April 23, 2025

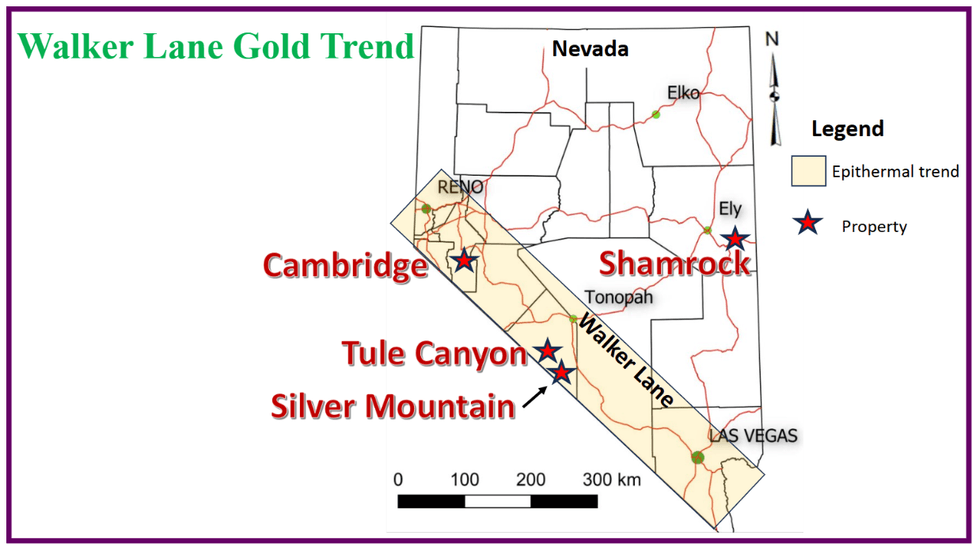

Walker Lane Resources (TSXV:WLR) is executing an exploration strategy focused on advancing high-impact projects across premier North American mining jurisdictions. The company’s portfolio spans the prolific Walker Lane Gold Trend in Nevada, as well as key exploration assets in British Columbia, the Yukon, and Newfoundland.

Near-term efforts are centered on two high-priority, drill-ready targets — Tule Canyon in Nevada and Amy in British Columbia — supported by the continued advancement of Silver Hart, Walker Lane’s flagship silver-lead-zinc asset in the Yukon, toward a development decision. All projects are accessible by road, enabling cost-effective exploration and streamlined logistics.

With a lean capital structure, high-grade and scalable assets, and a clear path from discovery through to early-stage development, Walker Lane is well-positioned to unlock significant value and deliver strong returns for shareholders. The company represents a compelling growth opportunity in the junior mining sector.

Company Highlights

- Walker Lane Resources is focused on high-grade gold, silver and polymetallic exploration, with a balanced project pipeline across multiple Canadian and US jurisdictions.

- Two flagship drill-ready projects – Amy (British Columbia) and Tule Canyon (Nevada) – are scheduled for 2025 drilling, each with compelling surface results, historical workings, and high-impact resource potential.

- The Silver Hart project in the Yukon is being positioned for near-term production through innovative ore-sorting and small-scale open pit development, designed to generate early-stage cash flow.

- Walker Lane holds approximately 1.3 billion shares in North Bay Resources (OTC:NBRI) and is entitled to option payments related to the sale of the Bishop Mill in California.

- The Silverknife project in British Columbia is subject to an option agreement with Coeur Mining, with potential milestone payments and expenditures totaling over $6 million through 2028.

- The company has an established pipeline of prospective exploration stage assets at Cambridge and Silver Mountain (Walker Lane, Nevada) and Logjam (Yukon).

This Walker Lane Resources profile is part of a paid investor education campaign.*

Click here to connect with Walker Lane Resources (TSXV:WLR) to receive an Investor Presentation

WLR:CC

Sign up to get your FREE

Walker Lane Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

01 October 2025

Walker Lane Resources

Advancing high-grade gold and silver assets in prolific Nevada, British Columbia and Yukon

Advancing high-grade gold and silver assets in prolific Nevada, British Columbia and Yukon Keep Reading...

1h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

18h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

Latest News

Sign up to get your FREE

Walker Lane Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00