October 30, 2023

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to provide the following summary of its activities for the three months ended 30 September 2023.

Highlights

- A maiden Auld Creek Mineral Resource Estimate (MRE) of 132koz @ 7.1g/t AuEq, containing 66koz @ 3.5g/t Au and 8,700t of antimony @ 1.5% Sb.

- The MRE comprises the Fraternal Shoot only and is based on existing surface trenches and drillholes, extending to approximately 175m below the surface.

- The Fraternal Shoot remains open at depth, with three other additional shoots identified at Auld Creek (Fraternal North, Bonanza and Bonanza East Shoots).

- The MRE includes the following significant intersections:

- 35.0m @ 4.1g/t Au, 2.9% Sb or 35.0m @ 11.0g/t AuEq,

- 6.0m @ 4.1g/t Au, 4.1% Sb or 6.0m @ 13.8g/t AuEq,

- 34.0m @ 1.6g/t Au, 0.7% Sb or 34.0.0m @ 3.3g/t AuEq, and

- 20.7m @ 5.9g/t Au, 2.6% Sb or 20.7m @ 12.0g/t AuEq.

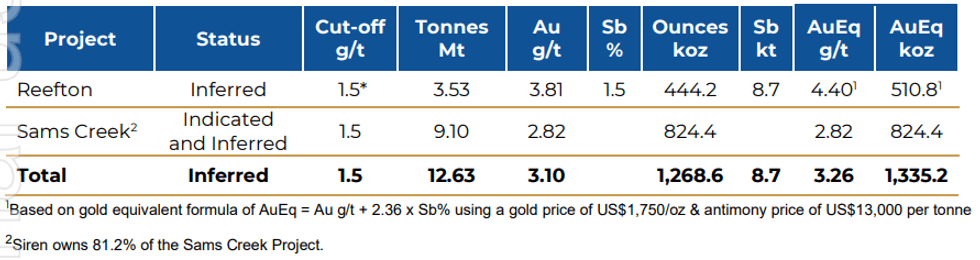

- Siren’s Reefton Mineral Resource estimate now stands at 444koz of gold and 8.7kt of Sb for 511koz @ 4.4 g/t AuEq.

- Siren’s Global Mineral Resource estimate now stands at 1.27Moz of gold and 8.7kt of Sb for 1.33Moz @ 3.3 g/t AuEq (100% basis).

- Drilling recommenced at the end of September, with the initial drill program targeting the Bonanza East Shoot at Auld Creek.

Background

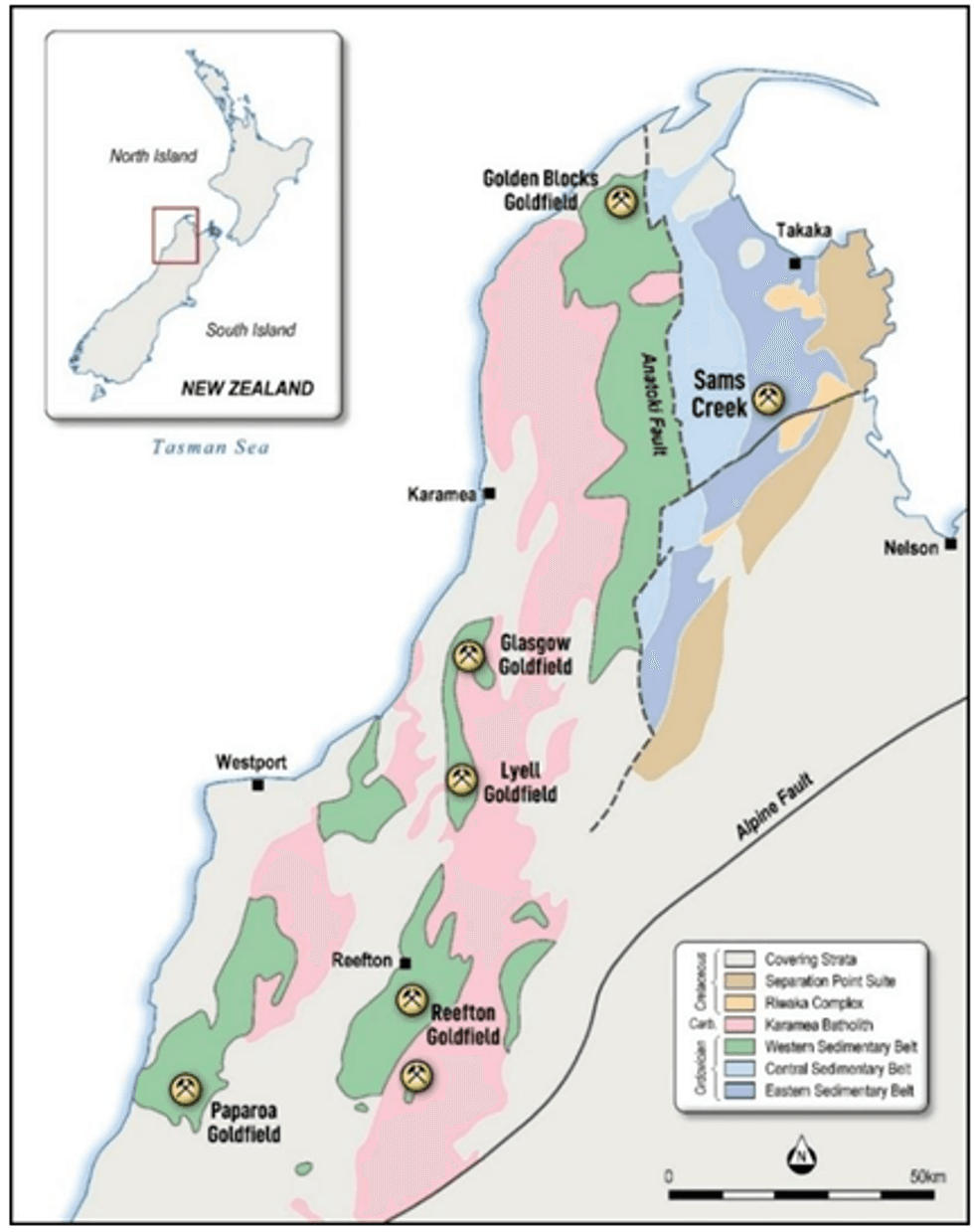

Siren is a New Zealand focussed gold explorer, with two key projects in the upper South Island at Reefton (Reefton and Lyell goldfields) and Sams Creek (Figure 1).

Western New Zealand was originally part of Gondwana and lay adjacent to eastern Australia until around 80 million ago. The NW of the South Island of New Zealand comprises an area of predominantly early Paleozoic rocks in broad northerly trending belts which terminate at the Alpine Fault (Figure 1). The Paleozoic sequence is divided into the Buller Terrane, Takaka Central and Takaka Eastern Belts.

These belts are interpreted to correspond with the Western, Central and Eastern belts of the Lachlan Fold Belt. The Buller and Western Lachlan belts contain orogenic gold deposits like Bendigo, Ballarat and Fosterville in Australia and the Reefton and Lyell Goldfields in New Zealand. The Eastern Takaka and Eastern Lachlan belts host porphyry-Au and porphyry copper-gold deposits, like Cadia and Ridgeway, respectively.

There are two distinctive sub-types of orogenic gold mineralisation in Victoria. The deeper (6-12kms) mesothermal deposits that formed almost all the significant gold deposits in the Bendigo and Stawell zones and the shallower (<6km) epizonal gold and stibnite deposits in the Melbourne zone and eastern Bendigo zone, including the Fosterville and Costerfield mines. The latter gold mineralising event in Victoria is characterised by arsenopyrite and stibnite associated gold, which is very similar to the Reefton and Lyell mineralisation.

Siren holds a large (1,000km2), strategic package of tenements in the Reefton, Lyell and Sams Creek goldfields (Figures 20 and 21 and Annexure 1).

Siren’s Global Mineral Resource Estimate now stands at 1.27Moz of gold and 8.7kt of antimony for 1.33Moz @ 3.3 g/t AuEq (100% basis) at a 1.5g/t cut-off.

Reefton Gold Project

The Reefton Goldfield was discovered in 1866 and produced ~2Moz of gold at an average recovered grade of 16g/t from 84 historic mines, plus an estimated alluvial gold production of 8Moz. Most underground mining ceased by 1942, with the famous Blackwater mine closing in 1951, when the shaft failed, after producing ~740koz of gold down to 710m below surface.

OceanaGold Limited (OGL) developed an open pit on the historic Globe Progress mine between 2007 and 2015. OGL recovered an additional 700koz at around 2g/t Au, increasing total hard rock production to around 2.7Moz @ 12g/t Au.

Federation Mining Limited (FML) a privately owned company, is currently developing the Snowy River Mine on the Birthday Reef (Figure 2), which historically produced 740koz of gold at an average recovered grade of 14.2g/t. FML plan to mine the Birthday Reef below the historic mine, with an estimated production of 700koz. FML have developed twin 3.2km declines and are currently resource drilling from underground, with the aim of producing around 70koz of gold per annum for 10 years from the end of 2024.

Click here for the full ASX Release

This article includes content from Siren Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

12h

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

22h

Canadian Investment Regulatory Organization Trade Resumption - IMR

Trading resumes in: Company: iMetal Resources Inc. TSX-Venture Symbol: IMR All Issues: Yes Resumption (ET): 10:30 AM CIRO can make a decision to impose a temporary suspension (halt) of trading in a security of a publicly-listed company. Trading halts are implemented to ensure a fair and orderly... Keep Reading...

23h

iMetal Resources Intersects 16.65 Metres at 1.24 g/t Gold Within 62.25 Metres at 0.61 g/t Gold at Gowganda West

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company") has intersected 16.65 metres at 1.25 gt gold within 62.25 metres at 0.61 gt gold at its Gowganda West Gold Project, southwest of Timmins, Ontario. Drilling in the West Zone intersected broad levels... Keep Reading...

25 February

Precious Metals Price Update: Gold, Silver, PGMs Boosted by Geopolitical and Trade Tensions

Precious metals are recovering their safe-haven demand appeal this week.Gold, silver and platinum are up this week, all still down from the all-time highs recorded in January. Escalating geopolitical tensions and US trade policy shifts are once again at center stage in this sector of the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00