(TheNewswire)

Victoria, British Columbia, Canada TheNewswire - November 4, 2025 - Teuton Resources Corp. ("Teuton" or "the Company") ("TUO"-TSX-V) ("TFE"- Frankfurt) is pleased to report that Joint Venture ("JV") partner Tudor Gold ("Tudor") has announced, in a news release dated November 3, 2025, results from the fifth and final drillhole of the 2025 drill program at the Goldstorm deposit, Treaty Creek property situated in northwestern British Columbia in the heart of the Golden Triangle.

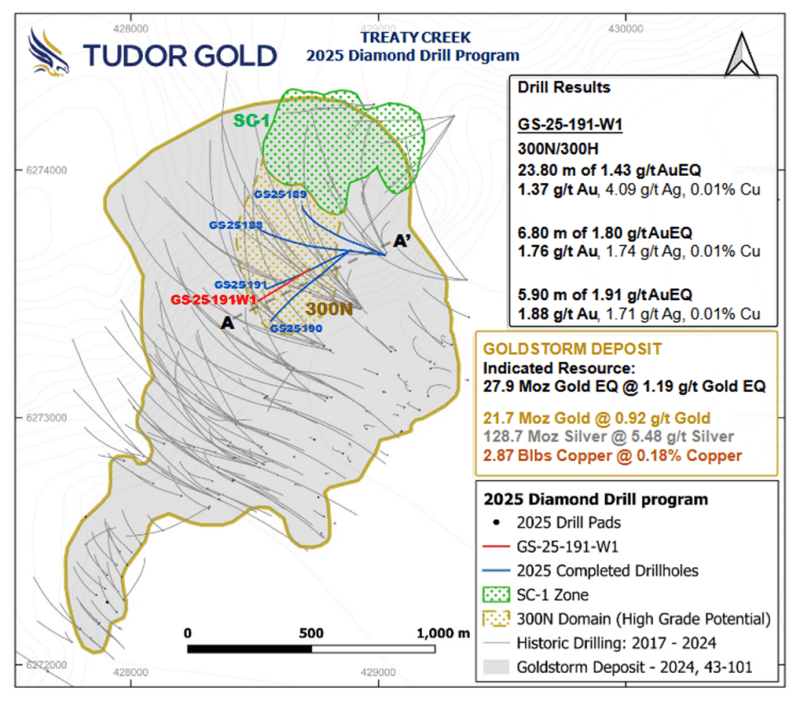

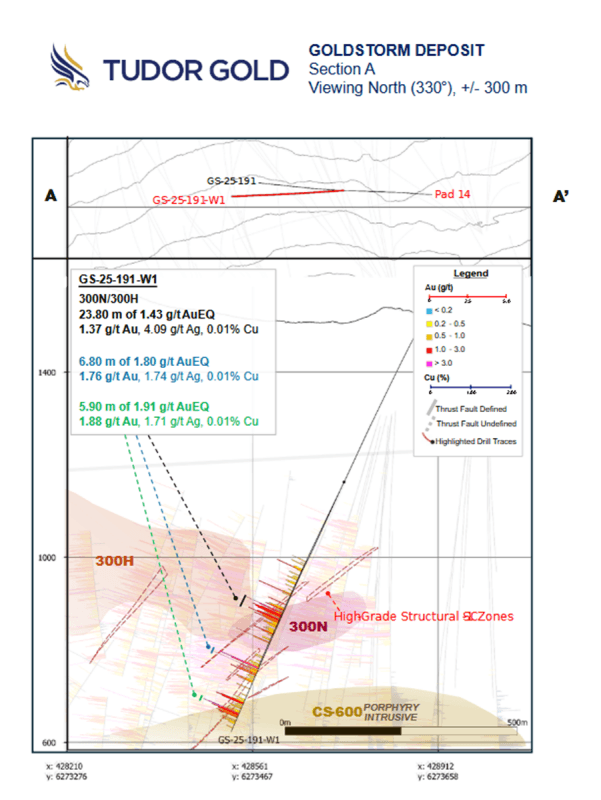

Hole GS-25-191-W1, the final hole, intersected a northeastward extension of the 300 Horizon Zone ("300H"), linking mineralized intercepts within the 300H and 300 North Zone ("300N") along two potential SC-1 Zone structural corridors. Highlights of the mineralized intercepts:

-

1.37 g/t gold , 4.09 g/t silver and 0.01% copper (1.43 g/t gold equivalent ("AuEQ")) over 23.80 meters (m) , including:

-

1.63 g/t gold , 4.89 g/t silver and 0.02% copper (1.70 g/t AuEQ) over 10.70m , and:

-

-

1.76 g/t gold , 1.74 g/t silver and 0.01% copper (1.80 g/t AuEQ) over 6.80m

-

1.88 g/t gold , 1.71 g/t silver and 0.01% copper (1.91 g/t AuEQ) over 5.90m

See Table 1 below for select drill results of hole GS-25-191-W1 accompanied by a plan map and cross section.

GS-25-191-W1 was targeted to demonstrate continuity between high-grade mineralization on a North-South axis between drillholes GS-25-190 and GS-25-191, as well as a Southwest-Northeast axis connecting the 300H and 300N mineralized domains. This drill hole further confirms a high grade intercept observed in GS-25-191 (4.12 g/t gold, 16.48 g/t silver, and 0.01% copper (4.30 g/t AuEQ) over 8.90m), stepping out 52m to the south intercepting 1.63 g/t gold, 4.89 g/t silver, and 0.02% copper (1.70 g/t AuEQ) over 10.70m. Additionally, a separate high-grade SC-1 like structure was intercepted lower in the hole, stepping out 75m to the north of several drillholes from 2022, providing continuity between 300H and 300N mineralized domains intercepting 1.88 g/t gold, 1.71 g/t silver, and 0.01% copper (1.91 g/t AuEQ) over 5.90m. Furthermore, a third unexpected intercept of 1.76 g/t gold, 1.74 g/t silver and 0.01% copper (1.80 g.t AuEQ) over 6.8m provides continuity to a previously unidentified additional SC-1 structure.

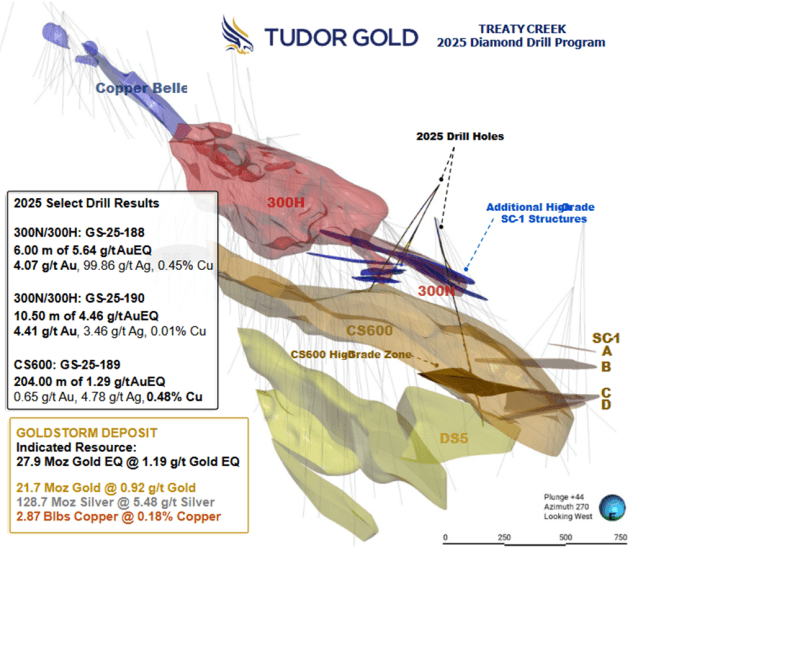

2025 Exploration Program

The 2025 Treaty Creek Exploration Program was designed to target gaps between the 300N and 300H Zones, as well as the recently discovered high-grade SC-1 Zone. The potential for additional high-grade SC-1 Zone-like structures was also targeted, with results confirming and expanding several high-grade corridors within and surrounding the 300N and 300H Zones.

Overall, drilling was successful in intersecting mineralization within and between these zones to confirm the higher-grade gold structures within the bulk-tonnage Mineral Resource at Treaty Creek. Ongoing reinterpretation of historic data is leading to the identification of further high-grade structural zones throughout the Goldstorm Deposit and will be included in an upcoming Mineral Resource estimate for Treaty Creek. The resource update will, in addition to updating the overall Mineral Resource, also provide sensitivity analysis of the tonnes and grade above 2 g/t gold. This analysis will provide Tudor with the ability to assess the potential for a higher-grade underground mine with a smaller footprint to kickstart gold production.

Table 1: Select Drill Results for 2025 Exploration Program

| Hole | Collar Coords | Dip/ | From | To | Interval | Gold | Silver | Copper | AuEQ (3) |

| GS-25-188 | 429024 mE 6273658 mN | -62/283 | 900.00 | 954.00 | 54.00 | 2.31 | 16.98 | 0.07 | 2.57 |

| Including | 900.00 | 906.00 | 6.00 | 4.07 | 99.86 | 0.45 | 5.64 | ||

| and | 901.50 | 903.00 | 1.50 | 5.90 | 343.00 | 1.45 | 11.16 | ||

| GS-25-189 | 429024 mE 6273658 mN | -71/293 | 836.00 | 845.00 | 9.00 | 2.45 | 0.94 | 0.01 | 2.48 |

| 882.50 | 885.50 | 3.00 | 7.01 | 4.22 | 0.01 | 7.06 | |||

| 1130.00 | 1334.00 | 204.00 | 0.65 | 4.78 | 0.48 | 1.29 | |||

| 1355.40 | 1365.60 | 10.20 | 3.72 | 6.04 | 0.29 | 4.14 | |||

| Including | 1357.50 | 1361.00 | 3.50 | 5.81 | 1.00 | 0.38 | 6.29 | ||

| GS-25-190 | 428884 mE 6273677 mN | -66/235 | 857.50 | 931.00 | 73.50 | 1.70 | 3.46 | 0.01 | 1.75 |

| including | 872.00 | 910.00 | 38.00 | 2.03 | 2.06 | 0.01 | 2.06 | ||

| Including | 872.00 | 880.00 | 8.00 | 2.58 | 3.01 | 0.01 | 2.62 | ||

| and | 899.50 | 910.00 | 10.50 | 4.41 | 3.46 | 0.01 | 4.46 | ||

| GS-25-191 | 428884 mE 6273677 mN | -64/245 | 776.50 | 822.50 | 46.00 | 1.70 | 12.56 | 0.02 | 1.85 |

| including | 782.00 | 790.90 | 8.90 | 4.12 | 16.48 | 0.01 | 4.30 | ||

| and | 812.10 | 819.50 | 7.40 | 1.91 | 25.06 | 0.01 | 2.17 | ||

| GS-25-191-W1 | 428884 mE 6273677 mN | -64/245 | 311.80 | 335.60 | 23.80 | 1.37 | 4.09 | 0.01 | 1.43 |

| including | 311.80 | 322.50 | 10.70 | 1.63 | 4.89 | 0.02 | 1.70 | ||

| 441.00 | 447.80 | 6.80 | 1.76 | 1.74 | 0.01 | 1.80 | |||

| 548.55 | 554.45 | 5.90 | 1.88 | 1.71 | 0.01 | 1.91 |

| · All assay values are uncut and intervals reflect drilled intercept lengths. |

| · HQ and NQ diameter core samples were sawn in half and typically sampled at standard 1.5 m intervals. |

| · The following metal prices were used to calculate the Au Eq metal content: Gold $1850/oz, Ag: $21/oz, Cu: $3.75/lb. Calculations used the formula AuEQ = Au g/t + (Ag g/t*0.0100901) + (Cu ppm*0.0001236). All metals are reported in USD and calculations consider recoveries of 90 % for gold, 80 % for copper, and 80 % for silver. |

| · True widths have not been determined as the mineralized body remains open in all directions. Further drilling is required to determine the mineralized body orientation and true widths. |

Plan Map of Drillhole GS-25-191-W1

2025-2026 Plans for Treaty Creek

Preparation of an updated Mineral Resource estimate for Treaty Creek is underway, which will include the additional drilling from 2024 and 2025 exploration programs comprising approximately 15,000 meters of drill data. The updated block model used to estimate the 2025 Mineral Resource will be comprised of 5mx5mx5m blocks rather than the 10mx10mx10m blocks used to estimate the 2024 Mineral Resource estimate. The smaller block size will provide better resolution of the higher-grade gold mineralization. The updated Mineral Resource estimate is targeted to be completed in the fourth quarter of this year.

On receipt of the permit for the development of an underground ramp to access the high-grade gold SC-1 Zone and the other zones, Tudor plans to collar the portal, and commence the excavation of, the underground ramp. Subject to receipt of all necessary permits, Tudor plans to commence the underground excavation in the third quarter of 2026.

Tudor is assessing opportunities for increasing the gold Mineral Resources at Treaty Creek in 2026 by drilling other known zones on the property. In particular, Tudor plans to follow up on drill hole PS-23-10 at the Perfectstorm Zone, which intersected 1.23 g/t gold, 3.43 g/t silver and 0.01% copper over 102.15 meters, including 1.80 g/t gold, 5.76 g/t silver and 0.02 % copper over 42.5 meters. Tudor expects to firm up exploration plans for 2026 over the winter.

Cross Section of Drillhole GS-25-191-W1

2025 Deposit Overview

Qualified Person

The Qualified Person for the Tudor Gold news release dated November 3, 2025 for the purposes of National Instrument 43-101 is Ken Konkin, P. Geo., Senior Vice President, Exploration, Tudor Gold. Ken Konkin has read and approved the scientific and technical information that forms the basis for the disclosure contained in this news release. D. Cremonese, P. Eng. Is the Qualified Person for Teuton Resources. Technical data presented in today's Teuton news release is consistent with that presented in the Tudor Gold news release dated November 2, 2025. As Mr. Cremonese is President and also director of Teuton, he is not independent of the Company.

QA/QC

Diamond drill core samples were prepared at MSA Labs' Preparation Laboratory in Terrace, BC and assayed at MSA Labs' Geochemical Laboratory in Langley, BC. Analytical accuracy and precision are monitored by the submission of blanks, certified standards and duplicate samples inserted at regular intervals into the sample stream by Tudor Gold personnel. MSA Laboratories quality system complies with the requirements for the International Standards ISO 17025 and ISO 9001. MSA Labs is independent of Tudor Gold as well as Teuton Resources.

About Treaty Creek

Teuton was the original staker of the Treaty Creek property, host to the large Goldstorm deposit, assembling the core land position in 1984-5. It presently holds a 20% carried interest in the Treaty Creek Project (Tudor Gold is responsible for paying all exploration costs up until such time as a production decision is made and owns a 80% interest). Additionally, Teuton owns a 0.98% Net Smelter Royalty in the Goldstorm deposit area as well as in the northern portion of the Perfectstorm zone; within the southern portion of the Perfectstorm zone, Teuton owns a 0.49% NSR with an option to increase that to 1.49% by paying $1 million to the current owner. It also owns numerous additional royalty interests within the Sulphurets Hydrothermal system on formerly 100%-owned properties such as the King Tut, Tuck, High North, Orion, Delta and Fairweather properties (King Tut and Tuck now owned by Newmont Mining; High North, Orion, Delta and Fairweather properties now owned by Goldstorm Metals).

The Treaty Creek Project not only contains the Goldstorm Deposit (a large gold-copper porphyry system) it also hosts several other prospective zones of mineralization lying along a north-northeast trending axis following the trace of the Sulphurets thrust fault. This thrust fault is spatially related to all of the porphyry deposits on the neighbouring KSM property (owned by Seabridge Gold) as well as the Treaty Creek property.

About Teuton

Teuton owns interests in more than twenty-three properties in the prolific "Golden Triangle" area of northwest British Columbia and was one of the first companies to adopt what has since become known as the "prospect generator" model. This model minimizes share equity dilution while at the same time maximizing opportunity. Earnings provided from option payments received, both in cash and in shares of the optionee companies over the past 9 years, has provided Teuton with substantial income.

ON BEHALF OF THE BOARD OF DIRECTORS OF Teuton Resources:

"Dino Cremonese"

Dino Cremonese, P. Eng.,

President and Chief Executive Officer

For further information, please visit the Company's website at www.teuton.com or contact:

Barry Holmes

Director Corporate Development and Communications

Tel. 778-430-5680

Email: bholmesmba@gmail.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements regarding Forward-Looking information

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially.

All statements relating to future plans, objectives or expectations of the Company are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include risks relating to the actual results of current exploration activities, fluctuating gold prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

Copyright (c) 2025 TheNewswire - All rights reserved.