Total reported intercept of 47.33 meters grading 42.79% Copper Equivalent or 21.40% Nickel Equivalent

Talon Metals Corp. (TSX: TLO) (OTC Pink: TLOFF) (together with its subsidiaries, "Talon" or the "Company"), the majority owner and operator of the Tamarack Nickel-Copper-Cobalt Project ("Tamarack Nickel Copper Project") in central Minnesota, is pleased to announce assays from the previously announced historic massive sulphide ("MSU") intercepts in drill hole 25TK0563 (see the Company's press release dated May 12, 2025) measuring a combined 34.9 meters grading 28.88% NiEq and 57.76% CuEq at the Tamarack Nickel Copper Project.

Highlights:

Table 1: Select assay intervals for drill hole 25TK0563

| Drill Hole # | From (m) | To (m) | Length (m) | Assay | NiEq (%) | CuEq (%) | ||||||

| Ni (%) | Cu (%) | Co (%) | Pd (g/t) | Pt (g/t) | Au (g/t) | Ag (g/t) | ||||||

| 25TK0563 | 762.34 | 809.67 | 47.33 | 11.01 | 11.40 | 0.08 | 6.39 | 12.06 | 6.79 | 33.54 | 21.40 | 42.79 |

| 1 including | 762.34 | 782.73 | 20.39 | 13.11 | 14.68 | 0.10 | 8.28 | 16.08 | 9.24 | 42.13 | 26.70 | 53.40 |

| 2 and | 795.16 | 809.67 | 14.51 | 17.32 | 16.34 | 0.12 | 9.18 | 16.63 | 9.09 | 46.52 | 31.95 | 63.90 |

| 1+2 combined | 762.34 | 782.73 | 34.90 | 14.86 | 15.37 | 0.11 | 8.65 | 16.31 | 9.18 | 42.92 | 28.88 | 57.76 |

| 795.16 | 809.67 | |||||||||||

See Table 3 for further technical information

Drill hole 25TK0563 intersected a combined length of 34.90 meters across two zones of MSU starting at 762.34 meters grading 14.86% Ni, 15.37% Cu, 0.11% Co, 9.18 g/t Au, 16.31 g/t Pt, 8.65 g/t Pd, and 42.92 g/t Ag.

Of the two zones of MSU that were intercepted, the upper MSU starts at 762.34 meters and graded 26.70% NiEq (53.40% CuEq) over the 20.39 meter interval. The lower MSU starts at 795.16 meters and graded 31.95% NiEq (63.90% CuEq) over 14.51 meters.

These assays represent a portion of the mineralization encountered in hole 25TK0563 and further details may be provided as the remainder of the drill hole is assayed.

The drill hole was targeting Borehole Electromagnetic ("BHEM") anomalies identified from previous drill holes 25TK0562 and 16TK0250.

Drill hole 25TK0563 represents an approximate 68-meter step-out to the east from the intercept in drill hole 16TK0250.

A BHEM campaign has been initiated using multiple loops to help evaluate this new zone from various orientations. The results of this program will guide the future drill program.

"Intercepts of this scale and grade are extremely rare, and they don't come without deep technical understanding. Our in-house geophysics team helped vector us into this target, and our in-house drill team executed it flawlessly. This result validates both the geology at Tamarack and the integrated approach we've taken to exploration. Tamarack continues to exceed expectations and has raised the bar as to what high-grade means," said Brian Goldner, Chief Exploration and Operations Officer.

"A 34.9-meter intercept grading 28.88% nickel equivalent is truly world-class. Even when you compare it to historical data from globally significant nickel deposits, intercepts like this are few and far between. From a geologic perspective, this is a bonanza result by any standard," added Dean Rossell, Chief Geologist of Talon and credited with the discovery of Tamarack, Eagle and Boulderdash.

"As the United States accelerates efforts to secure domestic critical mineral supply chains for energy security and national defense, Tamarack stands out as a rare and essential piece of the puzzle. These assay results not only underscore the global significance of our deposit, but also its strategic importance to America's energy future," said Henri van Rooyen, CEO of Talon.

Figure 1: Photo of drill core from drill hole 25TK0563 starting at 762.34 meters depth showing a combined 34.9 meters of massive sulphide mineralization.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2443/254546_306e336bf4791b22_001full.jpg

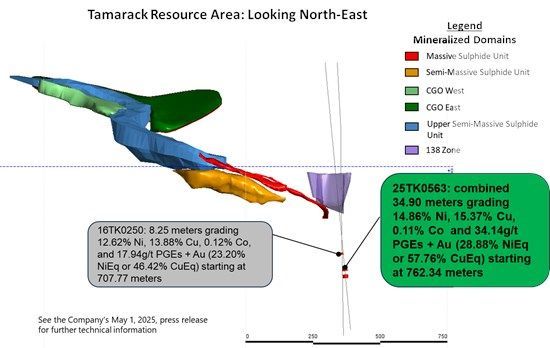

Figure 2: Location of the 34.90 meters intercept in drill hole 25TK0563 in relation to the Tamarack Resource Area.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2443/254546_306e336bf4791b22_002full.jpg

Lundin Earn-in Agreement Update

Talon and Lundin Mining Corporation ("Lundin Mining") have extended the exclusivity period until June 30, 2025 as the parties continue to work on the earn-in and related agreements ("Lundin Agreements") pursuant to which Lundin Mining may acquire up to a 70% ownership interest in the Boulderdash and Roland exploration targets, which are in close proximity to Lundin Mining's Eagle Mine and encompass approximately 33,000 acres of minerals rights out of Talon's over 400,000 acre mineral package in Michigan (see the Company's press release from March 5, 2025 for further information).

Talon has two of its drill rigs currently drilling at Boulderdash.

QUALITY ASSURANCE, QUALITY CONTROL AND QUALIFIED PERSONS

Please see the technical report entitled "November 2022 National Instrument 43-101 Technical Report of the Tamarack North Project - Tamarack, Minnesota" with an effective date of November 2, 2022 ("November 2022 Technical Report") prepared by independent "Qualified Persons" (as that term is defined in National Instrument 43-101 ("NI 43-101")) Brian Thomas (P. Geo), Roger Jackson (P. Geo), Oliver Peters (P. Eng) and Christine Pint (P.G) for information on the QA/QC, data verification, analytical and testing procedures at the Tamarack Nickel Copper Project. Copies are available on the Company's website (www.talonmetals.com) or on SEDAR+ at (www.sedarplus.ca). The laboratory used is ALS Minerals who is independent of the Company.

Lengths are drill intersections and not necessarily true widths. True widths cannot be consistently calculated for comparison purposes between holes because of the irregular shapes of the mineralized zones. Drill intersections have been independently selected by Talon. Drill composites have been independently calculated by Talon. The geological interpretations in this news release are solely those of the Company. The locations and distances highlighted on all maps in this news release are approximate.

Dr. Etienne Dinel, Vice President, Geology of Talon, is a Qualified Person within the meaning of NI 43-101. Dr. Dinel is satisfied that the analytical and testing procedures used are standard industry operating procedures and methodologies, and he has reviewed, approved and verified the technical information disclosed in this news release, including sampling, analytical and test data underlying the technical information.

Where used in this news release:

NiEq% = Ni% + Cu% x $4.00/$8.00 x Cu Recovery/Ni Recovery + Co% x $20.00/$8.00 x Co Recovery/Ni Recovery + Pt [g/t]/31.103 x $1,000/$8.00/22.04 x Pt Recovery/Ni Recovery + Pd [g/t]/31.103 x $1,000/$8.00/22.04 x Pd Recovery/Ni Recovery + Au [g/t]/31.103 x $2,000/$8.00/22.04 x Au Recovery/Ni Recovery + Ag [g/t]/31.103 x $20.00/$8.00/22.04 x Ag Recovery/Ni Recovery

CuEq% = Cu%+ Ni% x $8.00/$4.00 x Ni Recovery/Cu Recovery + Co% x $20.00/$4.00 x Co Recovery/Cu Recovery + Pt [g/t]/31.103 x $1,000/$4.00/22.04 x Pt Recovery/Cu Recovery + Pd [g/t]/31.103 x $1,000/$4.00/22.04 Pd Recovery/Cu Recovery + Au [g/t]/31.103 x $2,000/$4.00/22.04 Au Recovery/Cu Recovery + Ag [g/t]/31.103 x $20.00/$4.00/22.04 x Ag Recovery/Cu Recovery

For Ni and Cu recoveries, please refer to the formulae in the November 2022 Technical Report. Recovery of Ni to the Cu concentrate was excluded from the NiEq calculation. The following recoveries were used for the other metals: 64.1% for Co, 82.5% for Pt, 69.3% for Pd and 72.6% for Au and Ag.

ABOUT TALON

Talon is a TSX-listed base metals company in a joint venture with Rio Tinto on the high-grade Tamarack Nickel-Copper-Cobalt Project located in central Minnesota. Talon's shares are also traded in the US over the OTC market under the symbol TLOFF. The Tamarack Nickel Project comprises a large land position (18km of strike length) with additional high-grade intercepts outside the current resource area. Talon has an earn-in right to acquire up to 60% of the Tamarack Nickel Project and currently owns 51%. Talon is focused on (i) expanding and infilling its current high-grade nickel mineralization resource prepared in accordance with NI 43-101 to shape a mine plan for submission to Minnesota regulators, and (ii) following up on additional high-grade nickel mineralization in the Tamarack Intrusive Complex. Talon has a neutrality and workforce development agreement in place with the United Steelworkers union. Talon's Battery Mineral Processing Facility in Mercer County was selected by the US Department of Energy for US$114.8 million funding grant from the Bipartisan Infrastructure Law and the US Department of Defense awarded Talon a grant of US$20.6 million to support and accelerate Talon's exploration efforts in both Minnesota and Michigan. Talon has well-qualified experienced exploration, mine development, external affairs and mine permitting teams.

Please visit the Company's website at www.talonmetals.com or contact:

| Media Contact: Jessica Johnson (218) 460-9345 johnson@talonmetals.com | Investor Contact: Mike Kicis 1 (647) 968-0060 kicis@talonmetals.com |

FORWARD-LOOKING STATEMENTS

This news release contains certain "forward-looking statements". All statements, other than statements of historical fact that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Such forward-looking statements include statements relating to future exploration work, including future drill results and assays as well as geological interpretations, and whether Talon will enter into the Lundin Agreements. Forward-looking statements are subject to significant risks and uncertainties and other factors that could cause the actual results to differ materially from those discussed in the forward-looking statements, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company.

Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

Table 2: Collar Location of Drill Hole 25TK0563

| Drill Hole (#) | Easting (m) | Northing (m) | Elevation (masl) | Azm | Dip | End Depth (m) |

| 25TK0563 | 491049.16 | 5168344.40 | 388.00 | 170.66 | -84.56 | 867.77 |

Collar coordinates are UTM Zone 15N, NAD83.

Azimuths and dips are taken from the survey record at collar unless otherwise noted.

Table 3: Assay Table for Drill Hole 25TK0563

| Drill Hole # | From (m) | To (m) | Length (m) | Assay | NiEq (%) | CuEq (%) | ||||||

| Ni (%) | Cu (%) | Co (%) | Pd (g/t) | Pt (g/t) | Au (g/t) | Ag (g/t) | ||||||

| 25TK0563 | 762.34 | 809.67 | 47.33 | 11.01 | 11.40 | 0.08 | 6.39 | 12.06 | 6.79 | 33.54 | 21.40 | 42.79 |

| including | 762.34 | 782.73 | 20.39 | 13.11 | 14.68 | 0.10 | 8.28 | 16.08 | 9.24 | 42.13 | 26.70 | 53.40 |

| including | 795.16 | 809.67 | 14.51 | 17.32 | 16.34 | 0.12 | 9.18 | 16.63 | 9.09 | 46.52 | 31.95 | 63.90 |

Length refers to drill hole length and not True Width.

True Width is unknown at the time of publication.

All samples were analysed by ALS Minerals. Nickel, copper, and cobalt grades were first analysed by a 4-acid digestion and ICP AES (ME-MS61). Grades reporting greater than 0.25% Ni and/or 0.1% Cu, using ME-MS61, trigger a sodium peroxide fusion with ICP-AES finish (ICP81). Platinum, palladium, and gold are initially analyzed by a 30g fire assay with an ICP-MS finish (PGM-MS24). Any samples reporting >1g/t Pt or Pd trigger an over-limit analysis by ICP-AES finish (PGM-ICP27) and any samples reporting >1g/t Au trigger an over-limit analysis by AAS (Au-AA26). For Ag, ICP-AES through Aqua regia digestion (ME-ICP 41).

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/254546