May 20, 2024

Sierra Nevada Gold (ASX: SNX) is pleased to announce plans to follow up drill hole BHD006 which returned up to 1270 g/t silver at Endowment Mine, part of its Blackhawk Epithermal project in Nevada, USA.

Highlights

- Sierra Nevada to review potential for a large, high-grade epithermal silver-dominated vein system.

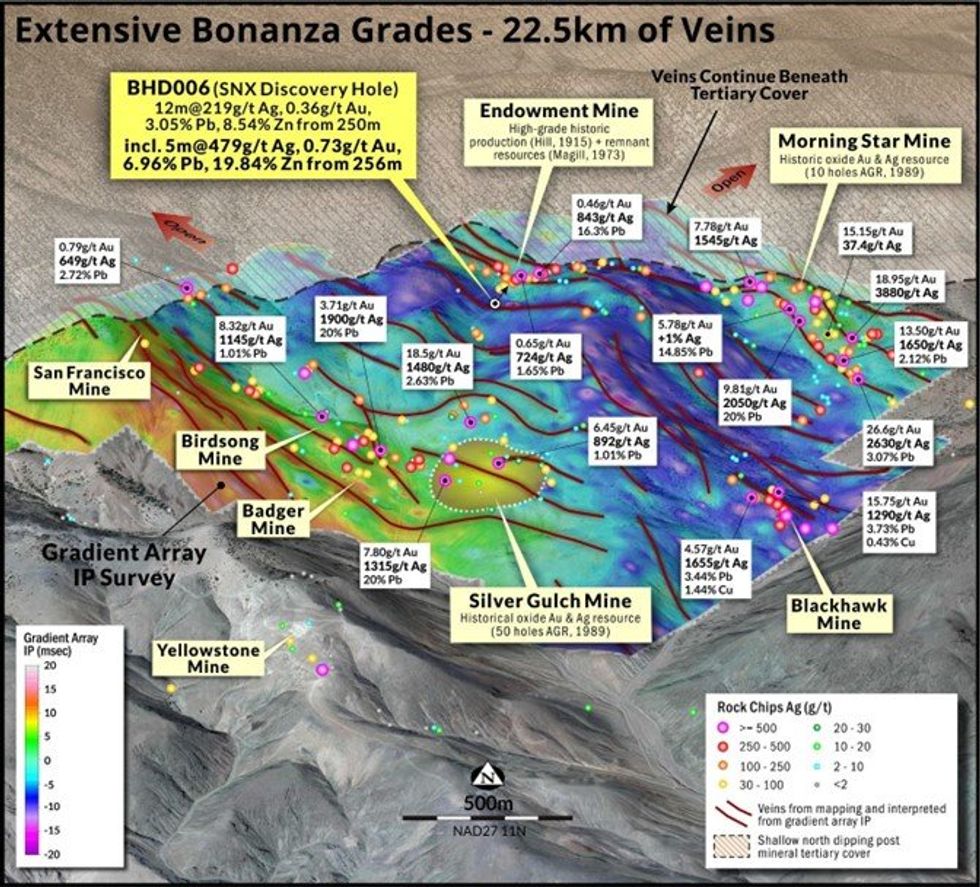

- Previously drilled core hole BHD006 returned 5m at 479 g/t Ag within a larger mineralised zone of 12m at 219 g/t Ag from 250m beneath the Endowment mine at its Blackhawk Epithermal Project in Nevada, USA.1

- This high-grade intercept is situated 150m vertically below the deepest portion of the historic mine and includes higher grade intersections of:

- 0.5m at 1270g/t Ag from 256.5m

- 1m at 823g/t Ag from 257m

- 1m at 654g/t Ag from 258m

- These silver intercepts are associated with very high-grade lead-zinc-gold (see table 1), demonstrating the potential for extremely high value ore.

- Potential for a company-making silver discovery at Blackhawk, where SNX has identified 22.5-line kilometres of high-grade silver-gold-lead-zinc veins.1

- Two shallow oxide resources (historic, non-JORC) estimated at Silver Gulch and Morning Star.1

- SNX has recently defined several high priority drill targets, and a multi-hole drill program is permitted.

SNX Executive Chairman Peter Moore said “These results which returned up to 1270 g/t silver from Blackhawk are very promising, coming from a vast and extensive vein network. We’ve identified 22.5-line kilometres of veins at Blackhawk, but this known mineralisation has sat largely untouched since mining ceased in the area in the 1920s. We have two shallow oxide resources which have not been defined to a JORC-compliant level but this provides us the opportunity to deliver value from an existing project with further drilling and mineral resource definition. Our 20-hole drill program is permitted and ready to drill, providing us with the opportunity to use modern exploration techniques to potential to return further high-grade results and shape this as a company-making discovery for Sierra Nevada.”

SNX has previously identified a large and high-grade intermediate sulphidation epithermal Ag-Au-Pb-Zn vein system, likely related to a large porphyry system located immediately to the south. Partially coincident with the porphyry system, the Blackhawk epithermal project vein system covers about 5km2 and is open under cover to the north and northeast, with 22.5-line km of veins identified to date (see figure 1).1

Previous drilling by SNX beneath the Endowment mine at Blackhawk returned 12m at 219 g/t Ag from 250m including 5m at 479 g/t Ag from 256m. This drill intercept is 150m vertically below the deepest portion of the mine and includes higher grade intersections of:

- 0.5m at 1270 g/t Ag from 256.5m (21.5% Pb + Zn)

- 1m at 823g/t Ag from 257m (30.1% Pb + Zn)

- 1m at 654 g/t Ag from 258m (+50% Pb+ Zn)

As shown in Table 1, the intersection described above comes with considerable polymetallic credits. The complete mineralised intersection of 12m at 219g/t Ag also contains 3.05% Pb and 8.54% Zn across the interval, significantly increasing the potential value of mineralisation within the vein/structures.

Click here for the full ASX Release

This article includes content from Sierra Nevada Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

11h

Ole Hansen: Next Gold Target is US$6,000, What About Silver?

Ole Hansen, head of commodity strategy at Saxo Bank, believes US$6,000 per ounce is in the cards for gold in the next 12 months; however, silver may not enjoy the same price strength. "If gold moves toward US$6,000, I would believe that ... silver at some point will struggle to keep up, and... Keep Reading...

11h

Kinross’ Great Bear Gold Project Accelerated Under Ontario’s 1P1P Framework

Ontario is moving to accelerate one of Canada’s largest emerging gold projects, cutting permitting timelines in half for Kinross Gold's (TSX:K,NYSE:KGC) Great Bear development in the Red Lake district.The province announced that Great Bear will be designated under its new One Project, One... Keep Reading...

11h

Massan Indicated Conversion Programme Continues to Deliver

Asara Resources (AS1:AU) has announced Massan indicated conversion programme continues to deliverDownload the PDF here. Keep Reading...

17h

Winston Tailings: Traxys Letter of Interest Signed

Panther Metals PLC (LSE: PALM), an exploration company focused on mineral projects in Canada, is pleased to announce that it has signed a letter of interest ("LOI") with Traxys Europe SA, a division of Traxys Group ("Traxys"), a global commodity trading and marketing market leader.The... Keep Reading...

18h

Selta Project - Exploration Update

Rare-Earth Element Stream Sediment Sampling Results and Target Refinement

First Development Resources plc (AIM: FDR), the UK-based, Australia-focused exploration company with mineral interests in Western Australia and the Northern Territory, is pleased to provide results and interpretation from the December 2025 stream sediment sampling programme completed at its... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00