May 20, 2024

Sierra Nevada Gold (ASX: SNX) is pleased to announce plans to follow up drill hole BHD006 which returned up to 1270 g/t silver at Endowment Mine, part of its Blackhawk Epithermal project in Nevada, USA.

Highlights

- Sierra Nevada to review potential for a large, high-grade epithermal silver-dominated vein system.

- Previously drilled core hole BHD006 returned 5m at 479 g/t Ag within a larger mineralised zone of 12m at 219 g/t Ag from 250m beneath the Endowment mine at its Blackhawk Epithermal Project in Nevada, USA.1

- This high-grade intercept is situated 150m vertically below the deepest portion of the historic mine and includes higher grade intersections of:

- 0.5m at 1270g/t Ag from 256.5m

- 1m at 823g/t Ag from 257m

- 1m at 654g/t Ag from 258m

- These silver intercepts are associated with very high-grade lead-zinc-gold (see table 1), demonstrating the potential for extremely high value ore.

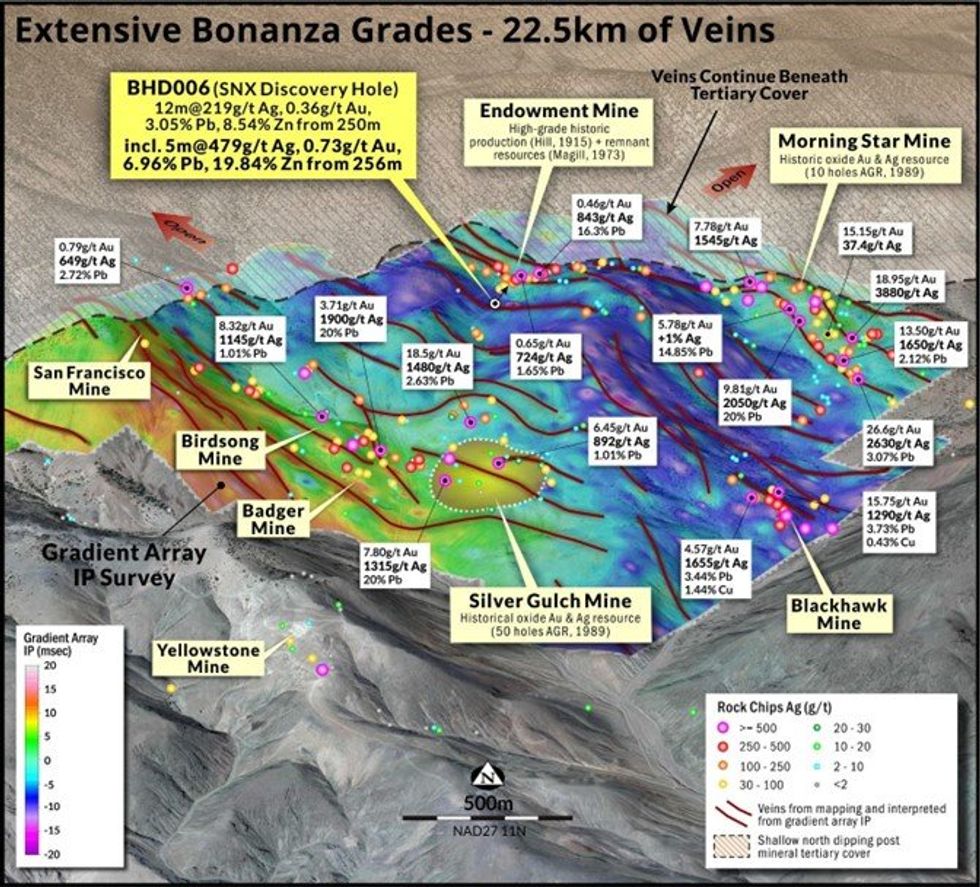

- Potential for a company-making silver discovery at Blackhawk, where SNX has identified 22.5-line kilometres of high-grade silver-gold-lead-zinc veins.1

- Two shallow oxide resources (historic, non-JORC) estimated at Silver Gulch and Morning Star.1

- SNX has recently defined several high priority drill targets, and a multi-hole drill program is permitted.

SNX Executive Chairman Peter Moore said “These results which returned up to 1270 g/t silver from Blackhawk are very promising, coming from a vast and extensive vein network. We’ve identified 22.5-line kilometres of veins at Blackhawk, but this known mineralisation has sat largely untouched since mining ceased in the area in the 1920s. We have two shallow oxide resources which have not been defined to a JORC-compliant level but this provides us the opportunity to deliver value from an existing project with further drilling and mineral resource definition. Our 20-hole drill program is permitted and ready to drill, providing us with the opportunity to use modern exploration techniques to potential to return further high-grade results and shape this as a company-making discovery for Sierra Nevada.”

SNX has previously identified a large and high-grade intermediate sulphidation epithermal Ag-Au-Pb-Zn vein system, likely related to a large porphyry system located immediately to the south. Partially coincident with the porphyry system, the Blackhawk epithermal project vein system covers about 5km2 and is open under cover to the north and northeast, with 22.5-line km of veins identified to date (see figure 1).1

Previous drilling by SNX beneath the Endowment mine at Blackhawk returned 12m at 219 g/t Ag from 250m including 5m at 479 g/t Ag from 256m. This drill intercept is 150m vertically below the deepest portion of the mine and includes higher grade intersections of:

- 0.5m at 1270 g/t Ag from 256.5m (21.5% Pb + Zn)

- 1m at 823g/t Ag from 257m (30.1% Pb + Zn)

- 1m at 654 g/t Ag from 258m (+50% Pb+ Zn)

As shown in Table 1, the intersection described above comes with considerable polymetallic credits. The complete mineralised intersection of 12m at 219g/t Ag also contains 3.05% Pb and 8.54% Zn across the interval, significantly increasing the potential value of mineralisation within the vein/structures.

Click here for the full ASX Release

This article includes content from Sierra Nevada Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00