- WORLD EDITIONAustraliaNorth AmericaWorld

July 22, 2024

NGX Limited (NGX or the Company) is pleased to announce that the Company has entered into earn-in joint venture agreements to acquire two uranium exploration project applications in Namibia. These projects enhance the Company’s focus on clean energy minerals in Africa and are complementary to NGX’s existing graphite assets in Malawi.

- NGX has entered into two binding earn-in joint venture agreements for two Exclusive Prospecting Licence applications (EPL) in Namibia

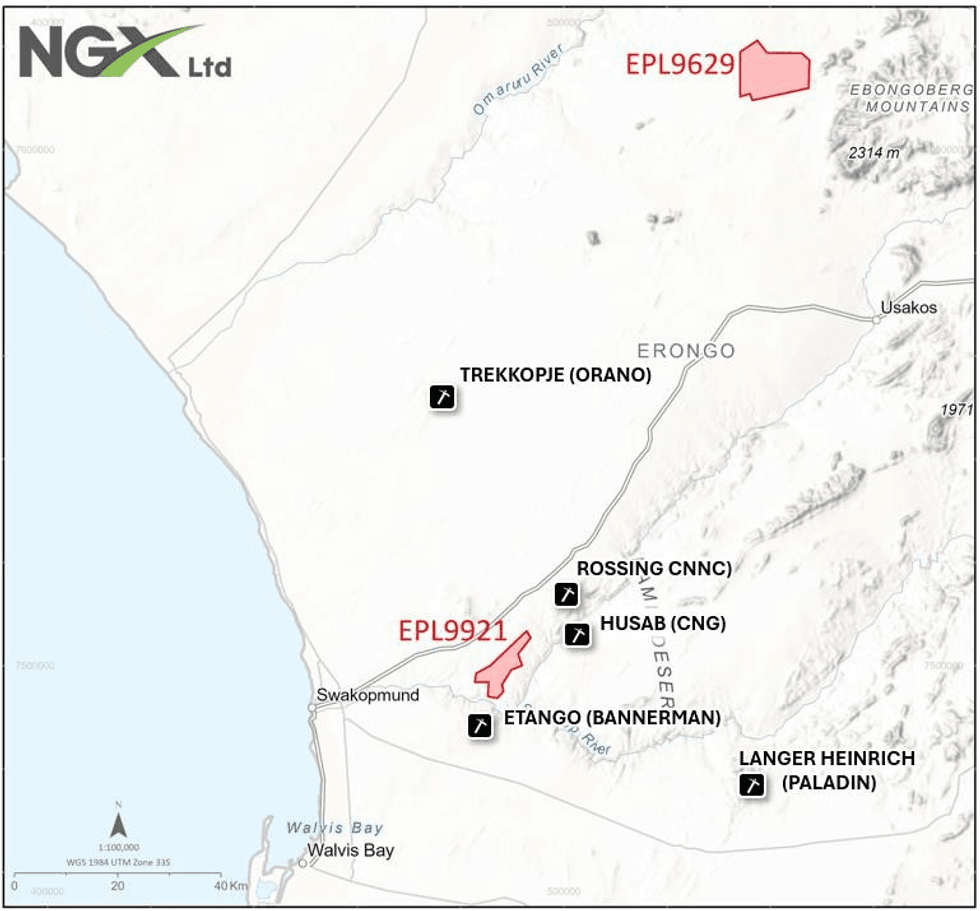

- Both EPLs are located in the Erongo Region of Namibia, one of the world’s best-known uranium districts with multiple operating mines in the area

- The acquisition of these uranium project applications enhances the Company’s focus on clean energy minerals in Africa and are complementary to NGX’s existing natural graphite assets in Malawi

- The Company’s downstream strategy and anode qualification program from its natural graphite project base in Malawi are continuing, with ongoing testwork programs and the recent appointments of two highly experienced commercial and technical experts

The Damara uranium belt of Namibia is one of the world’s best known uranium districts. With major uranium operations including Rio Tinto’s Rossing mine, China General Nuclear Power Group’s (CNG) Husab mine, Paladin’s Langer Heinrich mine and Bannerman Energy Limited’s (Bannerman) Etango deposit.

Rossingburg (EPL9921) is located in the main uranium production hub of the central Damara uranium belt, between the Rossing uranium mine and Etango uranium project. The Rossingburg licence application area shows evidence of widespread uranium mineralisation intercepted in drilling by previous explorers including Rio Tinto and Bannerman.

Tubusis (EPL9629), to the northeast of Swakopmund, is in an under-explored region of the Damara belt. The licence area was also the subject of limited historical exploration by previous permit holders.

NGX geologists recently inspected both licence application areas, which showed evidence of historical exploration and outcropping alaskite leucogranites units, prospective to host uranium mineralisation.

NGX’s Executive Director, Matt Syme, commented:

“While NGX has been progressing permitting and processing testwork on our flagship graphite projects in Malawi, we have also been looking for opportunities to expand our clean energy minerals portfolio in Africa, to meet the world’s growing need for carbon free energy. Our management group includes considerable and very successful experience in uranium exploration, so this is a natural addition to our portfolio. We are very optimistic about the outlook for the uranium market and Namibia remains the premier uranium exploration environment in Africa.”

Click here for the full ASX Release

This article includes content from NGX Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NGX:AU

The Conversation (0)

1h

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00