August 06, 2024

Heritage Mining Ltd. (CSE: HML FRA:Y66) (“Heritage” or the “Company”) is pleased to announce that the 2024 drilling program has started over the weekend at Zone 3. The program will focus with historical confirmation drilling and SGH soil target testing.

Highlights:

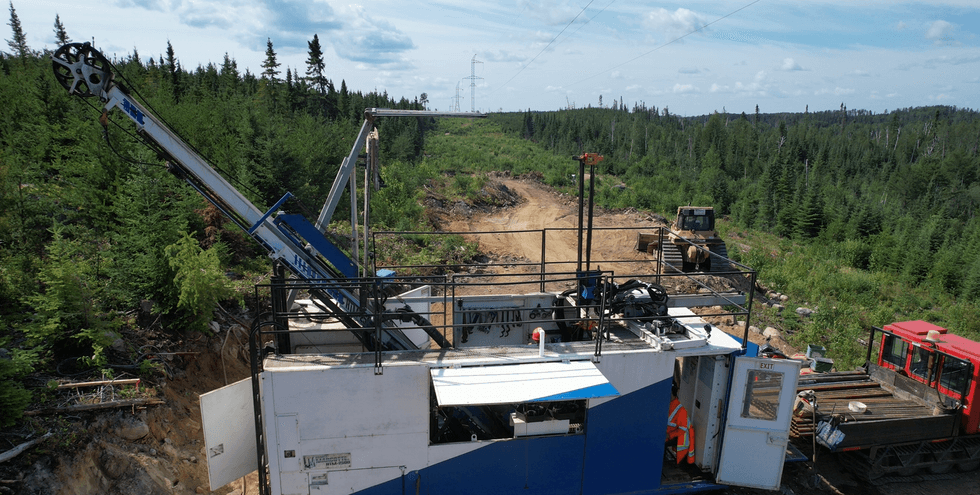

- Zone 3 Drill Program Start (Figure 1)

Figure 1: Zone 3 2024 drill program, August 5, 2024

“We are very excited to have the drill turning at Zone 3. The mineralization from the first hole is very encouraging supporting our internal model, we are right where we want to be. More updates to come in the very near future.” Commented Peter Schloo, President CEO and Director of Heritage.

Qualified Person

Mitch Lavery P. Geo, Strategic Advisor for the Company, serves as a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects and has reviewed the scientific and technical information in this news release, approving the disclosure herein.

ABOUT HERITAGE MINING LTD.

The Company is a Canadian mineral exploration company advancing its two high grade gold-silver-copper projects in Northwestern Ontario. The Drayton-Black Lake, Contact Bay and Scattergood projects are located near Sioux Lookout in the underexplored Eagle-Wabigoon-Manitou Greenstone Belt. The projects benefit from a wealth of historic data, excellent site access and logistical support from the local community. The Company is well capitalized, with a tight capital structure.

For further information, please contact:

Heritage Mining Ltd.

Peter Schloo, CPA, CA, CFA

President, CEO and Director

Phone: (905) 505-0918

Email: peter@heritagemining.ca

FORWARD-LOOKING STATEMENTS

This news release contains certain statements that constitute forward looking information within the meaning of applicable securities laws. These statements relate to future events of the Company. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “forecast”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe”, “outlook” and similar expressions are not statements of historical fact and may be forward looking information. All statements, other than statements of historical fact, included herein are forward-looking statements.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks include, among others, the inherent risk of the mining industry; adverse economic and market developments; the risk that the Company will not be successful in completing additional acquisitions; risks relating to the estimation of mineral resources; the possibility that the Company’s estimated burn rate may be higher than anticipated; risks of unexpected cost increases; risks of labour shortages; risks relating to exploration and development activities; risks relating to future prices of mineral resources; risks related to work site accidents, risks related to geological uncertainties and variations; risks related to government and community support of the Company’s projects; risks related to global pandemics and other risks related to the mining industry. The Company believes that the expectations reflected in such forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward‐looking information should not be unduly relied upon. These statements speak only as of the date of this news release. The Company does not intend, and does not assume any obligation, to update any forward‐looking information except as required by law.

This document does not constitute an offer to sell, or a solicitation of an offer to buy, securities of the Company in Canada, the United States, or any other jurisdiction. Any such offer to sell or solicitation of an offer to buy the securities described herein will be made only pursuant to subscription documentation between the Company and prospective purchasers. Any such offering will be made in reliance upon exemptions from the prospectus and registration requirements under applicable securities laws, pursuant to a subscription agreement to be entered into by the Company and prospective investors.

Click here to connect with Heritage Mining (CSE:HML) to receive an Investor Presentation

HML:CC

The Conversation (0)

11h

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

23h

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00