- WORLD EDITIONAustraliaNorth AmericaWorld

March 04, 2024

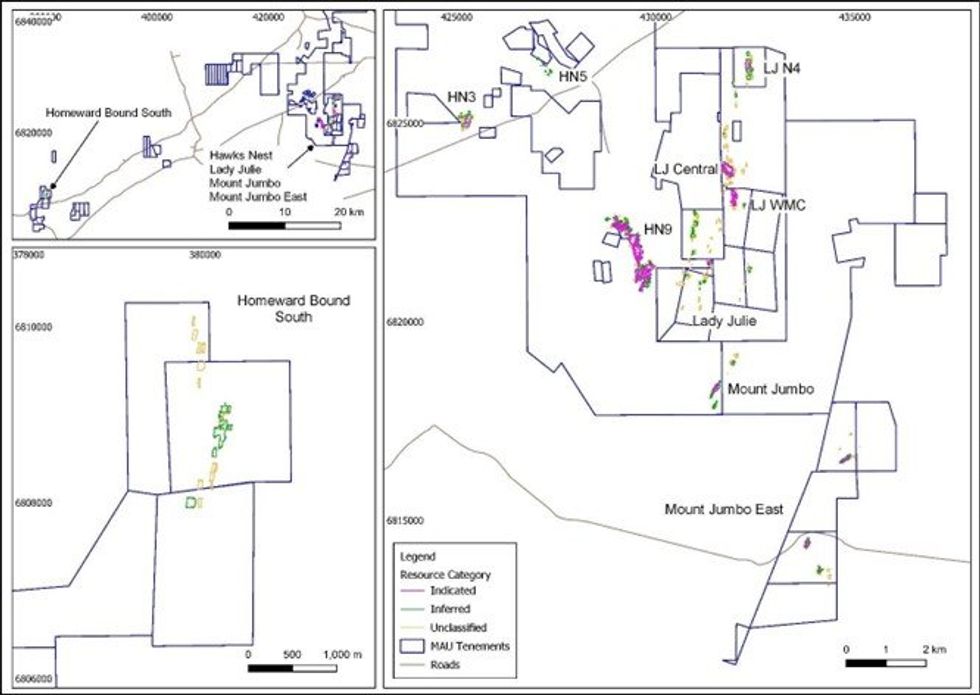

Magnetic Resources NL (Magnetic or the Company) is pleased to announce an Updated Mineral Resource Estimates from its deposits in the Laverton and Homeward Bound area.

HIGHLIGHTS

- This update incorporates results from recent drilling results carried out at Lady Julie North 4 (LJN4) since the last resource report announced in November 2023 (“Significant 107% Increase of Mineral Resource at Laverton Project”, ASX release 24 November 2023”).

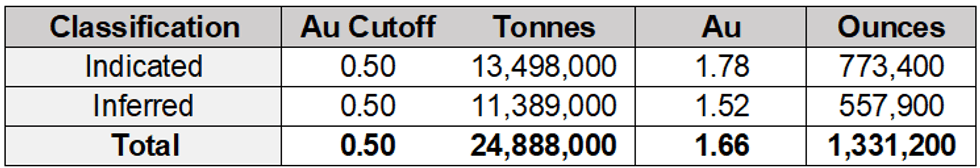

- Upgraded Mineral Resources Estimate for the project area of:

- 24.9Mt @ 1.66g/t Au totaling 1.33Moz of gold at 0.5g/t cutoff.

- Increase of 7.7% in contained gold over the 24 November 2023 ASX Release.

- Contained gold in LJN4 has risen 11 % from 852,000oz to 948,200oz Au.

- Recent drilling has also confirmed lode continuity on and between sections and as a result, the proportion of Indicated resource category ore has increased.

- Ongoing extension drilling continues at LJN4 and is expected to result in further resource increases as the northern, central and southern parts are still open downdip.

- Results for 6 deep diamond holes are pending and one deep hole is currently being completed.

The update follows extensive down-dip drilling at LJN4.

The verification and reporting of Mineral Resources on behalf of the Company was completed by its JORC Competent Person, Mr M Edwards of Blue Cap Mining. The Mineral Resources Estimate has been prepared and reported in accordance with the 2012 Edition of the JORC Code.

Total Mineral Resources reported for the Laverton and Homeward Bound South projects is now 24.9Mt @ 1.66g/t Au at 0.5g/t cut-off totaling 1.33Moz of gold (See Table 1 below). The cutoff grade is considered appropriate for a large-scale open pit operation.

Managing Director George Sakalidis commented:

“The Lady Julie North 4 Resource has been the key focus for recent drilling, with multiple stacked lodes identified with a number of thick intersections that have still not been closed off at depth. The LJN4 deposit keeps on adding ounces, increasing from 204,000oz in Feb 2023 to 948,000oz in this report.

The northern part of LJN4 is continuous over 300m down dip. The central part is continuous down dip to 550 and the southern part is continuous down dip to 400m. Note in all these cases LJN4 is still open further down dip and augers well for future drilling and resource update, Currently, there are results for 6 deep diamond holes pending with one deep diamond hole in progress.

Following the completion of all baseline background studies, our attention over recent months has turned to completing a Pre-Feasibility, which is being prepared on the basis of the resource, which was defined at November 2023. While this resource estimate does not include the benefit of the recent drilling results at LJN4, this latest drill program was deep and widely spaced and should not have materially changed the outcomes of the project economics.

Preparations are also underway for the development of a Mining Proposal. One mining lease application has already been lodged over LJN4 with others following the lodgement of the Mining Proposal.”

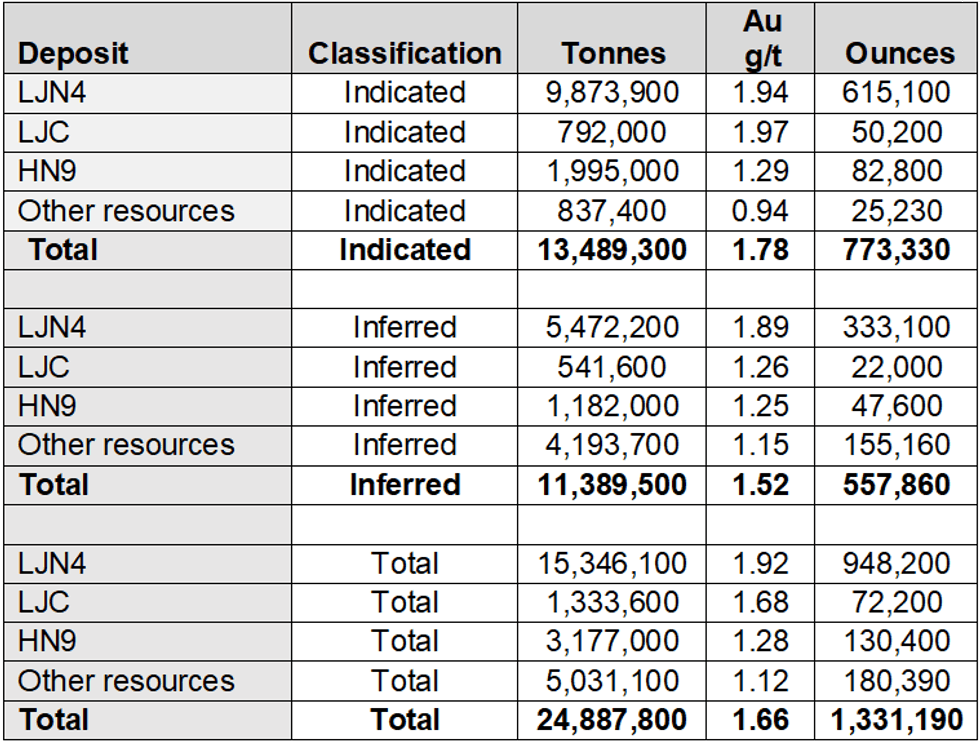

The Table below summarises the updated Total Mineral Resource at a 0.5g/t Au cutoff (Table 1), with Table 2 providing details of the major resources. Details for the smaller resources which have not changed can be found in the 3 February 2023 ASX release.

Drilling has concentrated on LJN4 over the last 4 months, which are shown in Table 2 and are further summarised below:

LJN4 Resource

The LJN4 (Indicated and Inferred) Resource of 15.3 Mt at 1.92 g/t for 948,200 oz has a present footprint of 750m x 500m (Figure 4) and remains open down dip to the east. Recent drilling results have confirmed the previous interpretation of a moderately dipping, multi-lode structure. Where the drilling encounters breccia, the mineralised structure expands considerably. This is particularly the case below 150m depth. More recent step out drilling has encountered large breccia zones which auger well for continuation of mineralisation at depth. Additional drilling is being planned to further test these expanded breccia zones.

From November 2023 to February 2024, some 29 DD/RC holes were completed for 10,741m with the deepest hole reaching 585.9mRL (500m below surface). A further 6 DD holes for 869m were drilled for geotechnical follow up. Exploration drilling is continuing and results are due for 6 deep diamond holes and with one deep diamond hole being completed.

Some 62% of the resource is classified in the Indicated Category – the increase over the November 2023 report is linked to the excellent continuity evidenced from recent drilling.

Click here for the full ASX Release

This article includes content from Magnetic Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

9h

How to Invest in Gold Royalty and Streaming Stocks

Gold royalty companies offer investors exposure to gold and silver with the benefits of diversification, lower risk and a steady income stream. Royalty companies operating in the resource sector will typically agree to provide funding for the exploration or development of a resource in exchange... Keep Reading...

9h

How Would a New BRICS Currency Affect the US Dollar?

The BRICS nations, originally composed of Brazil, Russia, India, China and South Africa, have had many discussions about establishing a new reserve currency backed by a basket of their respective currencies. The creation of a potentially gold-backed currency, known as the "Unit," as a US dollar... Keep Reading...

13h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

16h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

23 February

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23 February

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00