September 10, 2024

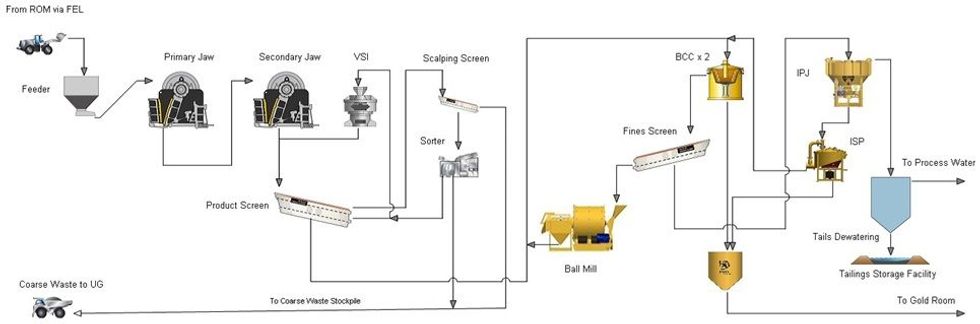

Vertex Minerals (ASX:VTX) (Vertex or the Company) is pleased to announce that Gekko has incorporated pre-concentration of gold ore into the flow sheet and plant design for the Hill End Project. This comprises the inclusion of a TOMRA ore sorter. Gekko will design and manufacture simple conveyances to and from the proposed ore sorting unit, with the ore unit comprising a separate module to the crushing and gravity recovery circuit.

- Vertex identified that pre-concentration of ore using TOMRA Laser Sorter technology should have a significant impact on the sustainability and profitability of the mining operation at Reward.

- Gekko has incorporated ore sorting into the Reward flow sheet and plant design being refurbished/built at their Ballarat factory.

- By processing only high-grade ore, energy and water consumption are greatly reduced leading to lower operating costs and reduction in carbon footprint.

- Importantly, preconcentration allows the rejection of barren crushed rock. This greatly reduces the mass of ore to the remaining process and greatly reduces the volume of process sand residue. The rejected material is transported back underground to fill the mined voids. This provides a significant cost advantage and has many ESG benefits.

- 94kg of sample from the low-grade stockpile at Reward Gold Mine (Reward) was sorted. The following results are reported;

- Head grade to Sorter weighted average grade (WAG) = 3.70 g/t gold,

- Ore grade WAG after sorting = 16.22g/t gold (337.20% increase on grade),

- Ore/waste split after sorting = 19.31kgs Ore vs 74.54kgs Waste (79% mass reduction),

- Gold lost to waste fraction = 0.03grams/t (>90% efficiency)

Refer to VTX ASX Announcement 26th July 2024

- Previous scoping test results from TOMRA suggested that the barren country rock that is mined with the gold bearing quartz veins can be efficiently detected and removed from mined material. This leads to significant increase in head grade reporting to the gravity section of the processing plant.

- Refurbishment of the plant is well underway, and Vertex anticipates that the plant will be re-installed at Hill End later this year. The Company anticipates production will commence in January 2025.

Demobilisation of equipment from the Morningstar and Hill End mines has been completed, and refurbishment of this equipment is underway at Gekko’s factory in Ballarat.

The ore sorting technology can separate high-grade gold bearing quartz ore from the barren sedimentary country rock before it enters the processing stream. This significantly reduces the quantity of material that requires further processing to recover gold. Vertex believes that the application of ore sorting technology at Hill End can achieve more than a 50% reduction in the ore processing volume. Benefits include:

- Reduction in energy consumption.

- Reduction in water consumption.

- Reduction in the process residue that requires dry stacking on surface.

- Processing plant will only need to be run on a day shift basis.

Commenting on the results, Executive Chairman, Roger Jackson, said “We are very pleased with how Gekko have been able to integrate the Sorter into the Hill End Gravity plant. Further we are very thrilled to see the plant starting to take shape in the Gekko Ballarat factory. We are very much looking forward to its installation and commissioning later this year”.

Click here for the full ASX Release

This article includes content from Vertex Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VTX:AU

The Conversation (0)

25 August 2025

Reward Gold Mine Production Update

youtu.be Vertex Minerals (VTX:AU) has announced Reward Gold Mine Production UpdateDownload the PDF here. Keep Reading...

11 August 2025

Underground Production Commences Reward Gold Mine Project

Vertex Minerals (VTX:AU) has announced Underground Production Commences Reward Gold Mine ProjectDownload the PDF here. Keep Reading...

31 July 2025

Quarterly Activities and Cash Flow Reports 30 June 2025

Vertex Minerals (VTX:AU) has announced Quarterly Activities and Cash Flow Reports 30 June 2025Download the PDF here. Keep Reading...

04 June 2025

UPDATE Fully Developed Stope Block Announcement (28/04/25)

Vertex Minerals (VTX:AU) has announced UPDATE Fully Developed Stope Block Announcement (28/04/25)Download the PDF here. Keep Reading...

12 May 2025

A$11m Capital Raising to Accelerate Mining at Hill End

Vertex Minerals (VTX:AU) has announced A$11m Capital Raising to Accelerate Mining at Hill EndDownload the PDF here. Keep Reading...

19h

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

20h

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00