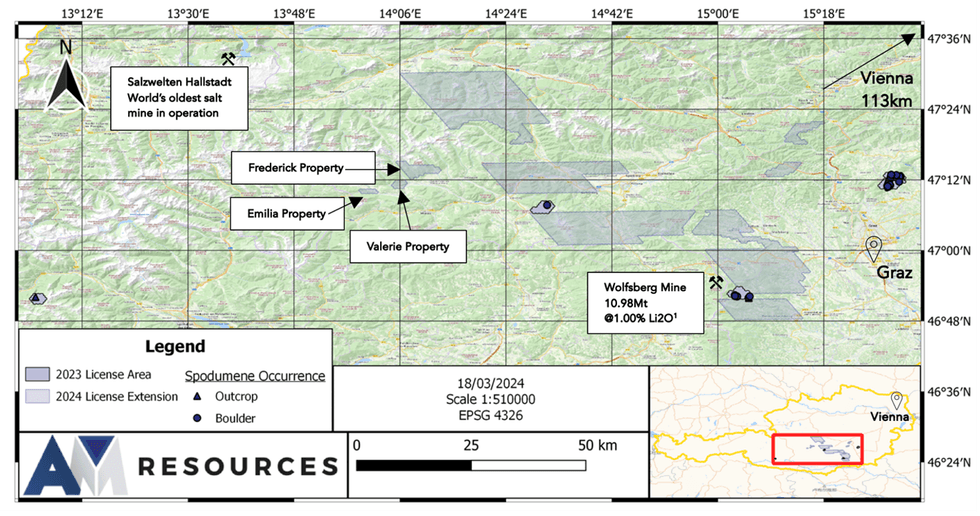

- Recently announced 1,500 km2 land package gives AM Resources control over a large area of the Austrian Pegmatite Belt (see press release dated March 21, 2024).

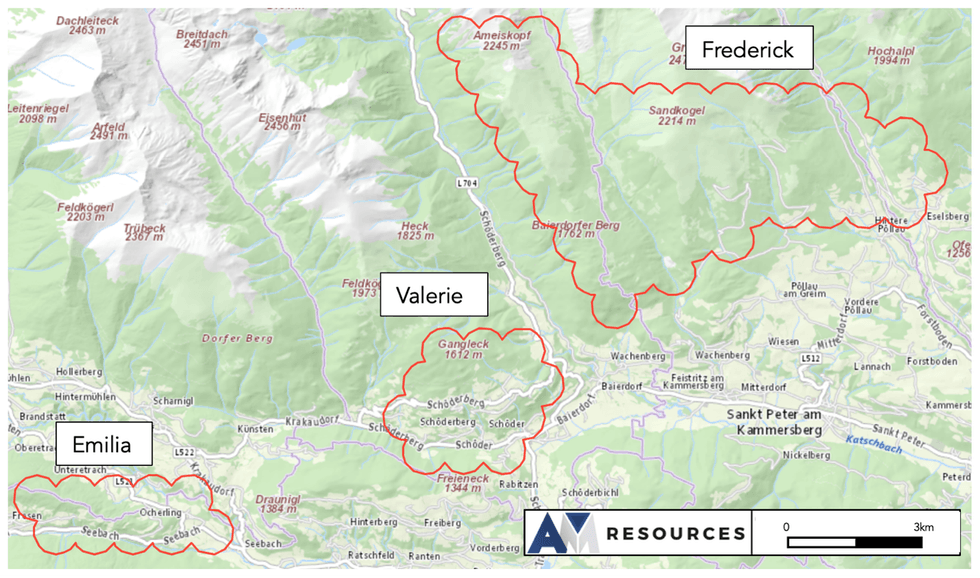

- Land package also includes the Valerie Property, where 27 pegmatites have been identified over an area of 7.2 km2, and the Emilia Property, where 22 pegmatites have been identified over an area of 5.12 km2.

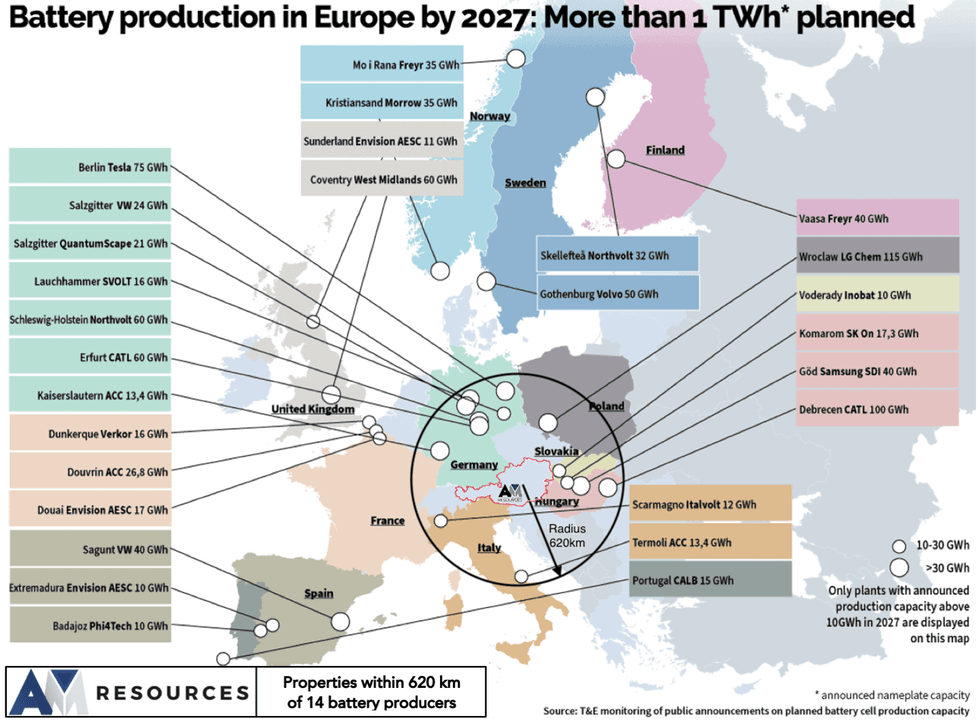

- AM Resources properties are located within a 620 km radius of 14 battery plants.

AM Resources’ 1,500 km2 land package

Valerie Property

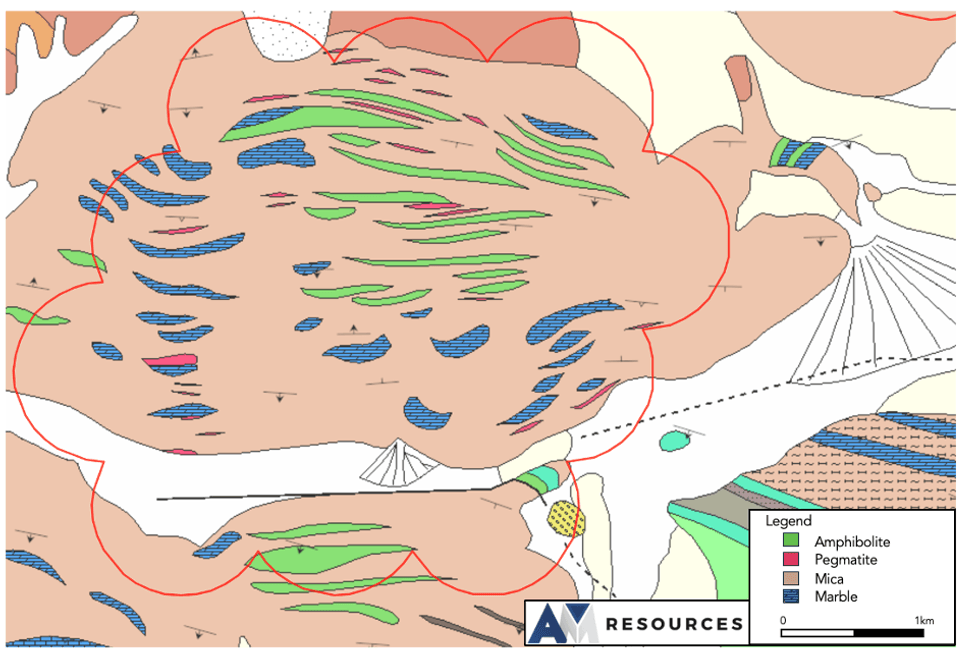

Located just 1 km southwest of the Frederick property, the Valerie property hosts 27 pegmatites over an area of 7.2 km2. The average pegmatite length is 203 metres and the longest one measures 447 metres.

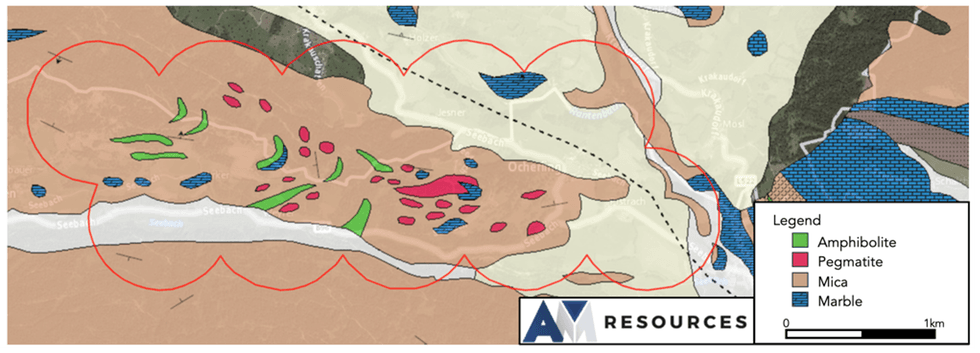

Emilia Property

Located 8 km southwest of the Frederick property, the 5.12 km2 Emilia property hosts 22 pegmatites with the longest pegmatite measuring 505 metres long and 110 metres wide, showcasing the large scale potential of the Austrian Pegmatite Belt.

Total length of pegmatites – a marker of potential

The cumulative length of pegmatites across the Valerie and Emilia properties amounts to 8 km, indicative of the substantial prospective lithium opportunity at hand.

David Grondin, CEO of AM Resources commented: “The added strategic value of our Emilia and Valerie properties cannot be overstated, with 8 km of pegmatite bodies to explore. Combined with the 112 pegmatites on the Frederick property, we could not be more excited to begin our exploration campaign.”

“In terms of logistics, we have the strong advantage of having our technical team, led by Julien Desrosiers, our COO Europe, all based in Europe, which will have a positive impact on costs and acquisition opportunities. In addition, our team has a strong understanding of the permitting and regulatory process in Austria and has access to the necessary resources and equipment to explore and develop our projects,” added Mr. Grondin.

Geological setting, the importance of the mica schists bodies1

The geology of the Austrian Pegmatite Belt is similar to geological formations in Canada. The presence of mica schists is significant. Mica schists are metamorphic rocks that have undergone high-temperature and pressure changes. These conditions are favorable for the formation of certain minerals, including spodumene, from the breakdown of Li-bearing alumino-silicate mineral staurolite, which can contain significant amounts of lithium (up to 0.3% Li2O). The breakdown of staurolite can release lithium into the surrounding rock, where it can be incorporated into pegmatites.

The partial melting of rocks is crucial for the development of pegmatites in the Austroalpine Unit of the Eastern Alps, where albite-spodumene pegmatites are associated with metamorphic events. The evidence suggests pegmatites are derived from the anatexis of Al-Li-rich metapelites under upper amphibolite facies conditions.

Location, location, location

As previously reported, the AM Resources team has been actively assembling a massive prospective land package with four key elements at the core of its strategy: proven geology, proximity to key markets, historical expertise, and a clear, proven mining code. AM Resources’ Austrian properties are located within 620 km of 14 planned battery plants and have direct access to an extensive rail system.

Qualified Person

Technical information related in this news release has been reviewed and verified by Jean Lafleur, P. Geo., of PJLEXPL Inc., a registered geologist with the Ordre des Géologues du Québec (OGQ #833) and is a qualified person (QP) as defined by NI 43-101. Mr. Lafleur is independent from the Company and has reviewed and approved the disclosure of the AM Resources geological information.

About AM Resources

AM Resources Corporation (TSXV: AMR) is a dynamic junior mining company focused on the exploration and development of high-potential pegmatite deposits. With a strategic portfolio of assets and a commitment to responsible resource development, the Company is dedicated to creating long-term value for its stakeholders while adhering to the highest standards of corporate governance and sustainability.

Forward-Looking Statements

This news release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of AM Resources to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “estimates”, “intends”, “anticipates” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Since forward-looking statements and information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Readers are cautioned that the foregoing list of factors is not exhaustive. The forward-looking statements contained in this news release are made as of the date of this release and, accordingly, are subject to change after such date. AM Resources does not assume any obligation to update or revise any forward-looking statements, whether written or oral, that may be made from time to time by us or on our behalf, except as required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information:

David Grondin

AM Resources Corporation

President and Chief Executive Officer

1-514-583-3490

www.am-resources.ca

AMR:CA

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00