May 28, 2024

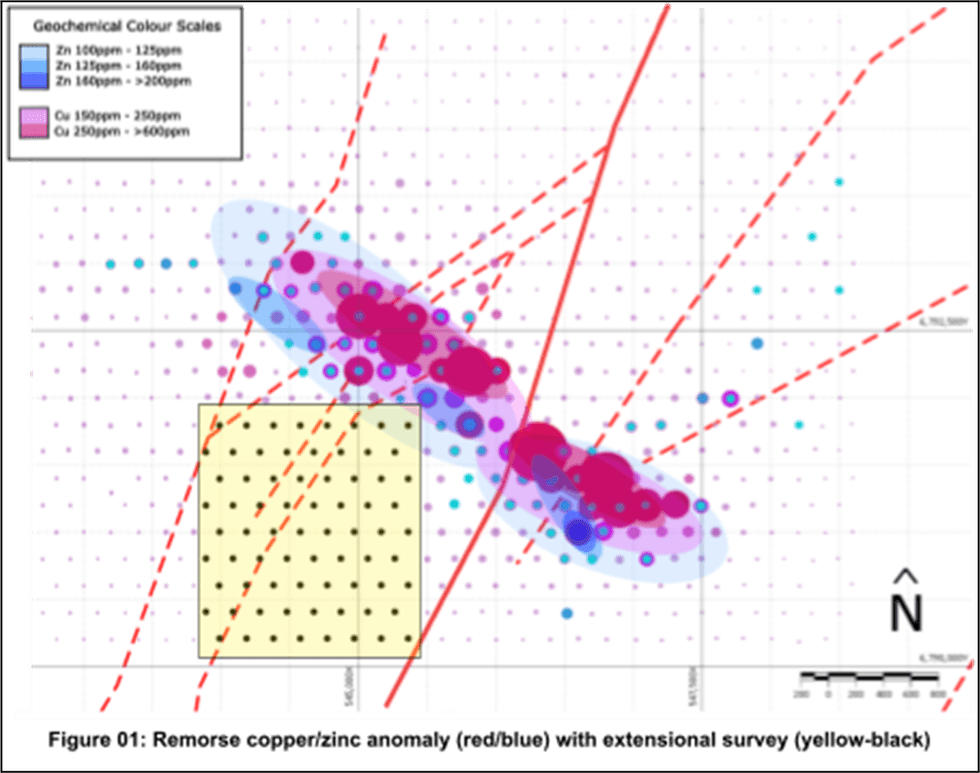

Tempest Minerals Ltd (TEM) is pleased to announce the completion of an extensional geochemistry sampling at the Remorse Target. An untested but previously tenement-constrained area to the south of the main copper anomaly has now been sampled. This area was identified as a high-priority task within ongoing fieldwork leading up to a major drill program at the Remorse Target.

Key Points

- >4km Remorse Copper Anomaly area open to the south now sampled

- Ultrafine assays and multi-sensor scanning results due in July 2024

- Ongoing fieldwork in the leadup to drilling

Yalgoo Project

Background

TEM holds more than 1,000km2 1 of highly prospective tenure in the Yalgoo Region of Western Australia 2. The Company previously announced the presence of large-scale copper zinc anomalies at the Remorse Target 3 that the Company is progressing towards drilling 4. The sampling area is one of a number of exploration targets and extensional geochem survey areas that previously became apparent 5 as a result of exploration works and were subsequently acquired in 2023 6.

Sampling

As part of ongoing fieldwork, approximately 80 soil samples were collected in an offset pattern to match existing surrounding sampling.

Samples will be Ultrafine assayed in conjunction with comprehensive scanning using Boxscan technology.

Assays are expected to be returned by July 2024 and integrated into the greater dataset in addition to drilling.

Next Steps

- Labwest Ultrafine assays of the collected samples

- Return of assays expected by July 2024

- Ongoing fieldwork in Yalgoo in preparation for drilling at Remorse

Click here for the full ASX Release

This article includes content from Tempest Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

03 February 2025

Tempest Minerals

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore.

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore. Keep Reading...

9h

How to Invest in Gold Royalty and Streaming Stocks

Gold royalty companies offer investors exposure to gold and silver with the benefits of diversification, lower risk and a steady income stream. Royalty companies operating in the resource sector will typically agree to provide funding for the exploration or development of a resource in exchange... Keep Reading...

9h

How Would a New BRICS Currency Affect the US Dollar?

The BRICS nations, originally composed of Brazil, Russia, India, China and South Africa, have had many discussions about establishing a new reserve currency backed by a basket of their respective currencies. The creation of a potentially gold-backed currency, known as the "Unit," as a US dollar... Keep Reading...

13h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

16h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

23 February

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23 February

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00