Stallion Uranium Corp. (the " Company " or " Stallion ") ( TSX-V: STUD ; OTCQB: STLNF ; FSE: FE0 ) is pleased to announce the successful completion of a ground gravity survey over its Coyote Target, located within the Southwestern Athabasca Basin Joint Venture ("JV") Project in partnership with Atha Energy Corp. (" Atha Energy ") ( TSX-V: SASK ). The survey marks a critical step in advancing the exploration efforts in this highly prospective uranium region.

Highlights:

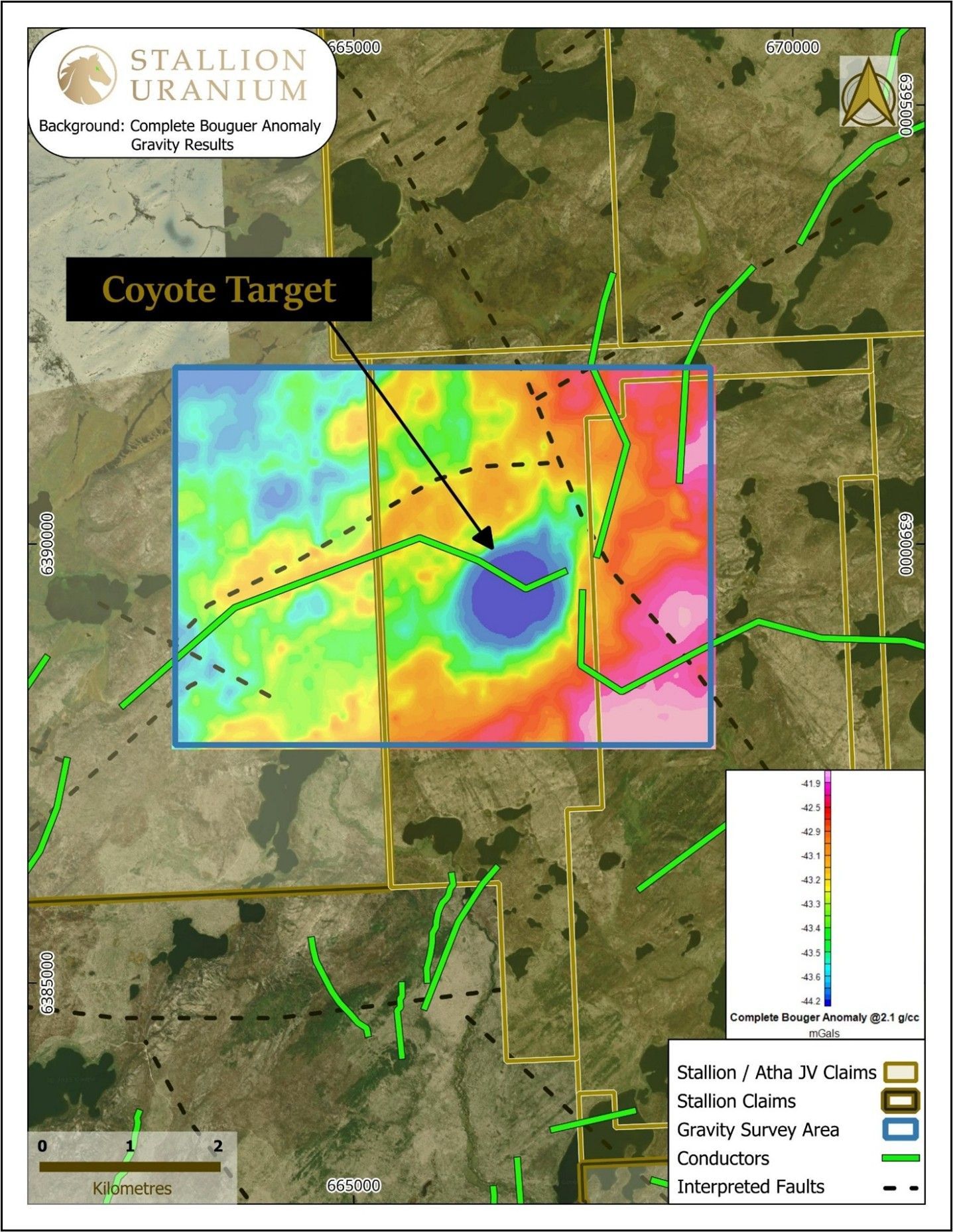

- Significant gravity low anomaly identified, closely resembling the geophysical signature of the Arrow Deposit and other significant discoveries in the Athabasca Basin.

- Structural and geophysical features align with those of NexGen Energy's Arrow Deposit, reinforcing the potential for Tier-1 uranium mineralization.

- Gravity anomaly located in a structurally complex corridor, characterized by intersecting conductors and breaks; prime settings for uranium deposition.

- Ongoing 3D Inversion of Ground Gravity to identify depth and shape of the gravity anomaly.

"The results of our ground gravity survey at the Coyote Target mark a significant milestone in our exploration efforts within the Athabasca Basin," said Matthew Schwab, CEO of Stallion Uranium Corp. "The identification of a substantial gravity low anomaly mirroring the characteristics of world-class uranium deposits reinforces our confidence in Coyote's potential. This advancement strengthens our commitment to pursuing exploration in this highly prospective region, and we are eager to take the next steps in unlocking the value of this target through focused drilling. Stallion remains dedicated to executing a systematic and science-driven approach as we continue to build shareholder value through discovery."

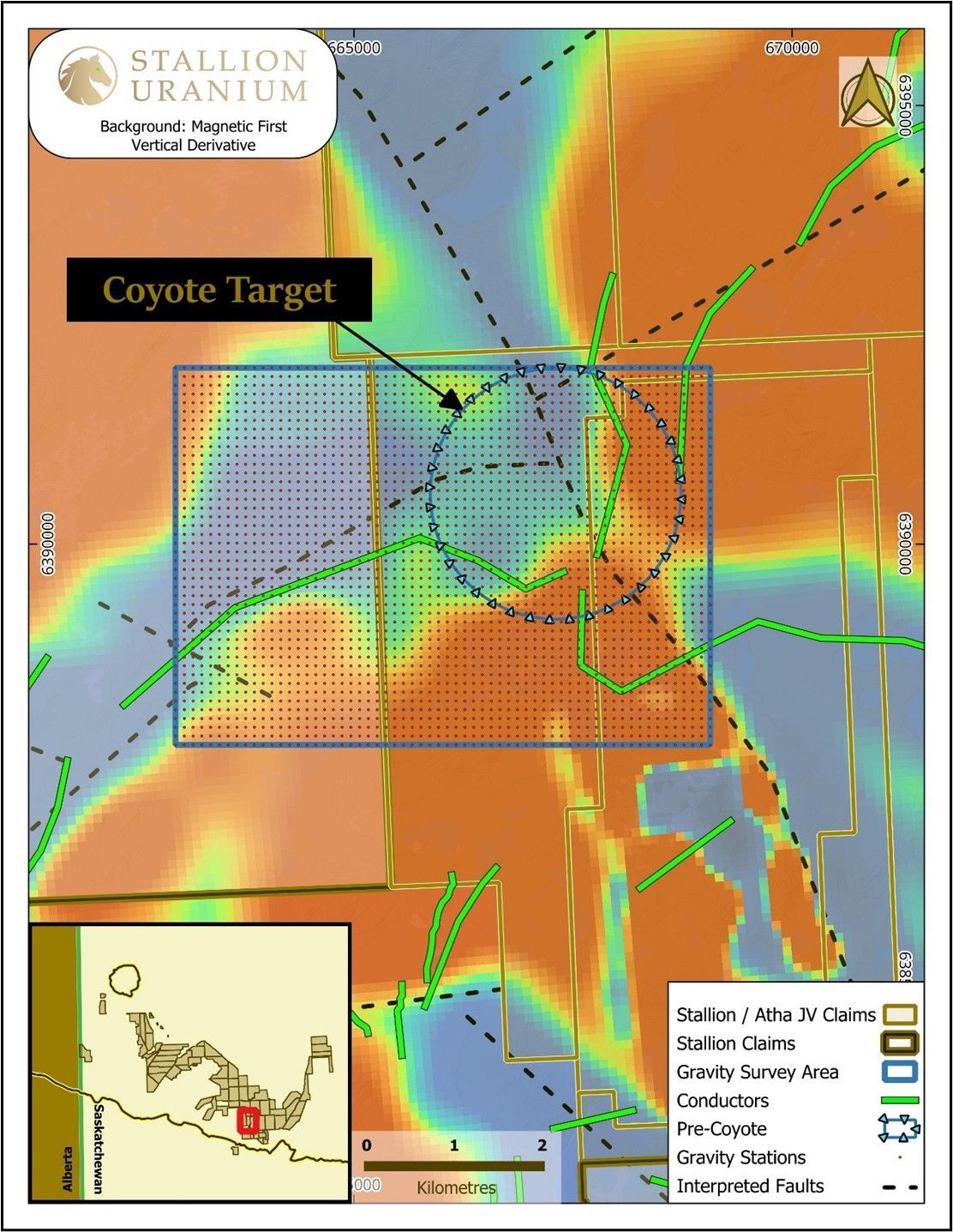

The survey encompassed a total area of 2,623 hectares, with 2,738 gravity stations strategically placed to detect subsurface variations in density that may indicate uranium alteration. The results revealed a substantial gravity low anomaly, a hallmark feature associated with large-scale uranium deposits, such as NexGen Energy's Arrow Deposit. The Arrow Deposit, one of the most significant uranium discoveries in the Athabasca Basin, shares multiple geological and geophysical similarities with the Coyote Target, strengthening confidence in the potential for a high-grade uranium discovery.

"Our ground gravity survey has identified a highly compelling target that exhibits striking similarities to the world-class Arrow Deposit," said Darren Slugoski, Vice President, Exploration at Stallion Uranium. "The anomaly's location is particularly compelling, as it coincides with structural complexities and breaks in conductors, and geological features that are strikingly similar to those associated with the Arrow Deposit. The convergence of multiple overlapping anomalies solidifies Coyote as a Tier 1 exploration target, warranting further advancement through targeted drilling."

Survey Area:

The Coyote Target is strategically positioned 58 kilometers northeast of NexGen Energy's Arrow Deposit, which hosts an estimated 256.7 million pounds of U₃O₈ at an average grade of 3.1% U₃O₈ (2021, NI 43-101 Technical Report). The gravity anomaly identified at Coyote aligns with key geological characteristics of Arrow, including structural breaks, intersecting conductive corridors, and large-scale alteration zones. This strong resemblance suggests that Coyote has the potential to host a world-class uranium deposit similar in scale and grade to Arrow. Given the compelling nature of these findings, Coyote is now a top-tier priority for Stallion's upcoming exploration programs.

Figure 1 : Survey Location over Regional Magnetics

Figure 2 : Ground Gravity Survey Results

About the Ground Gravity Survey:

Beginning February 5 and concluding February 21, 2025, MWH Geo-Surveys (Canada) Ltd. carried out a gravity survey at the Coyote Target in Saskatchewan. The survey utilized a customized L&R digital, electronic feedback gravity meter, operated via proprietary controller software. These advanced gravity meters, incorporating electronic levels and electronic nulling, ensure fast, accurate, and reliable readings, particularly in cold-weather conditions.

At each gravity station, GControl software, developed by MWH Geo-Surveys, recorded gravity samples at 1-second intervals. The resultant average of these readings was used as the final gravity measurement, significantly reducing high-frequency noise caused by wind and ground motion. Additionally, GControl calculated real-time, location-specific tidal corrections during data collection, enhancing the accuracy and reliability of the survey results.

With a typical mean data accuracy of 0.02 mgals, MWH Geo-Surveys continues to set the standard for high-resolution gravity surveys, delivering reliable results for resource exploration and geophysical studies.

Qualifying Statement:

The foregoing scientific and technical disclosures for Stallion Uranium have been reviewed by Darren Slugoski, P.Geo., VP Exploration, a registered member of the Professional Engineers and Geoscientists of Saskatchewan. Mr. Slugoski is a Qualified Person as defined by National Instrument 43-101.

About Stallion Uranium Corp.:

Stallion Uranium is working to ‘Fuel the Future with Uranium' through the exploration of roughly 2,700 sq/km in the Athabasca Basin, home to the largest high-grade uranium deposits in the world. The company, with JV partner Atha Energy holds the largest contiguous project in the Western Athabasca Basin adjacent to multiple high-grade discovery zones.

Our leadership and advisory teams are comprised of uranium and precious metals exploration experts with the capital markets experience and the technical talent for acquiring and exploring early-stage properties. For more information visit stallionuranium.com .

On Behalf of the Board of Stallion Uranium Corp.:

Matthew Schwab

CEO and Director

Corporate Office:

700 - 838 West Hastings Street,

Vancouver, British Columbia,

V6C 0A6

T: 604-551-2360

info@stallionuranium.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, "forward-looking statements") that relate to the Company's current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as "will likely result", "are expected to", "expects", "will continue", "is anticipated", "anticipates", "believes", "estimated", "intends", "plans", "forecast", "projection", "strategy", "objective" and "outlook") are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this material change report should not be unduly relied upon. These statements speak only as of the date they are made.

Forward-looking statements are based on a number of assumptions and are subject to a number of risks and uncertainties, many of which are beyond the Company's control, which could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for the Company to predict all of them or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements contained in this presentation are expressly qualified in their entirety by this cautionary statement .

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/9f662513-edcd-4d23-aaef-13b2a9234fca

https://www.globenewswire.com/NewsRoom/AttachmentNg/bd5964ef-50b1-4add-a2fb-d86ee32b0ad9