January 21, 2025

Wide intercepts continue to highlight the robust nature of the deposit

Saturn Metals Limited (ASX: STN) (“Saturn” or “the Company”) is pleased to report assay results from ongoing resource development drilling at its flagship 100%-owned Apollo Hill Heap Leach Gold Project, located near Leonora in Western Australia.

HIGHLIGHTS

- Excellent results received from resource-focused Reverse Circulation (RC) drilling completed last year, supporting the development potential at Apollo Hill.

- Thick and higher-grade results include:

- 53m @ 1.08g/t Au from 128m including 16m @ 3.02g/t Au from 144m – AHRC1022

- 29m @ 1.69g/t Au from 164m including 5m @ 8.94g/t Au from 187m – AHRC1028

- 29m @ 1.12g/t Au from 191m including 7m @ 3.03g/t Au from 191m – AHRC1020

- 21m @ 1.85g/t Au from 203m including 11m @ 3.26g/t Au from 206m; and,

- 86m @ 0.58g/t Au from 106m – AHRC1116

- 20m @ 1.13g/t Au from 85m within 27m @ 0.94g/t Au from 78m – AHRC1019

- 20m @ 2.04g/t Au from 3m within 65m @ 0.77g/t Au from 3m – AHRC1049

- The results highlight the continuity of mineralisation across the deposit, supporting the Company’s heap leach development strategy, whilst also emphasising localised higher-grade opportunities.

- Work is nearing completion on an interim resource upgrade for Apollo Hill, scheduled for early next month. Resource drilling has also re-commenced on site.

The results provide strong support for Saturn’s heap leach development strategy for Apollo Hill, reinforcing the continuity of mineralisation and the robustness of the deposit.

This announcement includes results from 50 drill-holes and 7,042m of assays (Appendix 1) from drilling completed at Apollo Hill last year. Drill-hole details are listed in Appendix 2. All holes reported intersections above the resource cut-off grade.

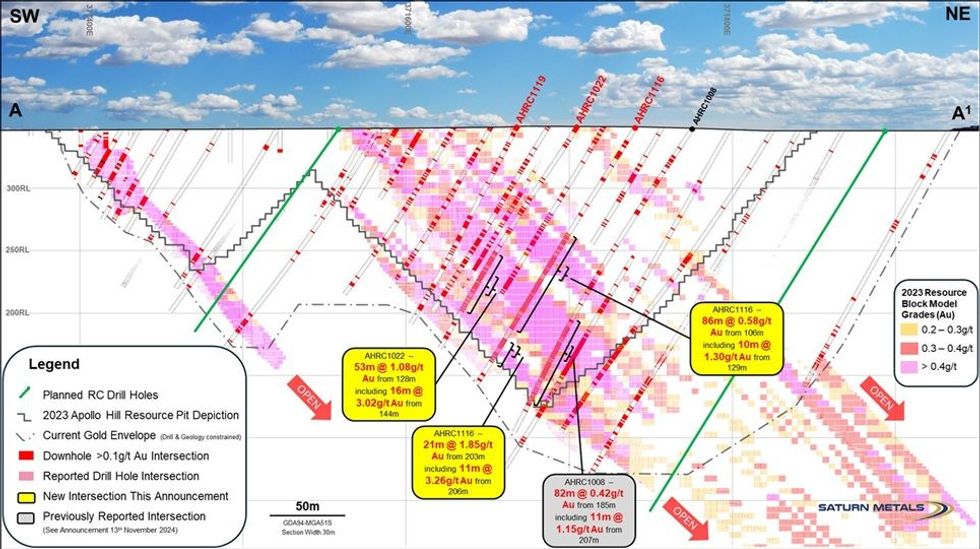

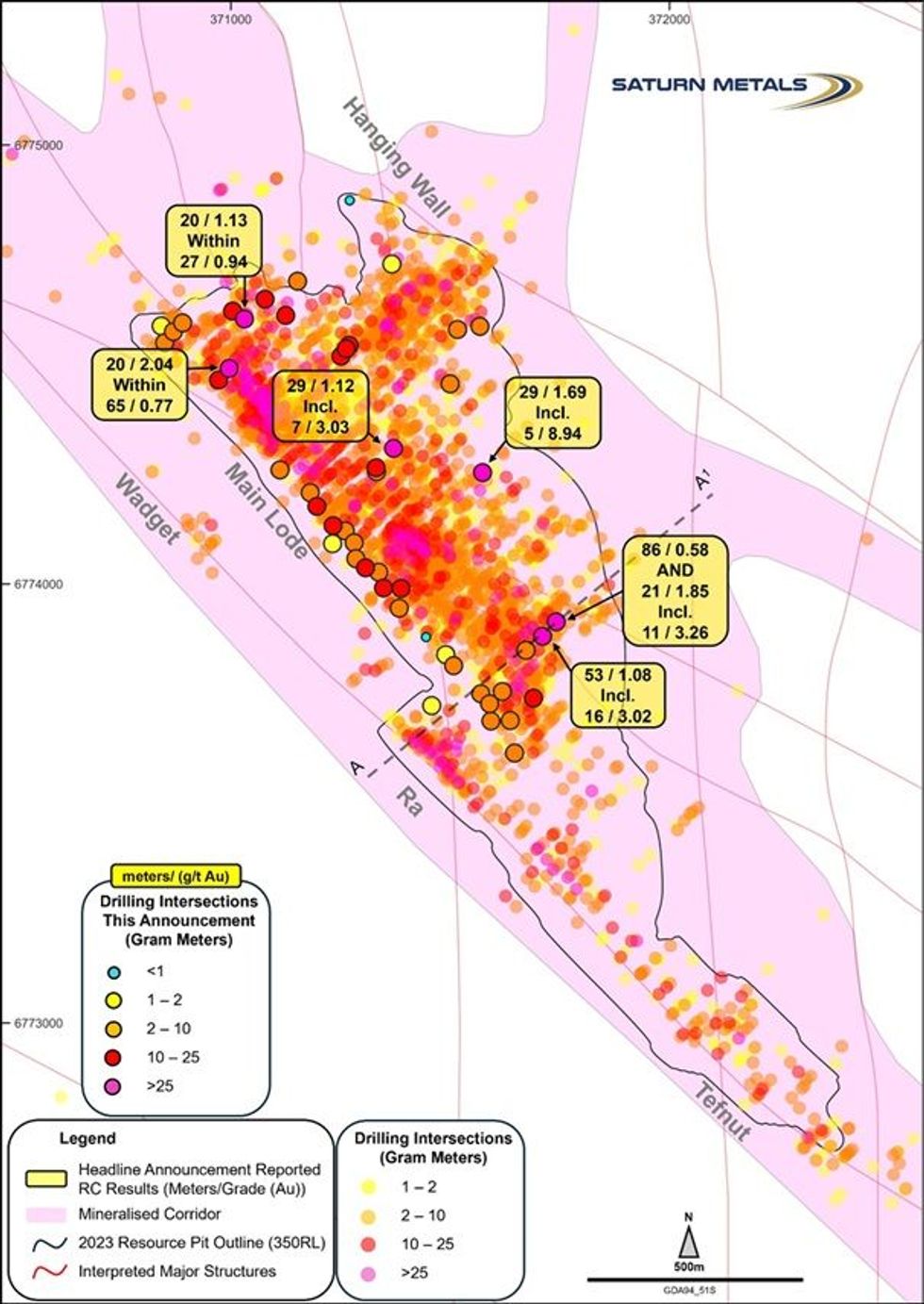

Figure 1 shows reported intersections on a simplified geological cross-section along with planned drill holes and the 2023 Mineral Resource Block model. Reported drill-hole locations and significant results are illustrated in Plan View in Figure 2.

Saturn’s Managing Director Ian Bamborough said: “These impressive results, as illustrated in Figure 1, show how the Apollo Hill deposit continues to develop. I am pleased with the deposit’s trajectory as we progress with drilling. With work nearing completion on the next interim resource upgrade at Apollo Hill, due next month, these results will feed into a subsequent resource upgrade targeted for Q2 2025, which will in turn underpin the Pre-Feasibility Study scheduled for completion later this year. We look forward to reporting additional rounds of results as we continue with our most comprehensive drill program at Apollo Hill to date.”

Assays remain pending from 38 holes and 8,200m, with a further 25,000m of drilling scheduled for the first half of 2025.

Drilling operations have resumed on-site.

As noted above, Saturn is currently working on an interim upgrade of Apollo Hill’s 1.84Moz1 Mineral Resource (anticipated for release next month) which will include results from 34 holes and 9,402m of extensional focused drilling recently reported to the ASX on 28 October 2024.

These latest results will be utilised in a future resource estimate planned as part of Saturn’s bulk tonnage heap leach PFS, scheduled for completion later this year.

Click here for the full ASX Release

This article includes content from Saturn Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

9h

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

11h

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00