Trevali Mining Corporation ("Trevali" or the "Company") (TSX: TV) (OTCQX: TREVF) ( Frankfurt : 4TI) is pleased to provide an update for the financing of the Rosh Pinah Expansion project (" RP2.0 "). The results of the Feasibility Study were released on August 17, 2021 and are available on Trevali's SEDAR profile at www.sedar.com . Trevali is currently working toward securing project financing for the RP2.0 expansion project and refinancing both the existing Corporate Revolving Credit Facility and Glencore Facility, maturing in September 2022 . In parallel, an early works program has commenced for RP2.0 .

Ricus Grimbeek, President and CEO of Trevali, commented, "I am pleased with the progress made toward securing financing for the RP2.0 project and a new corporate facility. The level of interest we have seen along with Glencore's continued support affirms our belief in the high-quality nature of the project. Endeavour Financial is assisting us in the financing process and we are excited to kick-off the early works program. We will continue to provide updates on the financing of RP2.0 and project progress as milestones are achieved."

Financing Update

Trevali appointed Endeavour Financial in September 2021 to advise the Company on the formation of a lending syndicate, coordinate lender due diligence and negotiate financing documentation with the objective of providing a competitive non-equity financing solution for RP2.0 and refinancing the existing Corporate Revolving Credit Facility. Trevali is considering several opportunities for the financing package, including project finance debt, subordinated debt and a silver stream on Rosh Pinah's silver production.

The Company has received non-binding expressions of interest from several capital providers about participating in the financing process, including commercial banks, streaming and royalty companies, and mining focused alternative lenders, as well as from Rosh Pinah's concentrate offtaker, Glencore.

Glencore has indicated its support for the project by proposing an aggregate $33 million financing package, which may include an extension to the existing Glencore Facility of $13 million , subordinated to traditional project finance debt and contingent on the remainder of the required financing package being secured as well as negotiation of satisfactory terms and conditions.

Commencement of RP2.0 Expansion Project Early Works Program

In parallel with its project financing initiatives, Trevali continues to advance certain aspects of RP2.0 in order to maintain the project schedule and mitigate the risks associated with the project as outlined in the Feasibility Study. The early works program, which has a capital budget of $20 million is expected to be financed from internal cash flows and consists of the following scope:

- Procurement of mobile equipment

- Power supply system upgrade

- Paste backfill plant long lead item procurement

- Portal construction and decline development

- Process plant detailed engineering

Trevali will provide more comprehensive information regarding planned 2022 capital expenditures as part of its production and cost guidance which is expected to be issued in January 2022 .

About the Rosh Pinah Expansion " RP2.0 " Project

The Company released and filed the results of the NI 43-101 Feasibility Study with respect to the RP2.0 project on August 17, 2021 .

The Feasibility Study estimated that at $1.17 /lb zinc, $0.96 /lb lead and $24.47 /oz silver, the RP2.0 Net Present Value (at an 8% discount rate) is approximately $156 million with an expected payback period of 4.6 years and a forecasted Internal Rate of Return of 58%. Expansionary capital costs were estimated at $111 million . Once complete, the expanded mine is projected to produce an annual average of 135 million pounds of payable zinc, 23.7 million pounds of lead and 303,000 ounces of silver over an expected 9-year post-expansion mine life at a forecasted All-In-Sustaining-Cost 1 of $0.67 per pound of zinc.

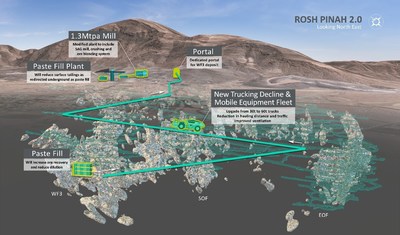

Processing Plant: The FS incorporates a planned upgrade to the comminution circuit to include a new single-stage SAG mill and pebble crusher. The upgrade also includes primary crushing upgrades and ore blending area, along with other circuit modifications intended to provide increased flotation, thickening, filtration and pumping capacity to achieve the target throughput of 1.3 Mtpa. The upgrade will also include several flowsheet modifications aimed at improving both the concentrate grade and metal recoveries.

Underground Development and Infrastructure: A dedicated portal and decline to the WF3 deposit will be constructed to support the expected increase to mine production levels and reduce operating costs. The planned trucking decline is 3.9 km in length, excluding level access and stockpiles. The new trucking decline will act as an additional fresh air intake within the ventilation network and will enable direct ore haulage from the WF3 zone to a new surface primary crusher station utilizing large-scale (60 tonne) trucks. Ore sourced from other areas (EOF, SF3, SOF, and BME) will be transported to the existing underground crushing system using the existing 30 tonne truck fleet and conveyed to surface via the existing conveying system.

Paste Fill Plant: A paste fill plant designed to operate at both the current 0.7 Mtpa and the 1.3 Mtpa targeted throughput rate has been included. The paste plant commissioning date is anticipated in Q2 2023 (approximately 9 months before the upgraded processing plant's expected commissioning date) as it is critical to fill existing voids (particularly within WF3) to achieve the increased production target and preferred mining sequence considered as part of the expansion project. Paste filling the stopes rather than leaving them void is expected to improve ground stability, increase ore recovery, and reduce dilution, and also to reduce surface tailings as a portion of new tailings will be redirected underground to be used as paste fill. A water treatment plant has been added to the paste fill plant system which is expected to significantly reduce water consumption. The system in conjunction with the paste fill plant system is anticipated to reduce the water intensity of the Rosh Pinah operation from 1.54 m 3 /t to 0.65 m 3 /t of ore.

| ____________________________ |

| 1 All-In-Sustaining-Cost "AISC" and C1 cash costs are non-IFRS financial performance measures. All-In-Sustaining Cost adds mine operating costs, smelting and refining costs, distribution costs, royalty costs, sustaining capital expenditures and lease payments and expresses them on a per pound of payable zinc produced basis. All-In-Sustaining Cost is not a standardized measure under IFRS and might not be comparable to similar financial measures disclosed by other issuers. This measure is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. See "Use of Non-IFRS Financial performance Measures" in the Company's Management's Discussion and Analysis for the three and nine months ended September 30, 2021, dated November 11, 2021 and filed on sedar.com, which section is incorporated herein by reference, for further information regarding these measures, including an explanation of this measure and a reconciliation to the Company's reported financial results in accordance with IFRS. |

Mobile Equipment: The existing small-scale underground trucks and load-haul dump (LHD) fleet will continue to be used primarily in the current mining areas. As mining extends deeper and average haulage distances increase in WF3, new large-scale trucks and LHDs are planned to be purchased for the more efficient transportation of material to surface which is expected to reduce costs over the life-of-mine.

Renewable Solar Energy Power Purchase Agreement: Trevali has entered into a fifteen-year Power Purchase Agreement (the "PPA") with Emerging Markets Energy Services Company ("EMESCO"). The PPA with EMESCO is anticipated to deliver 30% of Rosh Pinah's power requirements during the life of the agreement. EMESCO will be responsible for the design, permitting, financing and implementation of a solar energy system on a neighbouring property at no cost to Trevali. EMESCO will sell the power generated to Trevali at a fixed rate that is expected to reduce energy costs by 8% over the fifteen-year term of the agreement.

Onsite Operating Costs: Once the project is commissioned, onsite operating costs are expected to reduce by approximately 26% on a per tonne milled basis. Mining costs per tonne milled are expected to be reduced due to the planned change in the mining method to include paste fill allowing for increased ore recovery and reduced mining dilution. Mining costs are also expected to benefit from the dedicated underground decline to the WF3 deposit which should allow for more efficient material handling and reduced cycle times. The processing unit costs are expected to decrease as a result of treating increased tonnages following the upgrade. Fixed on site costs on a per tonne milled basis are also expected to decrease as the mine ramps up from 0.7 Mtpa to the FS target of 1.3 Mtpa as a function of higher annual throughput.

Figure 1: Rosh Pinah Expansion " RP2.0 " Project Overview

For more information, please review the detailed Feasibility Study filed August 17, 2021 with an effective date of March 31, 2021 , filed under the Company's profile at SEDAR.com.

About Endeavour Financial Limited (Cayman)

Endeavour Financial, with offices in London, UK , George Town, Cayman Islands and Vancouver, British Columbia , is one of the top mining financial advisory firms, with a record of success in the mining industry, specializing in arranging multi-sourced funding solutions for development-stage companies. Founded in 1988, Endeavour Financial has a well-established reputation of achieving success with over US$500 million in royalty and stream finance, US$4 billion in debt finance and US$28 billion in mergers and acquisitions. The Endeavour Financial team has diverse experience in both natural resources and finance, including investment bankers, geologists, mining engineers, cash flow modelers and financiers.

ABOUT TREVALI

Trevali is a global base-metals mining Company headquartered in Vancouver, Canada . The bulk of Trevali's revenue is generated from zinc and lead concentrate production at its three operational assets: the 90%-owned Perkoa Mine in Burkina Faso , the 90%-owned Rosh Pinah Mine in Namibia , and the wholly-owned Caribou Mine in northern New Brunswick, Canada . In addition, Trevali owns the Halfmile and Stratmat Properties and the Restigouche Deposit in New Brunswick, Canada . Trevali also owns an effective 44% interest in the Gergarub Project in Namibia , as well as an option to acquire a 100% interest in the Heath Steele deposit located in New Brunswick, Canada . The company's growth strategy is focused on the exploration, development, operation and optimization of properties within its portfolio, as well as other mineral assets it may acquire that fit its strategic criteria. Trevali's vision is to be a responsible, top-tier operator of long-life, low-cost mines in stable pro-mining jurisdictions. Trevali is committed to socially responsible mining, working safely, ethically, and with integrity. Integrating responsible practices into its management systems, standards, and decision-making processes is essential to ensuring everyone and every community's long-term sustainability.

The shares of Trevali are listed on the TSX (symbol TV), the OTCQX (symbol TREVF), and the Frankfurt Exchange (symbol 4TI). For further details on Trevali, readers are referred to the Company's website ( www.trevali.com ) and to Canadian regulatory filings on SEDAR at www.sedar.com .

Cautionary Note Regarding Forward-Looking Information and Statements

This news release contains "forward-looking information" within the meaning of Canadian securities legislation and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, "forward-looking statements"). Forward-looking statements are based on the beliefs, expectations and opinions of management of the Company as of the date the statement are published, and the Company assumes no obligation to update any forward-looking statement, except as required by law. In certain cases, forward–looking statements can be identified by the use of words such as "plans", "expects", "outlook", "guidance", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might", "will be taken", "occur" or "be achieved" or the negative of these terms or comparable terminology.

Forward-looking statements relate to future events or future performance and reflect management's expectations or beliefs regarding future events. Forward-looking statements in this news release include, but are not limited to, statements with respect to the financing of the RP2.0 Project, including with respect to the timing and receipt of project financing for the expansion, the indicative non-binding expressions of interest received to date, the contingent financing commitment from Glencore, the completion of satisfactory lender due diligence, and the negotiation of definitive documentation with respect to new financing facilities; statements with respect to the RP2.0 Project preparatory activities and early works, including the proposed project schedule and the potential for same to mitigate the risk the project execution as outlined in the feasibility study, the Company's ability to finance these activities from internal cash flows, the stand-alone investment case underpinning the early works program, the activities comprising the early works program, the timing of proposed capital expenditures in respect of the project, and that the early works program will enhance the existing operations at Rosh Pinah and advance the Company's ESG goals; statements with respect to the results of the Feasibility Study, including the expected expansion of throughput and the existing production capacity, the expected reduction of operating costs as a result of the expansion project, the Company's planned development and construction activities in respect of the expansion project and the anticipated results of these development and construction activities, the environmental and safety benefits expected from the expansion process, the design of the project to minimize production risks and capture expected elevated zinc prices to support the funding of the project while also positioning the operation for long-term resource expansion, estimates of project capital costs, future production forecasts, , estimates of All-in Sustaining Cost, and economic estimates, including estimates of internal rate of return, payback period and net present value.

Forward-looking statements are necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company's control and many of which, regarding future business decisions, are subject to change. Assumptions underlying the Company's expectations regarding forward-looking statements or information contained in this press release include, but are not limited to, that the Company will be able to secure adequate financing for the RP2.0 expansion project and the refinancing of the Company's existing credit facilities, and that the board of director of the Company will make a positive investment decision regarding the expansion project; that the Company will proceed with the development and construction of the expansion project as set forth in the Feasibility Study; that the expansion project will proceed on the timeline currently anticipated, including with respect to the preparatory activities and early works program described above; that the expansion project will yield the benefits expected by the Company; that the assumptions and estimates underlying production, cost and economic forecasts, including commodity price and exchange rate assumptions, are reasonable and are representative of these actual inputs; that the assumptions and estimates underlying mineral resource and reserve estimates, including commodity price and exchange rate assumptions, cut-off grade assumptions and recovery and dilution estimates, are reasonable and are representative of these actual inputs; that the Company will achieve actual production and cost and economic performance in-line with its assumptions; that mineral resource and reserve estimates are indicative of actual mineralization; and that the life of mine of Rosh Pinah after the expansion will accord with expectations.

By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that the Company will be unable to security financing for the RP2.0 project on acceptable terms or at all, risks related to changes in project parameters as plans continue to be refined; future prices of zinc, lead, silver and other minerals and the anticipated sensitivity of our financial performance to such prices; possible variations in ore reserves, grade or recoveries; dependence on key personnel; potential conflicts of interest involving our directors and officers; labour pool constraints; labour disputes; availability of infrastructure required for the development of mining projects; delays or inability to obtain governmental and regulatory approvals for mining operations or financing or in the completion of development or construction activities; counterparty risks; increased operating and capital costs; foreign currency exchange rate fluctuations; operating in foreign jurisdictions with risk of changes to governmental regulation; compliance with governmental decrees and regulations, including any new or ongoing decrees and regulations issued by a governmental authority in response to the COVID-19 pandemic; compliance with environmental laws and regulations; land reclamation and mine closure obligations; challenges to title or ownership interest of our mineral properties; maintaining ongoing social license to operate; impact of climatic conditions on the Company's mining operations; corruption and bribery; limitations inherent in our insurance coverage; compliance with debt covenants; competition in the mining industry; our ability to integrate new acquisitions into our operations; cybersecurity threats; litigation and other risks and uncertainties that are more fully described in the Company's annual information form, interim and annual audited consolidated financial statements and management's discussion and analysis of those statements, all of which are filed and available for review under the Company's profile on SEDAR at www.sedar.com . Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Trevali provides no assurance that forward-looking statements will prove to be accurate, as actual results and future events may differ from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

SOURCE Trevali Mining Corporation

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2022/20/c8109.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2022/20/c8109.html