June 01, 2022

Blackstone Minerals Limited (“Blackstone” or the “Company”) is pleased to provide an update on drilling at the Company’s flagship Ta Khoa Nickel Project (TKNP) in northern Vietnam.

- Portable XRF records up to 20% Ni at New Massive Sulfide Discovery

- Resource drilling at Ban Chang and King Snake continues to deliver impressive results

New Massive Nickel Sulfide Targets

Blackstone drilling targeting new opportunities within the Ta Khoa district has identified Massive Sulfide Vein (MSV), Semi-Massive Sulfide Vein (SMSV) and Net-textured Sulfide (NTS) mineralisation.

- At the Suoi Phang prospect (refer Figures 2, 3), drill hole SP22-01 has intersected 2.95m of sulfide (including MSV, SMSV and NTS) with Portable XRF readings indicating the presence of up to 20% Ni (refer Table 1, Table 3, Table 4 and Appendix 1)

- At the Suoi Chanh prospect (refer Figure 4), the second drill hole SC22-02 has intersected SMSV consistent with the Blackstone Electromagnetic (EM) targeting.

Resource Drilling

Blackstone has continued to drill its most advanced MSV deposits (Ban Chang & King Snake), primarily focusing on upgrading the current resources (refer ASX announcement 23 December 2021) into a higher confidence category. At King Snake, the most recent drilling indicates potential for the deposit to continue to plunge further west and at depth (refer Image 1, Figure 7, Figure 8 & Table 2).

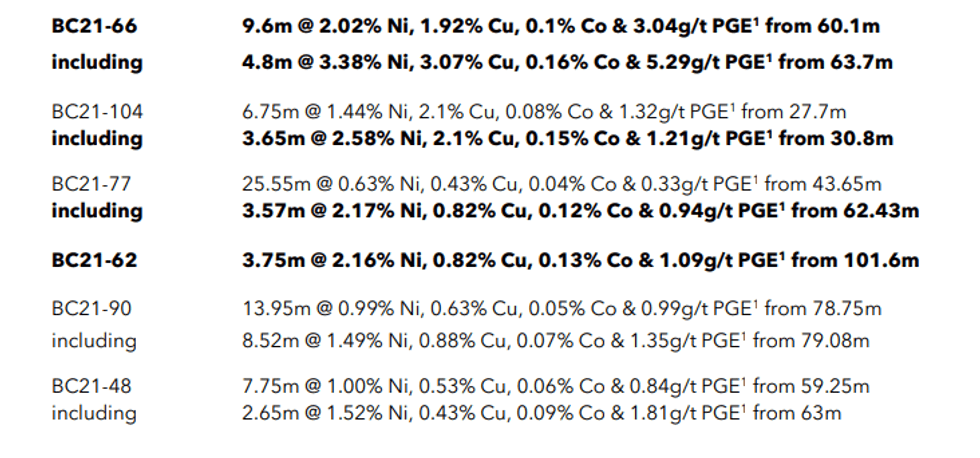

Highlights from infill drilling at Ban Chang include:

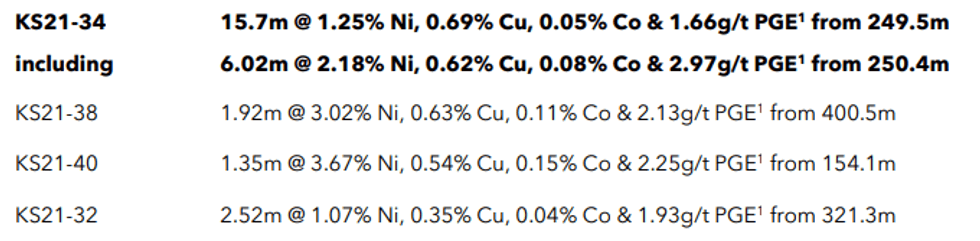

Highlights from infill drilling at King Snake include:

Scott Williamson, Blackstone’s Managing Director, said:

“It is an exciting phase of exploration for the Company as we start to look at massive sulfide opportunities in addition to Blackstone’s established resources at Ban Chang and King Snake. Suoi Chanh is yet another example of our in-house geophysics teams proven track record, with success being achieved from the second drill hole. We look forward to continuing to systematically assess the massive sulfide potential at Ta Khoa.”

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSX:AU

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 July 2025

Blackstone Minerals

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

19 December 2025

Nickel Price 2025 Year-End Review

After peaking above US$20,000 per metric ton (MT) in May 2024, nickel prices have trended steadily down. Behind the numbers is persistent oversupply driven by high output from Indonesia, the world’s largest nickel producer. At the same time, demand from China's manufacturing and construction... Keep Reading...

Latest News

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00