May 06, 2025

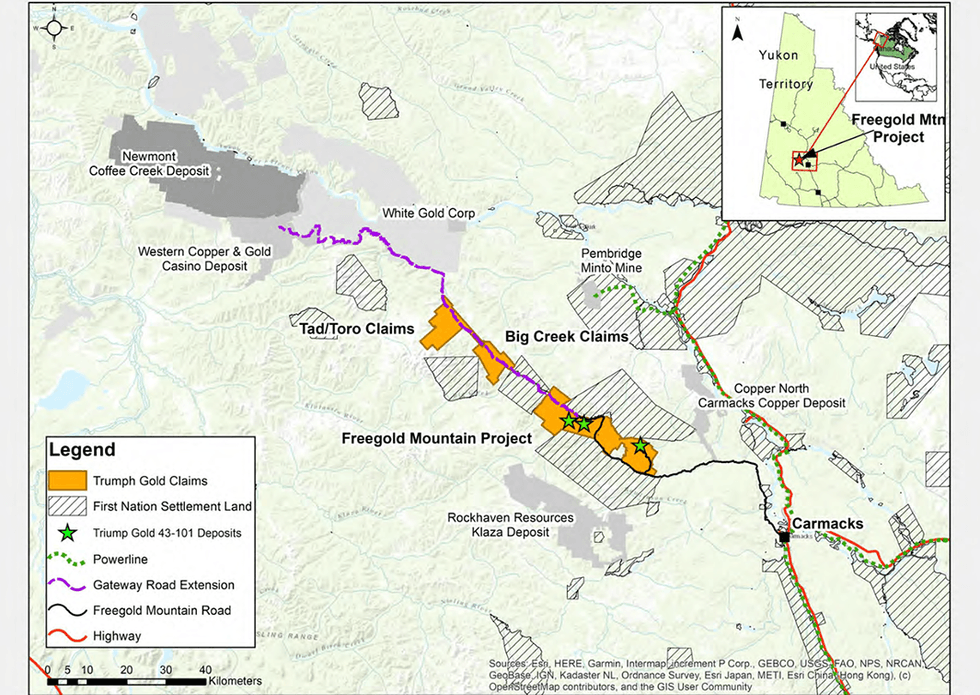

Triumph Gold (TSXV:TIG,OTC:TIGCF) is a Canadian gold exploration company well-positioned to benefit from a strengthening gold market. The company’s primary focus is advancing its 100 percent-owned Freegold Mountain Project, a district-scale property located in Yukon’s highly prospective Dawson Range gold-copper belt.

With defined multi-million ounce gold resources, significant potential for expansion, and promising discovery targets, Triumph Gold provides investors with exposure to a large, consolidated land package in one of Canada’s most mining-friendly jurisdictions.

The Freegold Mountain Project is Triumph Gold’s flagship asset — a district-scale property extending 34 kilometers along the highly mineralized Big Creek Fault system in Yukon. What sets this project apart is the widespread presence of mineralization across all major rock types on the property, including Paleozoic metamorphics, Jurassic intrusives, and Cretaceous intrusives. Each of these hosts distinct styles of precious and base metal mineralization, underscoring the project’s exceptional geological potential.

Company Highlights

- Resource Base: Combined indicated resources of 1 million ounces and inferred resources of 1.08 million ounces gold equivalent across the Freegold Mountain project

- Strategic Location: Positioned in the mineral-rich Dawson Range, home to major deposits including Newmont's Coffee, Western Copper's Casino, and Pembridge's Minto mine

- Multiple Deposit Types: Mineralization found in various forms (porphyry, epithermal, skarn) providing diversified exploration targets

- Expansion Potential: All deposits remain open in multiple directions with numerous untested satellite targets

- Fully Permitted: Exploration permits in place until 2025-2026 allowing for extensive drilling programs

- Experienced Leadership: Management team with proven track records in mineral exploration, mine development and capital markets

This Triumph Gold profile is part of a paid investor education campaign.*

Click here to connect with Triumph Gold (TSXV:TIG) to receive an Investor Presentation

TIG:CA

Sign up to get your FREE

Triumph Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

26 August

Triumph Gold

Multi-million-ounce, district-scale gold assets in the prolific Yukon Territory

Multi-million-ounce, district-scale gold assets in the prolific Yukon Territory Keep Reading...

08 July

Triumph Gold's Executive Chairman Discusses Utah Silver-Gold Acquisition and Exploration Strategy in New INN CEO Insights Interview

The Investing News Network (INN) has released a new episode of its CEO Insights video series featuring John Anderson, executive chairman of triumph gold (TSXV: TIG) (OTC Pink: TIGCF). In the interview, Anderson shares insights on the company's recently acquired Coyote Knoll silver-gold project... Keep Reading...

04 June

Triumph Gold Announces the Acquisition of the Coyote Knoll Silver-Gold Mineral Property - Located in Central Utah

triumph gold Corp. (TSXV: TIG) (OTC Pink: TIGCF) (FSE: 8N6) ("triumph gold" or the "Company") is pleased to announce the acquisition of the Coyote Knoll Silver (Ag Gold (Au) Property, located in central Utah, approximately 40 km southwest of the prolific Tintic Mining District (Figure 1).... Keep Reading...

12 May

Triumph Gold Discovers a New Silver and Gold Vein Showing at the Freegold Mountain Project, Yukon

triumph gold Corp. (TSXV: TIG) (OTC Pink: TIGCF) (FSE: 8N6) ("triumph gold" or the "Company") is pleased to announce the discovery of a new Silver-Gold vein system, now named the Proton Zone, at its 100%-owned Freegold Mountain Project in Yukon, Canada. The discovery lies 1.3 km northeast of the... Keep Reading...

09 May

Triumph Gold Updates Shareholders on Operations, Engages Market Maker, and Grants Options

Reviews 2025 exploration strategy across Freegold Mountain and Andalusite PeakAdvances acquisition strategy targeting high-grade silver assetsEngages Independent Trading Group to improve trading liquiditytriumph gold Corp. (TSXV: TIG) (OTC Pink: TIGCF) (FSE: 8N61) is pleased to provide an... Keep Reading...

9h

Top 5 Canadian Mining Stocks This Week: Quarterback Resources Scores with 160 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released October’s job numbers on Friday (November 7). The data showed a... Keep Reading...

14h

Goldgroup Files Updated Technical Report on Cerro Prieto Project

Goldgroup Mining Inc. ("Goldgroup" or the "Company") (TSXV:GGA)(OTCQX:GGAZF) is pleased to announce that it has filed an updated NI 43-101 technical report on the Cerro Prieto gold project located in Sonora State, Mexico. The report is entitled "Cerro Prieto Project, Heap Leach Project,... Keep Reading...

06 November

Adrian Day: Gold Far from Top, Two Triggers for Next Price Move

Adrian Day, president of Adrian Day Asset Management, shares his thoughts on gold's price pullback, saying he currently sees no evidence of a top. "It's perfectly normal in middle of a bull market to have a significant correction. This really isn't even a correction yet, let's not forget that.... Keep Reading...

06 November

Rick Rule: Gold Strategy, Oil Stocks I Own, "Sure Money" in Uranium

Rick Rule, proprietor at Rule Investment Media, recently sold 25 percent of his junior gold stocks, redeploying the funds into physical gold, as well as Franco-Nevada (TSX:FNV,NYSE:FNV), Wheaton Precious Metals (TSX:WPM,NYSE:WPM) and Agnico Eagle Mines (TSX:AEM,NYSE:AEM). In addition to those... Keep Reading...

Latest News

Sign up to get your FREE

Triumph Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00