October 20, 2024

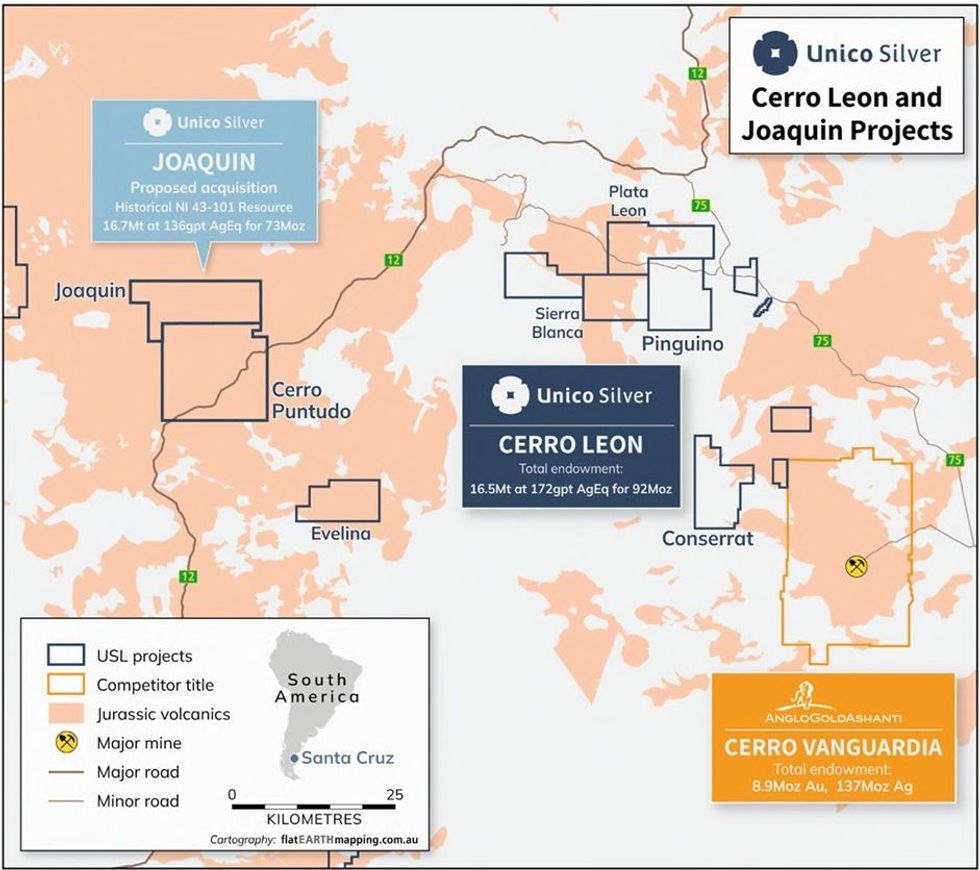

Unico Silver Limited (“USL” or the “Company”) refers to the announcement on 20 August 2024 regarding the proposed acquisition of Minera Joaquin S.R.L, the 100% owner of the mineral claims that make up the Joaquin project, and the 100% acquisition of the mineral titles that make up the Cerro Puntudo project (collectively the “Joaquin Project”).

Following the satisfaction of all required approvals and consents, and execution of final definitive legal agreements between Pan American Silver Corp. (“PAAS”) and USL, the Company is pleased to advise that it has completed the acquisition of the Joaquin Project.

HIGHLIGHTS

- 100% acquisition of two contiguous properties (Joaquin and Cerro Puntudo) totalling 35,G46Ha.

- Joaquin contains a historical Foreign Estimate1 of 16.7Mt at 136gpt silver equivalent (AgEq2) for 73Moz AgEq (68Moz Ag, 64koz Au) in the La Negra and La Morocha deposits.

- Strategically located 60km west of USL’s G1Moz AgEq Cerro Leon resource2 and portfolio, enhancing future development options, with added scale and economics.

- Historical Foreign Estimates exclude adjacent Cerro Puntudo mineral properties which host the along strike extensions of the La Negra and La Morocha deposits.

- USL is planning a comprehensive exploration program on four advanced prospects, aiming to boost current Foreign Estimates and publish a maiden JORC (2012) MRE.

- Historical drill holes that fall outside the current resource:

- La Negra Feeder: 4.5m at 16GGgpt Ag, 22gpt Au from 272m

- La Negra Extension: 3m at 2723gpt Ag, 4.1gpt Au from 54m

- La Morocha Extension: 8m at 226gpt Ag, 0.5gpt Au from 189m

- Cerro Puntudo is host to numerous vein targets (Brunilda, La Esmeralda, Isabella) with high silver gold values at surface that are untested by drilling.

- The transaction includes camp infrastructure and a mining and access agreement valid until 2034.

- Upfront consideration of USD$2m funded from existing cash reserves, with future payments of USD$2m on publication of an economic study supporting a mineral resource at the Joaquin project and USD$8m on commercial production.

Cautionary Statement

(a) The estimates of mineralisation included in this announcement are foreign estimates and are not reported in accordance with the Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves (2012 JORC Code) and is a “Foreign Estimate”

(b) A Competent Person has not yet done sufficient work to classify the Foreign Estimate as Mineral Resources or Ore Reserves in accordance with the 2012 JORC Code.

(c) It is uncertain that following evaluation and/or further exploration work that the Foreign Estimates will be able to be reported as mineral resources or ore reserves in accordance with the JORC Code 2012.

The information in this Announcement that relates to foreign estimates of mineralisation has been extracted from information contained in the Company’s ASX announcement of 20 August 2024. USL confirms that it is not in possession of any new information or data relating to the foreign estimates of mineralisation that materially impacts on the reliability of those foreign estimates or USL’s ability to verify the foreign estimates a mineral resources or ore reserves in accordance with Appendix 5A (JORC Code). USL confirms that the supporting information provided in the initial market announcement of 20 August 2024 continues to apply and has not materially changed.

Click here for the full ASX Release

This article includes content from Unico Silver Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

17h

Peter Krauth: Silver Cycle Still Early, Big Money Ready to Buy

Peter Krauth, editor of Silver Stock Investor and Silver Advisor, shares his thoughts on silver price activity and where the white metal is in the cycle. He believes the awareness phase is just beginning, with mania still relatively far in the future. Don't forget to follow us @INN_Resource for... Keep Reading...

05 March

Chen Lin: Key Silver Date to Watch, My Favorite 2026 Commodities

Chen Lin of Lin Asset Management weighs in on silver and gold, as well as the critical minerals market, which is his favorite sector for 2026. He also discusses how conflict in the Middle East could impact the resource sector. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

05 March

Prince Silver: Fully Funded and Targeting 100 Million Ounces Silver Equivalent in Nevada

Ranking first in the world in the Fraser Institute’s 2025 Annual Survey of Mining Companies, Nevada remains a top choice for companies. Prince Silver’s (CSE:PRNC,OTCQB:PRNCF) flagship Prince silver project stands to benefit from its outstanding permitting process and geology.Prince Silver CEO... Keep Reading...

04 March

What's Next for the Silver Price After $100 Per Ounce?

First Majestic Silver (TSX:AG,NYSE:AG) CEO Keith Neumeyer’s silver price prediction of over US$100 per ounce came true in 2026. When will silver prices make a more lasting hold in triple digit territory?The silver price was up over 189 percent year-on-year as of March 2, 2026, on the back of... Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00