September 15, 2022

Torrent Gold (CSE:TGLD) focuses on gold exploration and development backed by a management team with the right expertise and experience. The company’s flagship project is Jessup, a drill-ready, gold-silver asset in Nevada. Jessup currently has a measured resource estimate of 331,800 ounces of gold equivalent, and there is potential for additional deposits as much of the asset is unexplored. Torrent Gold’s management team has operational experience in Nevada, technical experience in gold, and prioritizes transparency throughout its organization.

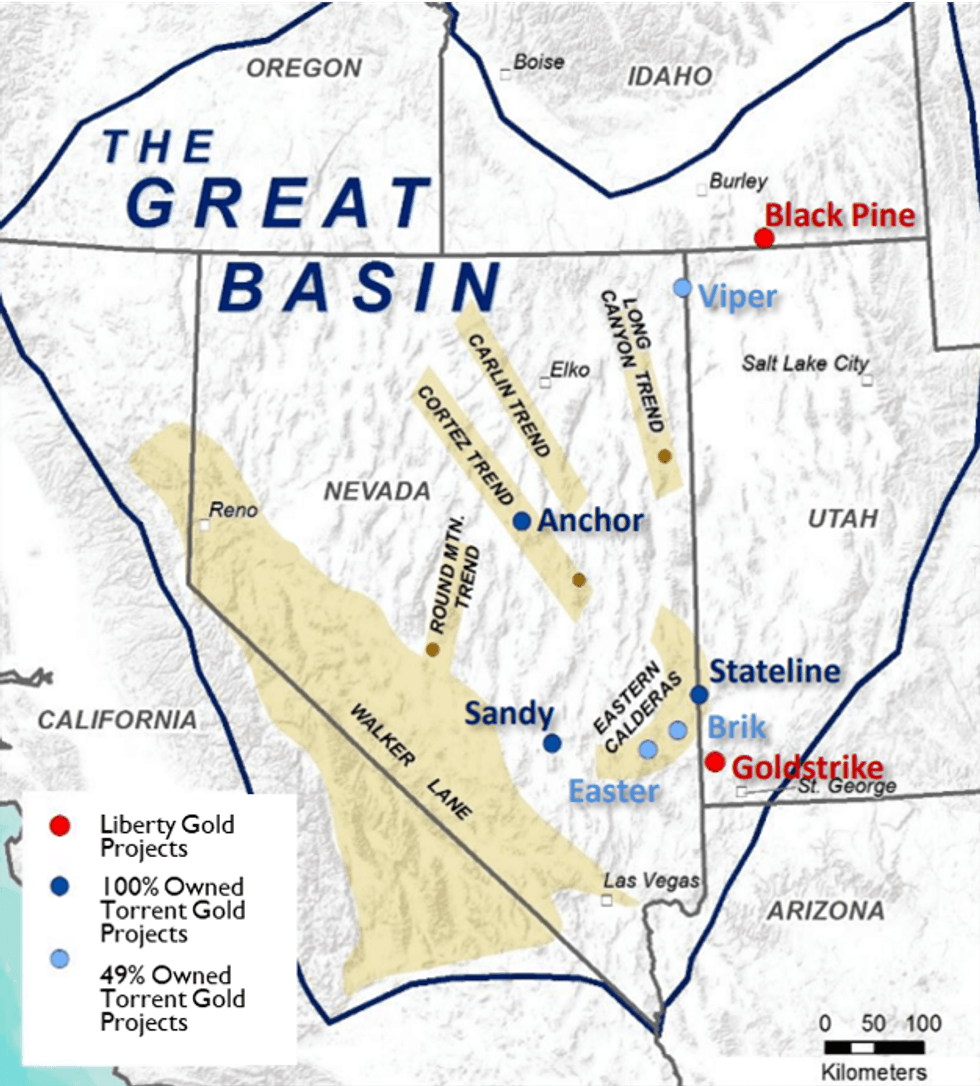

The company also has an exploration portfolio of properties throughout Nevada, each of which is primed for a potential JV model, creating an additional revenue stream. In addition, Torrent Gold is continuously evaluating new projects for synergy potential with Jessup and its early-stage assets. The company is also exploring its Clover Mountain Project in Idaho, which has excellent development potential following additional exploratory campaigns.

Company Highlights

- Torrent Gold is led by a management team that has found success in previous gold-focused companies, with expertise and experience in gold exploration and development, as well as managing and building operations in Nevada.

- Daniel Kunz, executive chairman, is the former CEO of Ivanhoe Mines and MK Gold Company as well as Prime Mining, playing a critical role in the companies’ growth and success.

- Torrent Gold’s flagship Jessup asset has historic results that build initial confidence in its potential, prompting the company to acquire and fully explore the project.

- The Jessup Project has demonstrated a resource composition of 84 percent gold and 27 percent silver.

- Torrent Gold also has exploration opportunities throughout its portfolio of early-stage assets in Nevada and Idaho, creating potential for a joint venture (JV) model.

This Torrent Gold profile is part of a paid investor education campaign.*

Click here to connect with Torrent Gold (CSE:TGLD) to receive an Investor Presentation

TGLD:CC

The Conversation (0)

24 May 2023

Torrent Gold

Drill-Ready Exploration in Nevada

Drill-Ready Exploration in Nevada Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00