April 25, 2022

RESULTS CONTINUE TO CONFIRM SPODUMENE PEGMATITE CONTINUITY, MONTE ALTO DRILLING COMMENCED

Latin Resources LimitedLatin Resources Limited (ASX: LRS) (“Latin” or “the Company”) is very pleased to announce that diamond drill testing of high-grade outcropping lithium pegmatites at the Company’s second prospect area, the Monte Alto Prospect in Brazil, has commenced. The latest assays from drilling at the Company’s first prospect, the Bananal Valley Prospect to the west (Appendix 1, Figure 7), continue to return exceptional results.

HIGHLIGHTS

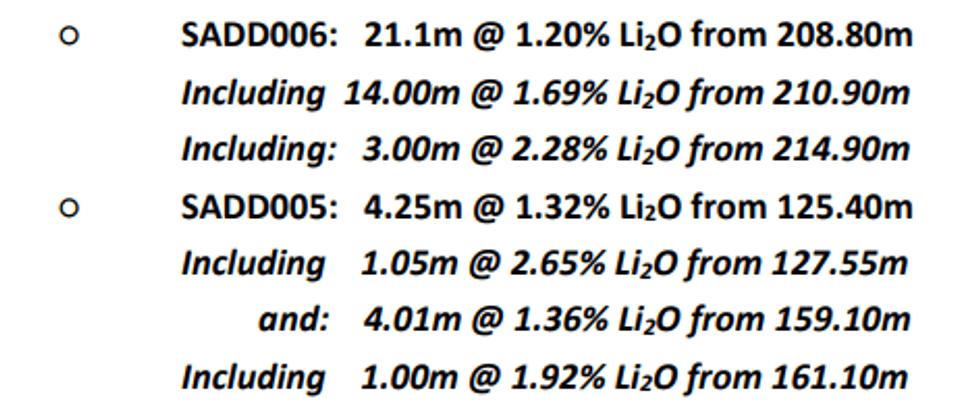

- Latest results from diamond drill holes at the Bananal Valley Prospect area have returned the thickest intersection recorded to date with 21.1m @ 1.20% Li2O from 208.80m in hole SADD006.

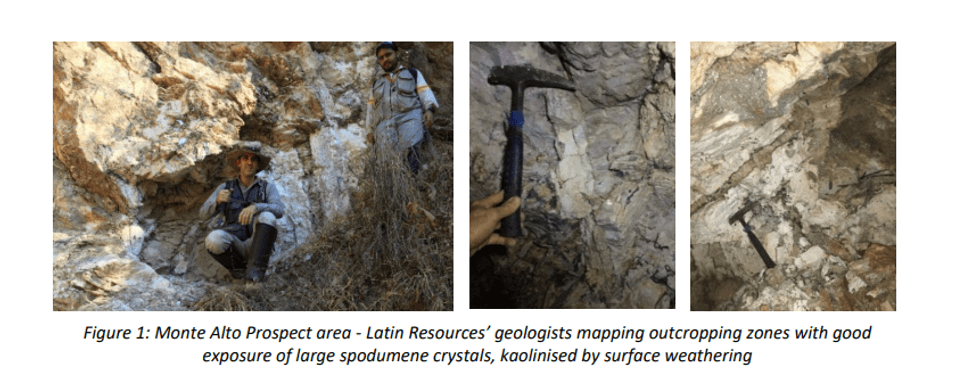

- Drilling has commenced at the new Monte Alto Prospect area where the Company will undertake the first ever drill testing of the outcropping high-grade lithium pegmatites, in parallel with the commencement of a large 25,000m resource definition campaign at the Company’s more advanced Bananal Valley Prospect approximately 4 kilometres to the west.

- Assay results continue to demonstrate the strong continuity of the lithium grades with significant intersections returned over a strike length of greater than 600m and remaining open along strike and down dip.

- Most recent new intersections received for the Bananal Valley Prospect include

Latin Resources’ Managing Director, Chris Gale, commented:

“We continue to receive exceptional assay results from our Bananal Valley Prospect. This continues to get more encouraging every day. We are also very excited to be commencing drilling at our new Monte Alto Prospect. Our mapping and outcrop sampling in this area has shown us that we have thick, highgrade lithium pegmatites outcropping over a considerable strike extent. With multiple high-grade results up to 2.30% Li2O1 from initial surface sampling, the early signs are equal to or better than those returned at the same stage from our more advanced Bananal Valley Prospect. We are planning an initial 2,000m of drilling in two stages at Monte Alto and assay results should start flowing in May.

“With the company recently raising $35,000,000, we have now expedited the drilling program by commencing our 25,000m resource definition drilling campaign at Bananal Valley.

“With drilling now on multiple fronts, and more rigs on the way to site, we have really stepped up our pace in Brazil to fast track our pathway to an initial JORC Mineral Resource estimate.”

Click here for the full ASX Release

This article includes content from Latin Resources Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRS:AU

The Conversation (0)

02 February 2022

Latin Resources

Developing mineral projects to support the global decarbonization

Developing mineral projects to support the global decarbonization Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00