May 13, 2024

Lightning Minerals (“L1M” or “the Company”) is pleased to provide an update for the Dundas South Project and reports assay results for its recent drilling program on tenement E63/2000. The drilling program tested lithium and rubidium targets identified through regional soil exploration work (refer ASX release 9th February). The results demonstrate a continuation of strong lithium and rubidium occurrences (up to 994ppm lithium and 1,834 ppm rubidium at depths of up to 26m.

Highlights

- Positive assays for the Company’s 96 hole, 3,820m Aircore drill campaign1 on tenement E63/2000 have now been received

- Assays have returned elevated lithium values on composite samples with peak results of 994ppm lithium, confirming and increasing the tenor of the previously identified anomalism

- Results highlight three sites of interest which exhibit correlated elevations in lithium and pathfinder elements supporting continued exploration

Strong assay results have continued at the Company’s Dundas South Project within tenement E63/2000 following completion of drilling in February 2024. Results continue to demonstrate the presence of elevated lithium across the project area with strategies now being reviewed to identify the potential source of the anomalous lithium values. The staged approach to exploration across the Company’s Dundas projects continues to build confidence in lithium potential throughout the region.

Lightning Minerals Managing Director Alex Biggs said, “Drilling on E63/2000 has yielded positive results that suggest we are potentially closing in on what might be a source of lithium mineralisation. The staged approach we have taken: geophysics, soil sampling, infill soil sampling and now Aircore drilling have helped us identify the areas of highest importance and we will continue to follow up on these with further targeted drilling. It also demonstrates that this approach to exploration works, while at the same time conserving capital and ensuring maximum value proposition for exploration expenditure.

The Company remains committed to its exploration at its Dundas project and is excited to begin exploration at its newly acquired Caraíbas and Sidrônio projects in Brazil’s Lithium Valley region of Minas Gerais. It is important that we generate optionality in our exploration strategy and we now hold projects in three of the most prospective lithium districts in the world: Minas Gerais, Brazil, Dundas, Western Australia and Quebec, Canada. We remain excited about the Company’s project’s potential and are supportive of the overall lithium thematic”.

Drilling Results for Dundas Tenement E63/2000

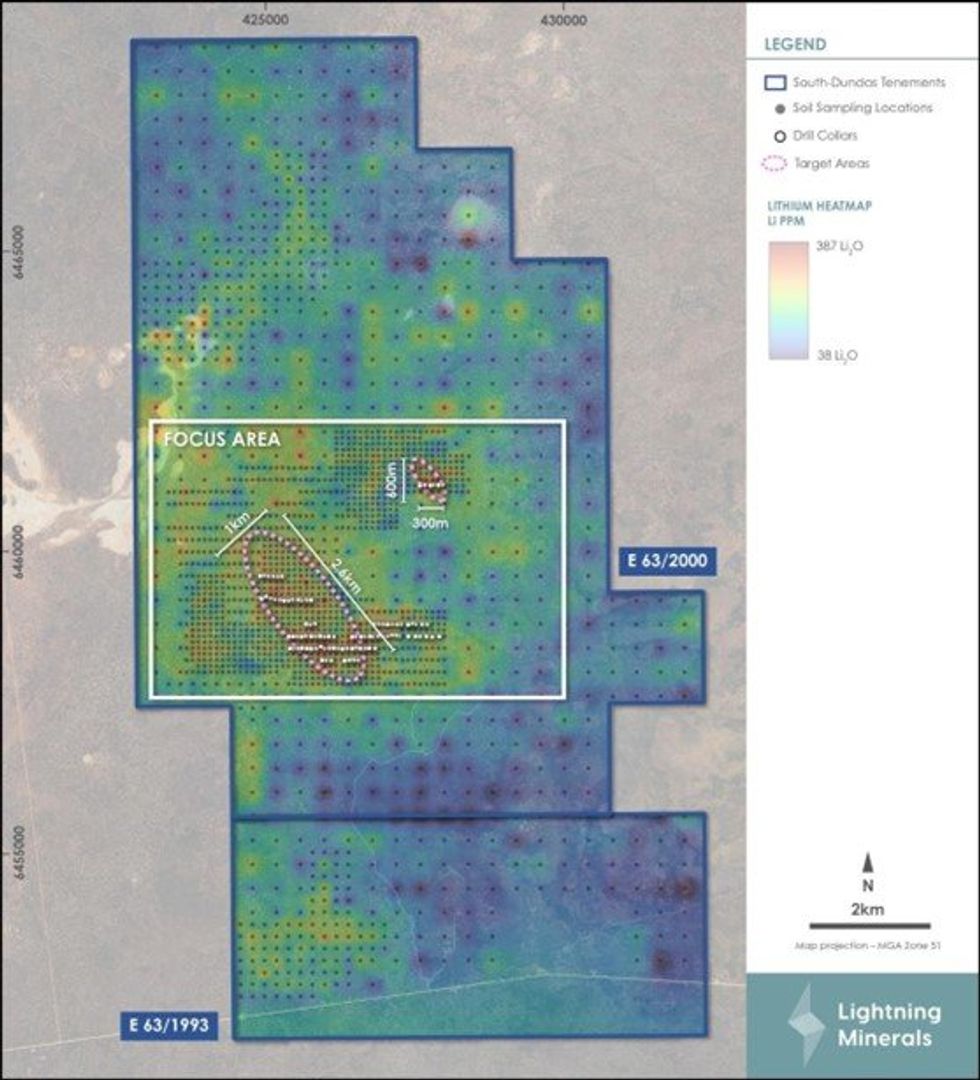

During early 2023 Lightning Minerals completed a first pass reconnaissance soil geochemistry program consisting of 1,391 soil samples at its Dundas South Project. Results within tenements E63/2000 and E63/1993 defined a broad lithium in-soil anomaly over an approximate 2.4km x 1.0km area, including a peak result of 218ppm lithium (Figure 1). Infill sampling was then completed to further define anomalism and to delineate drill targets through the shallow regolith and alluvial cover present in the area. The positive results of the infill program were sufficient to support the continuation of exploration activities through Aircore drilling.

The maiden drill program within E63/2000 was then completed in February 2024 and assays have now been received for all samples submitted for laboratory analysis. Results show three sites of interest, these exhibit broadly correlated elevations in pathfinder elements within highly weathered saprolites. Two of the three sites (Drill Traverse 4 and 6, Figure 2) are located on the eastern extents of east west orientated drill lines and will require follow up exploration to continue vectoring toward any potential lithium mineral system that may be responsible for the elevated results.

Samples were collected from all holes using a 4m composite sampling technique from surface. The samples were then submitted to Nagrom laboratories for a full suite of exploration stage low level elemental analysis. Lithological logging via suitably qualified contract geologists reported a range of end of hole (EOH) rock types including mafic volcanics, granites, and metasediments, with some holes ending at hard undifferentiated saprock/saprolite boundaries.

Click here for the full ASX Release

This article includes content from Lightning Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00