(TheNewswire)

NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Multiple high-grade gold vein systems channel sampled at Drayton-Black Lake

Heritage Mining Ltd. (CSE:HML) (" Heritage " or the " Company ") is pleased to report the completion of the 2022 field program at the Company's 15,257 Ha Drayton-Black Lake Project (" DBL" ). DBL is located approximately 20 km northeast of Sioux Lookout, Ontario (Fig. 1) and covers 30 km of the Central Volcanic and Southern Sedimentary domains within the Eagle-Wabigoon-Manitou (" EWM ") Greenstone Belt, which also hosts Treasury Metals Inc.'s Goliath Gold-Silver Complex immediately to the southwest. This year's exploration program included property-wide MagEM airborne geophysical surveying, regional mapping, prospecting and sampling in addition to the recently completed channel sampling work

Program Highlights

Alcona : Mineralized deformation corridor over 1,000 m (up to 200 m wide) consisting of multiple discrete zones of deformed volcanic rocks and shear parallel quartz veins.

-

Main Prospect - 2022 grab samples returned values up to 58.1 g/t Au

-

Nine channels completed (50 sample assays pending) over 250 m of strike

-

Individual quartz – carbonate – sulphide veins up to 60 cm wide

-

-

Pond Prospect - 2022 grab samples returned values up to 24.6 g/t Au

-

Nine channels completed (80 sample assays pending), over 250 m of strike

-

Up to meter scale quartz – carbonate – sulphide veins

-

Alcona-New Millennium : At least two mineralized deformation corridors consisting of multiple discrete zones of deformed volcanic rocks and shear parallel quartz veins.

-

New Millennium Prospect - 2022 grab samples returned values up to 46.5 g/t Au

-

Nine channels completed (42 sample assays pending)

-

Multiple quartz veins from 0.50 to 1.0 m wide, with carbonate and sulphides

-

Multi-element analysis of vein material averaged 19.3 g/t Au, 97.6 g/t Ag and 76 ppm Te

-

Moretti: Mineralized deformation corridor over 2,500 m consisting of discrete zones of deformed volcanic rocks and shear parallel quartz veins ranging from cm to metre scale. Drilling by previous operators identified narrow high-grade Au intervals (e.g., 18.78 g/t over 0.6 m and 190.7 g/t over 0.24 m) and an 8.5 tonne bulk sample returned 14.62 g/t Au (ca. 1950). Refer to assessment file 52J04NE9387.

-

Moretti - 2022 grab sampling returned values up to 208 g/t Au

-

Seven channels completed (30 samples pending assays)

-

Multiple shear-parallel quartz veins, associated (Fe-) carbonate alteration, coarse gold observed

-

-

Black Lake - 2022 grab samples returned values up to 0.95 g/t Au

-

Sixteen channels completed (68 sample assays pending)

-

Evaluated multiple deformation zones with centimeter to meter quartz veins

-

Forster Area : Reconnaissance prospecting identified sheeted quartz veins referred historically to as the "Hi Grade Showing".

-

"Hi Grade Showing" - Five (5) samples collected, assays pending

-

Field confirmed the 6-meter-wide zone with multiple cm-scale quartz-carbonate veins that was historically sampled

-

Conecho Mines Ltd's 1951 report indicates "samples with no visible gold reported up to 1.52 oz (or 47.3g/t gold) and a grab sample with pin-point size visible gold reported 4.40 oz (or 136.8g/t gold), refer to Assessment file 52G13NW0039

-

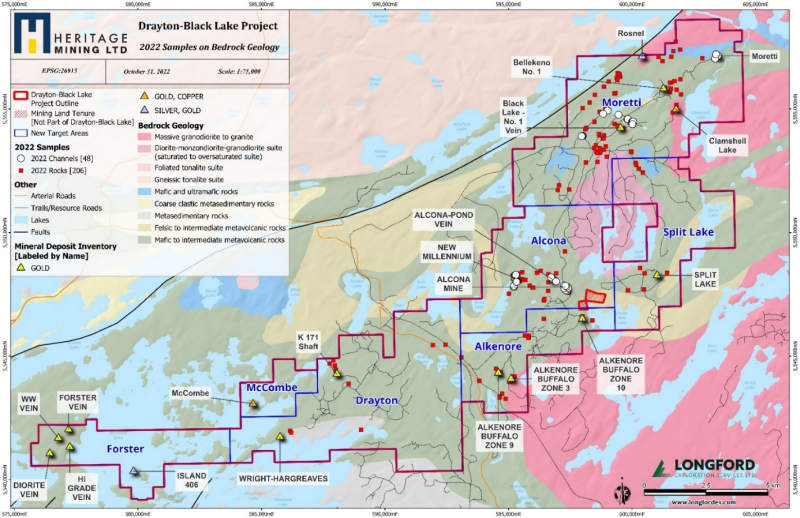

Peter Schloo, CEO of Heritage Mining commented, "Our first pass field program at Drayton-Black Lake Project confirms the area is a highly prospective, yet significantly underexplored mineral district. Our systematic boots on the ground exploration philosophy has been highly successful, with the team discovering multiple new veins and extending known vein systems along strike. Multiple meter-scale quartz veins and quartz stockwork zones reported high grade gold assays in rock grabs from Alcona-Main (58.1 g/t Au), Alcona-New Millennium ( 46.5 g/t Au ) and Moretti ( 208.0 g/t Au ) project areas (see Figure 1). To optimize our drill target prioritization, we recently completed systematic channel-sampling across these high-grade structures and look forward to reporting assays when received. These initial results, along with the highly anticipated channel-sample data, will provide Heritage valuable information as we plan systematic follow up for the winter and into the 2023 exploration program."

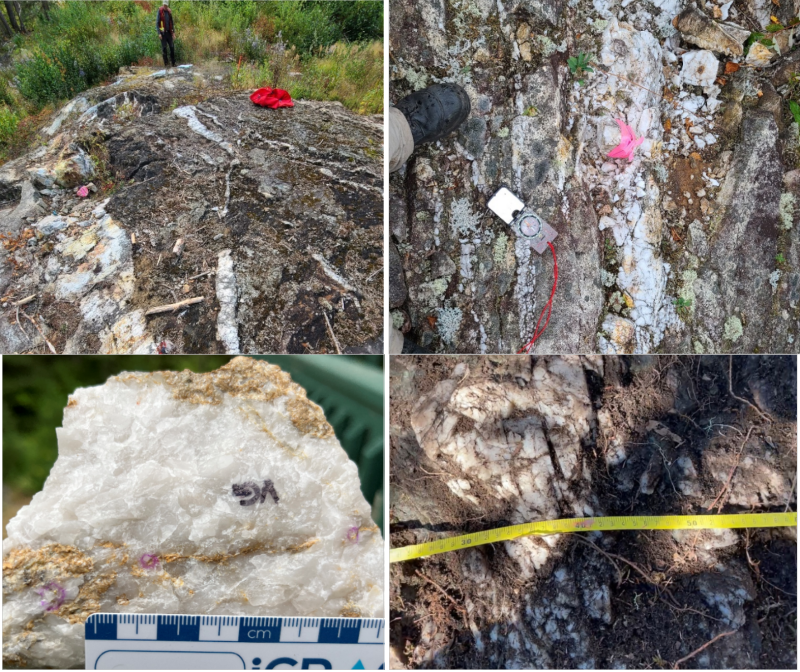

Figure 1: (Top Left) Alcona Pond Vein Area (Top Right) Sheeted quartz veins at New Millennium (Bottom Left) Coarse gold collected in the Moretti Area (Bottom Right) Quartz veins within the Hi Grade Vein showing at the Forster Area.

Program Summary

The 2022 field program focused on characterizing known high-grade mineralization for the planned follow-up drill program (e.g., vein type, structural setting, alteration and mineralogical characteristics) and was successful in confirming numerous surface exposures of high-grade Au and Au-Ag mineralization throughout the property. This is the first time a systematic "belt-scale" approach has been undertaken in the Drayton-Black Lake area, building off a compilation of historic exploration program data sets, enhanced with new systematic mapping, sampling and multi-element geochemistry to develop multi-scale exploration vectors.

A recently completed channel sampling program included forty-eight individual channels) ranging from 1 to 18 m in length (average 3-5 m), see Figure 2. In total, 323 samples (279 rocks and 44 QAQC samples) were submitted for Au + multi-element analysis. Samples were delivered to the lab in Thunder Bay in three batches. Outcrops were cleaned and mapped prior to marking for channel sampling. Channels were oriented to cross veins and deformed host rock and or oriented to cut dominant or distinct vein arrays or deformation/alteration exposures. Samples were marked at 1 m intervals (from start to end) and subdivided into 0.5 m intervals where single veins or discrete mineralization was noted. Where only partial samples (within marked metreage) were collected due to cover or poor ground conditions, a percent sample was noted. Sample weights averaged 3-5 kg. Blind field duplicates (where required by our Quality Management System) were prepared by collecting an individual sample, bagging, mixing and splitting the sample to provide two equal (by weight) sub-samples for that interval.

Figure 2. Drayton-Black Lake property with regional geology showing 2022 rock sample and channel sample (collar) locations.

Several significant relationships (e.g., high Ag and Te tenors) and new prospect areas were recognized and these data will be used to improve exploration vectors as the Company advances the Property. Our work has confirmed that DBL contains an extensive, shallow, high-grade Au (+Au-Ag), structurally controlled mineral system that includes many untested high-grade prospects (e.g., New Millennium) and other prospects that have only seen limited drill-testing by previous operators (e.g., Alcona-Pond and Moretti Main). Several new prospects (Au >0.1 ppm) were also identified through regional prospecting and will be added the prospect pipeline for additional follow-up work.

Based on field observations and analytical results, the Company has noted the lack of visible gold (" VG ") in many samples with grades above 20-30 g/t Au. Preliminary multi-element analysis indicates a positive relationship between Au-Ag-Te. Therefore, to better understand the character of the high-grade Au mineralization and improve exploration vectors, the Company has initiated a deportment study for Alcona, Moretti and New Millennium. Six (6) samples have been sent to Actlabs in Dryden, Ontario for complete multi-element and QEMSCAN (Quantitative Evaluation of Materials by Scanning Electron Microscopy) analysis.

For further information please see the Heritage's profile on SEDAR at www.sedar.com .

ABOUT THE DRAYTON-BLACK LAKE PROJECT

The Drayton-Black Lake Project is located near the town of Sioux Lookout in Northern Ontario and comprises more than 15,000 Ha within the Eagle-Wabigoon-Manitou ("EWM") Greenstone Belt along strike of and contiguous with Treasury Metals Inc.'s Goliath Gold-Silver Complex. There are numerous historic high-grade gold (silver, copper) prospects throughout the property within the Central Volcanic domain. All set within a broad multi-kilometer regional-scale deformation corridor with associated secondary and tertiary structural elements. Mineralization is typically shear-hosted quartz-carbonate veins with minor sulphides (1-5%). Locally, mineralized massive sulphide (Py +/- Cpy) occurrences have been documented. Some of the more sulphide rich Au + Au-Ag occurrences in the Southern Sedimentary domain have been notionally reclassified (e.g., Treasury Metal Goliath Deposit) as a hybrid or pre-orogenic atypical greenstone gold (POAGG).

Heritage employs a rigorous quality management system for field sampling and analysis. All samples and sample sites are described, photographed and geo-referenced and digitally archived at the time of sample collection. Material is securely bagged at the sample site and returned to the field office for secure storage. Sampled are delivered by Company personnel to the ALS laboratory in Thunder Bay, Ontario for prep. Samples are crushed (min. 1 kg) and pulverized (250 g; PREP-31A). Au values are determined by 50 g fire assay (Au-AA24), overlimit (Au) are treated with a gravimetric finish (Au-GRA22) and overlimit Ag are treated with acid digestion and ICP/FA finish (Ag-OG62). Multi-element analysis is provided by ICP-MS (ME-MS61). Blind duplicates, blanks and CRM (Certified Reference Materials) are inserted on a regular basis and p ulps and rejects are retained for check and duplicate analysis.

Scientific and technical information contained in this press release has been prepared under the supervision of Stephen Hughes, P. Geo. Technical Advisor to HML, a qualified person within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects .

Sampling protocols, quality control and assurance measures and geochemical results related to historic results quoted in this news release (e.g., sampling, drilling, trenching and other data) have not been verified by the Qualified Person and therefore must be regarded as estimates.

ABOUT HERITAGE MINING LTD.

The Corporation is a Canadian mineral exploration company advancing its two high grade gold-silver-copper projects in Northwestern Ontario. The Drayton-Black Lake and the Contact Bay projects are located near Sioux Lookout in the underexplored Eagle-Wabigoon-Manitou Greenstone Belt . Both projects benefit from a wealth of historic data, excellent site access and logistical support from the local community. The Corporation is well capitalized, with a tight capital structure.

For further information, please contact:

Heritage Mining Ltd.

Peter Schloo, CPA, CA, CFA

President, CEO and Director

Phone: (905) 505-0918

Email: peter@heritagemining.ca

FORWARD-LOOKING STATEMENTS

This news release contains certain statements that constitute forward looking information within the meaning of applicable securities laws. These statements relate to future events of Heritage Mining Ltd. (" Heritage " or the " Corporation "). Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "forecast", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe", "outlook" and similar expressions) are not statements of historical fact and may be forward looking information. All statements, other than statements of historical fact, included herein are forward-looking statements.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Corporation to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks include, among others, the inherent risk of the mining industry; adverse economic and market developments; the risk that the Corporation will not be successful in completing additional acquisitions; risks relating to the estimation of mineral resources; the possibility that the Corporation's estimated burn rate may be higher than anticipated; risks of unexpected cost increases; risks of labour shortages; risks relating to exploration and development activities; risks relating to future prices of mineral resources; risks related to work site accidents, risks related to geological uncertainties and variations; risks related to government and community support of the Corporation's projects; risks related to global pandemics and other risks related to the mining industry. The Corporation believes that the expectations reflected in such forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward‐looking information should not be unduly relied upon. These statements speak only as of the date of this news release. The Corporation does not intend, and does not assume any obligation, to update any forward‐looking information except as required by law.

This document does not constitute an offer to sell, or a solicitation of an offer to buy, securities of the Corporation in Canada, the United States or any other jurisdiction. Any such offer to sell or solicitation of an offer to buy the securities described herein will be made only pursuant to subscription documentation between the Corporation and prospective purchasers. Any such offering will be made in reliance upon exemptions from the prospectus and registration requirements under applicable securities laws, pursuant to a subscription agreement to be entered into by the Corporation and prospective investors.

Copyright (c) 2022 TheNewswire - All rights reserved.