October 03, 2024

Description:

Australian market analyst firm Vested Equities has estimated a 194 percent upside over the current share price of oil producer and explorer Jupiter Energy (ASX:JPR), citing the company’s large reserve and plans for sustainable growth.

“Jupiter Energy's resilient financial performance, strategic positioning, and significant reserves potential make it an attractive prospect for investors seeking exposure to the energy sector,” wrote Vested analyst Stuart McClure in a June 2024 report.

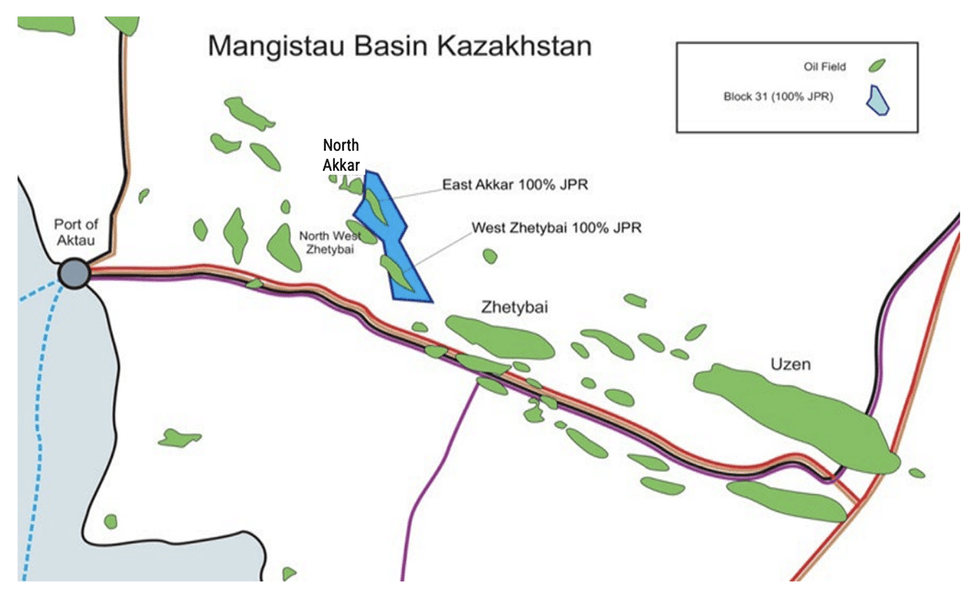

Jupiter Energy is an oil exploration and production company operating in Kazakhstan, with three licenced oil fields producing approximately 640 barrels per day from four wells, with plans to increase to approximately 1,000 barrels per day by the end of 2024.

The Vested report also cited Kazakhstan's supportive regulatory environment with policies and programs aimed at strengthening its energy sector, by facilitating the increase of production capacity, attracting new investments and supporting industry growth.

“Jupiter Energy’s operations benefit from these favourable policies, the most recent being the support offered to the company by the Kazakh Ministry of Energy in addressing its gas utilisation requirements. These initiatives have provided access to essential resources and infrastructure, enhancing the company’s operational stability and capacity for growth,” the report said.

Highlights of the report:

- Vested determined Jupiter’s valuation through a blended approach of both the discounted cash flow method and market approach, which is most suited for the company with its large reserve and strategic plans to increase future incomes.

- The discounted cash flow analysis suggests a per-share value of AU$0.029 assuming a terminal growth rate of 4 percent and discounts future cash flows at a weighted average cost of capital of 13.6 percent.

- The market approach is calculated by taking peer companies’ EV/2P reserves value and arriving at a target price of AU$0.14.

- The valuation methodology assigns 60 percent weight to the income approach and 40 percent to the market approach, resulting in a weighted average target price of AU$0.074 per share, reflecting a 194.1 percent premium over its current market price of AU$0.025.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

JPR:AU

The Conversation (0)

21 October 2025

Sep25 Quarterly Activities Report

Jupiter Energy (JPR:AU) has announced Sep25 Quarterly Activities ReportDownload the PDF here. Keep Reading...

21 October 2025

Sep25 Appendix 5B

Jupiter Energy (JPR:AU) has announced Sep25 Appendix 5BDownload the PDF here. Keep Reading...

13 July 2025

Jun25 Appendix 5B

Jupiter Energy (JPR:AU) has announced Jun25 Appendix 5BDownload the PDF here. Keep Reading...

13 July 2025

Jun25 Quarterly Activities Report

Jupiter Energy (JPR:AU) has announced Jun25 Quarterly Activities ReportDownload the PDF here. Keep Reading...

22 May 2025

Variation to Noteholder Agreements

Jupiter Energy (JPR:AU) has announced Variation to Noteholder AgreementsDownload the PDF here. Keep Reading...

7h

Syntholene Energy Corp. Announces Upsize to Previously Announced Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it will be increasing the size of its previously announced... Keep Reading...

06 February

Syntholene Energy Corp. Announces $2.0 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it intends to complete a non-brokered private placement of... Keep Reading...

05 February

Angkor Resources Celebrates Indigenous Community Land Titles and Advances Social Programs, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 5, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") is pleased to announce that nine Indigenous community land titles have been formally granted to Indigenous communities in Ratanakiri Province, Cambodia, following a... Keep Reading...

05 February

Syntholene Energy Corp Strengthens Advisory Board with Former COO of Icelandair Jens Thordarson

Mr. Thordarson brings two decades of expertise in operations, infrastructure development, and large-scale business transformation in the aviation industrySyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces the nomination of Jens... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00