Tinka Resources Limited ("Tinka" or the "Company") (TSXV & BVL:TK)(OTCQB:TKRFF) is pleased to announce results for four drill holes from the Company's ongoing infill and resource expansion drill program at the Ayawilca zinc project in central Peru. All four drill holes are from South Ayawilca. Hole A22-202 has returned the best drill intercept ever made at the Ayawilca project: 38.9 metres grading 20.0% zinc including an ultra high-grade interval of 10.4 metres grading 42.0% zinc . The 2022-2023 drill program has now been expanded due to the excellent results to date, with about half of the drill holes (13) now reported of the estimated 30 holes to be completed at both South Ayawilca and West Ayawilca

Key highlights

- Hole A22-202: 38.9 metres at 20.0% zinc from 170.5 metres depth, including

- 10.4 metres at 42.0% zinc from 193.3 metres depth, including

- 3.8 metres at 49.9% zinc from 198.0 metres depth.

- The widest interval is the highest grade-thickness intercept ever drilled at Ayawilca.

- Massive sulphide mineralization is concentrated in the hinge of a fold ‘anticline' at South Ayawilca.

- Several fan-holes are now targeting extensions of this ultra high-grade zinc mineralization.

- 10.4 metres at 42.0% zinc from 193.3 metres depth, including

- Hole A22-199: 5.3 metres at 14.3% zinc from 138.8 metres depth and 42.4 metres at 9.4% zinc from 246.5 metres, including:

- 5.5 metres at 22.9% zinc from 261.3 metres depth, and

- 9.1 metres at 20.8% zinc from 279.8 metres depth.

- Hole A22-204: 14.8 metres at 8.4% zinc from 196.4 metres depth, including:

- 6.1 metres at 12.6% zinc from 200 metres depth, and

- 26.5 metres at 6.2% zinc from 264.5 metres depth, including

- 3.9 metres at 15.1% zinc from 283.8 metres depth.

True thicknesses of the mineralized intercepts are estimated to be at least 75% of the downhole thicknesses.

The drill program at Ayawilca is continuing without interruption with two rigs operating 24/7. Around 7,000 metres have been completed with another 4,000 metres planned. Drilling is expected to continue until April 2023, with one rig at South and a second rig at West Ayawilca (where several holes have results pending).

Dr. Graham Carman, Tinka's President and CEO, stated: "The ultra high-grade zinc intercept in A22-202 is a potential game changer for the Ayawilca project. The interval of 10.4 metres grading 42% zinc consists of almost pure zinc sulphide mineralization, while part of this interval grading ~50% Zn is reflective of zinc concentrate grade accepted by smelters. Importantly, the mineralization is relatively shallow (~140 m depth) and comes from an area of the resource that could be accessed early in a mine plan. Several fan holes are in progress from the same drill platform (or from nearby sites) targeting extensions of this ultra high-grade zinc mineralization, particularly the limestone-sandstone footwall contact where the zinc appears to be concentrated. Two follow-up holes, A22-206 and A22-208, have already been completed and another hole is in progress".

Dr. Carman continued, "We are pleased to report that on the back of these excellent drill results to date, the 2022-2023 drill program has been extended to 11,000 metres. One drill rig continues to operate at South Ayawilca, with a second rig at West Ayawilca. We look forward to publishing more drill results as they come to hand from both areas."

Discussion of the drill results

Tinka has now completed approximately 7,000 metres (21 holes) in the 2022-2023 resource definition-expansion drill program with only 13 of the holes reported so far, including this release (see previous results dated Oct 11, 2022 and Nov 21, 2022 - drill hole map - Figure 1 ). The objectives of the drill program continue to be to target the highest-grade zinc mineralization at both South and West Ayawilca, and to expand measured and indicated zinc resources. Indicated resources are currently estimated at 19.0 Mt grading 7.2% Zn, 17 g/t Ag & 0.2% Pb and inferred resources are 47.9 Mt @ 5.4% Zn, 20 g/t Ag & 0.4% Pb (as at August 30 th , 2021).

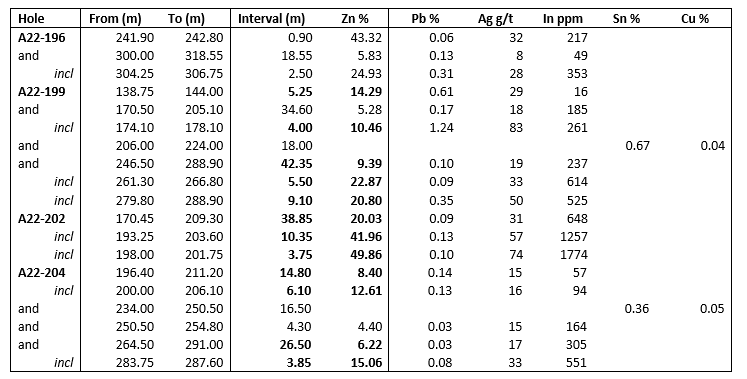

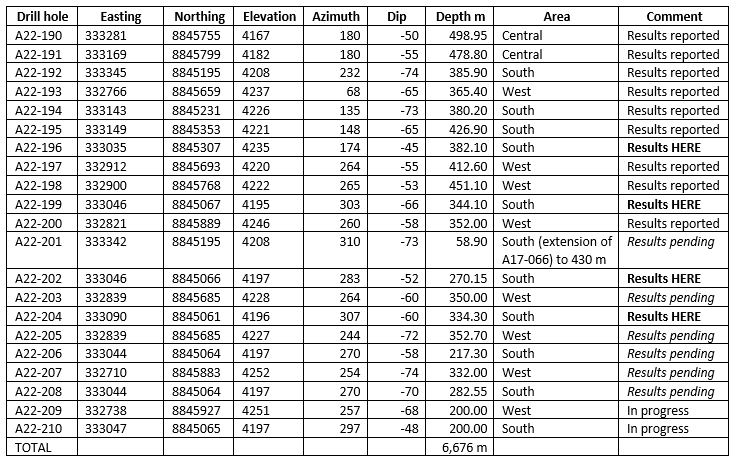

Table 1 summarises the drill intercepts highlighted in this news release. Table 2 summarises the complete list of holes to date in the 2022 drill program.

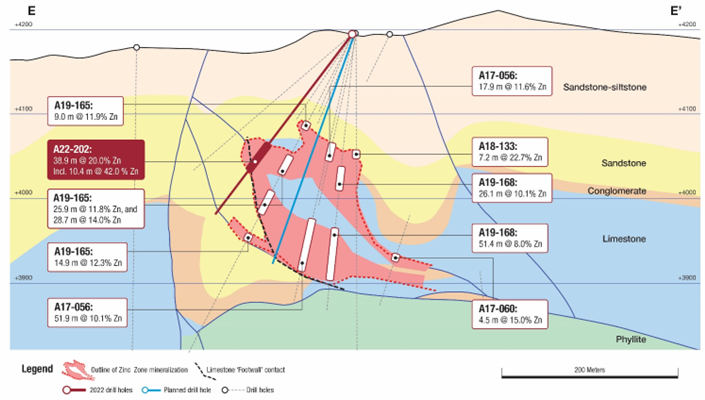

Hole A22-202 was drilled to test the hinge zone of the limestone ‘anticline' fold previously identified at South Ayawilca. The hole intersected massive zinc sulphide mineralization over 38.9 metres grading 20.0% Zn from 170.5 metres depth (~140 metres vertical depth) - see cross section - Figure 2 . The interval of 10.4 metres at 42.0% zinc consists of almost pure zinc sulphide (sphalerite) mineralization - see drill core photograph - Figure 3 . The ultra high-grade zinc mineralization appears to be focussed along the limestone-sandstone footwall contact on the edge of the overturned anticline fold.

Hole A22-199 intersected two massive zinc sulphide intervals. The shallowest interval of 5.3 metres grading 14.3% zinc from 138.8 metres is hosted by sandstone. The deeper zinc interval is hosted by limestone and intersected 42.4 metres grading 9.4% zinc (including 5.5 metres grading 22.9% zinc and 9.1 metres grading 20.8% zinc). A third zone of sulphide (predominantly pyrrhotite hosted) intersected tin mineralization, including 18.0 metres grading 0.67% tin from 206 metres depth.

Hole A22-204 was drilled from a nearby drill collar targeting a gap in the indicated resource. This hole intersected two zones of high-grade zinc mineralization within the Pucara limestone, the best mineralized interval being 14.8 metres grading 8.4% zinc from 196.4 metres, including 6.1 metres grading 12.6% zinc. Another zone of sulphide intersected tin mineralization including 16.5 metres grading 0.36% tin from 234 metres depth associated with massive pyrrhotite - pyrite.

Hole A22-196 was a hole collared some 150 metres north of the South Ayawilca resource and was drilled at a shallow angle (45 degrees) to the south. This hole intersected moderate grade zinc mineralization in the uppermost part of the South Ayawilca deposit (18.6 metres grading 5.8% zinc from 300 metres depth) but missed the high-grade core of the deposit due to the shallow dip of the drill hole.

Table 1. Summary of drill hole results in four new drill holes from South Ayawilca

Figure 1. Drill hole map of Ayawilca highlighting 2022-2023 drill holes and the Zinc Zone indicated resources

Figure 2. Cross section highlighting hole A22-202 and zinc mineralization focussed in a folded limestone ‘anticline'

Figure 3. Drill cores from hole A22-202 highlighting the 10.4 metre interval grading 42% zinc

Table 2. Drill hole details for 2022-2023 drill program including drill collar coordinates

Notes: Datum for coordinates is WGS84 Zone 18S. Azimuth is true azimuth

Note on sampling and assaying

Drill holes are diamond HQ size core holes with recoveries generally above 80% and often close to 100%. The drill core is marked up, logged, and photographed on site. The cores are cut in half at the Company's core storage facility, with half-cores stored as a future reference. Half-core was bagged on average over 1 to 2 metre composite intervals and sent to SGS laboratory in Lima for assay in batches. Standards and blanks were inserted by Tinka into each batch prior to departure from the core storage facilities. At the laboratory samples are dried, crushed to 100% passing 2mm, then 500 grams pulverized for multi-element analysis by ICPMS using multi-acid digestion. Samples assaying over 1% zinc, lead, or copper and over 100 g/t silver were re-assayed using precise ore-grade AAS techniques. Samples within massive sulphide zones were also assayed for tin using XRF techniques.

The Qualified Person, Dr. Graham Carman, Tinka's President and CEO, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

Readers are encouraged to read the NI 43-101 Technical Report entitled "Ayawilca Polymetallic Project, Central Peru, NI 43-101 Technical Report on Updated Preliminary Economic Assessment" available for download on Tinka's website at www.tinkaresources.com . The Technical Report was prepared by Mining Plus Peru S.A.C. ("Mining Plus") as principal consultant, Transmin Metallurgical Consultants ("Transmin"), Envis E.I.R.L ("Envis"), and SLR Consulting (Canada) Ltd ("SLR").

| On behalf of the Board, " Graham Carman " | Further Information: Mariana Bermudez 1.604.685.9316 Stay up to date by subscribing for news alerts at Contact Tinka and by following Tinka on Twitter , LinkedIn and Facebook . |

About Tinka Resources Limited

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca zinc-silver-tin project in central Peru. The Zinc Zone deposit has an estimated Indicated Mineral Resource of 19.0 Mt @ 7.15% Zn, 16.8 g/t Ag & 0.2% Pb and Inferred Mineral Resource of 47.9 Mt @ 5.4% Zn, 20.0 g/t Ag & 0.4% Pb (dated August 30, 2021). The Ayawilca Tin Zone has an estimated Inferred Mineral Resource of 8.4 Mt grading 1.0% Sn.

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned work programs and results varying from expectations; delay in obtaining results; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; the Company's expectations regarding the Ayawilca Project PEA; the political environment in which the Company operates continuing to support the development and operation of mining projects; risks related to negative publicity with respect to the Company or the mining industry in general; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

SOURCE: Tinka Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/734432/Tinka-Drills-Spectacular-Hole-at-Ayawilca-389-M-20-Zinc-Including-104-M-42-Zinc