September 17, 2024

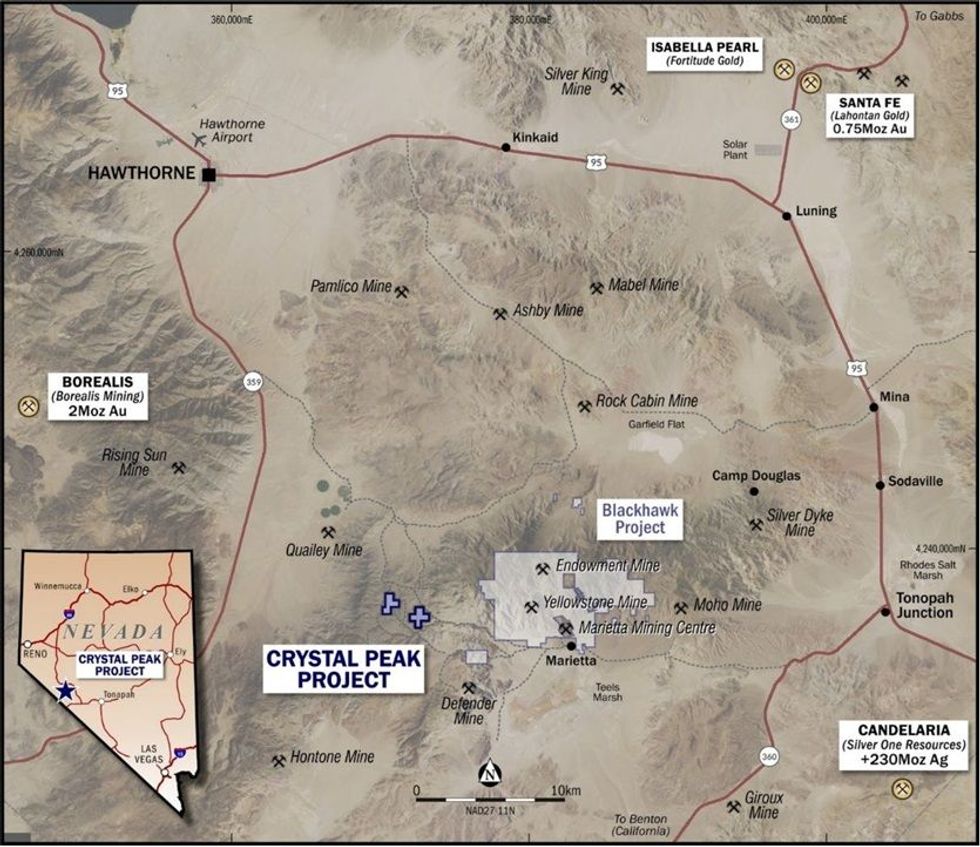

Sierra Nevada Gold (ASX: SNX) is pleased to announce it has staked two additional projects prospective for high-grade silver-gold-copper near existing projects in Nevada, USA. The new projects are 10km west of SNX’s large-scale Blackhawk Porphyry and Epithermal Projects in Mineral County, SW Nevada (see figure 1).

Highlights

- In conjunction with ongoing work at its nearby Blackhawk Project, Nevada USA, SNX stakes two additional areas prospective for high-grade silver-gold-copper-antimony (see figure 1).

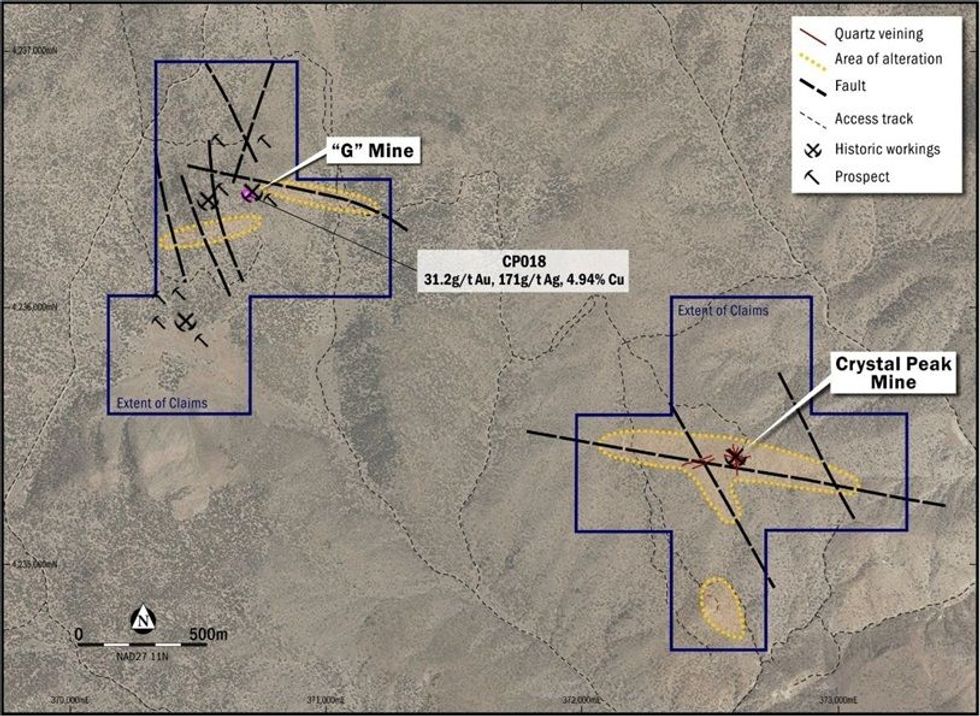

- Initial sampling returns 1,880g/t Ag from a quartz stockwork zone at Crystal Peak and 31.2g/t Au from G Mine area associated with copper up to 4.94% (see figure 2).

- Outcropping quartz stockwork zone at Crystal Peak returned high-grade silver results of 1,880 g/t Ag, 752g/t Ag, 485g/t Ag, 427g/t Ag, 142g/t Ag & 141g/t Ag within a 60m x 30m densely quartz veined (stockwork) area (see figure 3).

- Elevated copper and antimony at Crystal Peak stockwork, up to 0.64% Cu and 0.38% Sb.

- No drilling or modern exploration at either Crystal Peak or G Mine; last recorded activity in early 1980s.

- SNX has completed a soil sampling program covering extensions to the Crystal Peak and G Mine areas, with assays due in early October 2024.

- Building on existing reconnaissance mapping and sampling, SNX will aim to deliver drill targets for the 2025 field season.

SNX Executive Chairman Peter Moore said: “These new prospects near the Blackhawk Project in Nevada, have returned exciting high-grade results from the initial mapping and sampling work. Results demonstrate potential for high-grade silver, gold, copper and antimony mineralisation with results up to 1,880g/t silver with associated copper and antimony at Crystal Peak and up to 31.2g/t gold at G Mine. We are excited to be the first explorer to implement modern exploration techniques across this ground, and we are planning additional exploration to follow up these initial results. Preparations for the upcoming RC drilling program at the Endowment high-grade silver mine located 10kms east of Crystal Peak continue with drilling expected to commence in early October”.

At Crystal Peak, SNX identified a high-grade silver-copper-antimony quartz stockwork zone outcropping over an area of 60m x 30m. The stockwork zone forms a prominent ridge with outbound dispersed quartz float zones suggesting potential for extensions to currently mapped zone.

SNX’s initial mapping and sampling at Crystal Peak returned peak silver assays of up to 1,880g/t Ag, 752g/t Ag, 485g/t Ag and 427g/t Ag, all with strong copper and antimony association.

Crystal Peak

The Crystal Peak stockwork zone is hosted within a coarse-grained quartz monzonite which in turn forms part of a larger composite intrusion complex ranging in composition of granodiorite to quartz monzonite. Locally, minor diorite intrusions are observed although account for only a small portion of the composite intrusion.

Alteration about the stockwork zone and along through-going structures is characterised as proximal quartz- sericite-pyrite within a larger argillic alteration halo (see figure 2). Typically, the quartz stockwork is made up of continuous to semi-continuous linear veins up to 10cm wide at various attitudes to each other (see photo 1). While there are some prominent low angle veins many of the veins are sub-vertical, suggesting good potential at depth. Within the stockwork, vein density ranges from 3 veins per meter up to 15 veins per meter where veins account for up to 85% of the rock by volume. Within the larger stockwork area some consistently more sheeted quartz vein zones are observed.

Click here for the full ASX Release

This article includes content from Sierra Nevada Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

8h

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

10h

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

22 February

High-Grade Gold in Initial White Dam Drilling Results

Pacgold (PGO:AU) has announced High-Grade Gold in Initial White Dam Drilling ResultsDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00