August 20, 2023

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to provide a maidenMineral Resource Estimate for the Auld Creek Prospect.

Highlights

- A maiden Mineral Resource Estimate (MRE) of 132koz @ 7.1g/t AuEq containing 66koz @ 3.5g/t Au & 8,700t of antimony @ 1.5% Sb.

- The MRE comprises the Fraternal Shoot only and is based on existing surface trenches and drillholes and extends to approximately 170m below the surface.

- The Fraternal Shoot remains open at depth and there are three other shoots identified at Auld Creek (Fraternal North, Bonanza and Bonanza East Shoots).

- The MRE includes the following significant intersections;

- 35.0m @ 4.1g/t Au, 2.9% Sb or 35.0m @ 11.0g/t AuEq,

- 6.0m @ 4.1g/t Au, 4.1% Sb or 6.0m @ 13.8g/t AuEq,

- 34.0m @ 1.6g/t Au, 0.7% Sb or 34.0.0m @ 3.3g/t AuEq, and

- 20.7m @ 5.9g/t Au, 2.6% Sb or 20.7m @ 12.0g/t AuEq.

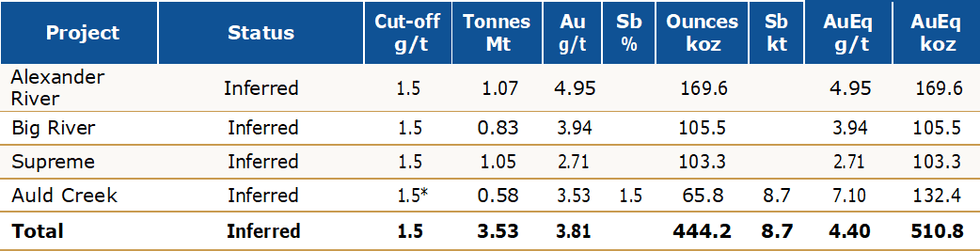

- Siren’s Reefton Mineral Resource estimate now stands at 444koz of gold and 8.7kt of Sb for 511koz @ 4.4 g/t AuEq.

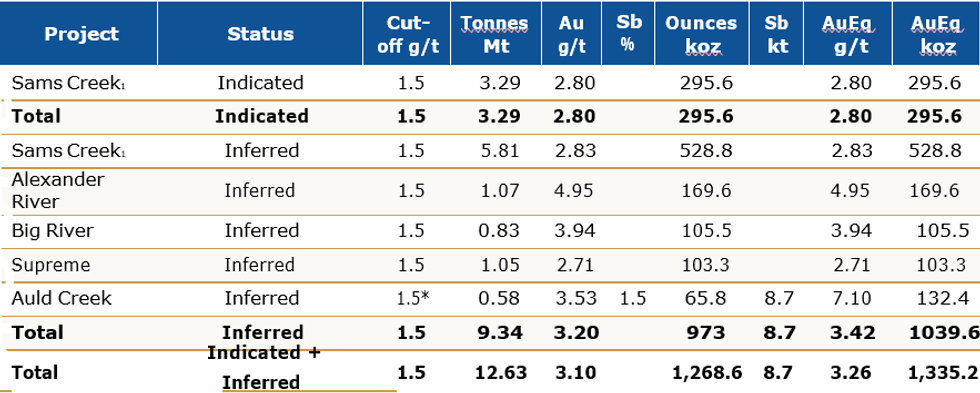

- Siren’s Global Mineral Resource estimate now stands at 1.27Moz of gold and 8.7kt of Sb for 1.33Moz @ 3.3 g/t AuEq (100% basis).

Executive Chairman Brian Rodan commented:

“The Auld Creek Resource is the fourth high grade Resource defined at Reefton with all Resources remaining open along strike and at depth. The Auld Creek deposit is the first with high grade antimony which is a critical mineral in the global transition to clean energy. Siren’s vision is to be a multiple million-ounce high grade gold and antimony producer and with a global MRE now above 1.3Moz, we are well on track with this vision.”

*Based on gold equivalent formula of AuEq = Au g/t + 2.36 x Sb% using a gold price of US$1,750/oz & antimony price of US$13,000 per tonne.

*Based on gold equivalent formula of AuEq = Au g/t + 2.36 x Sb% using a gold price of US$1,750/oz & antimony price of US$13,000 per tonne.

1Siren owns 81.2% of the Sams Creek Project.

Background

The Auld Creek Prospect is contained within Siren’s Golden Point exploration permit and is situated between the highly productive Globe Progress mine, which historically produced 418koz @ 12.2g/t Au, and the Crushington group of mines that produced 515koz @ 16.3g/t Au (Figure 1). More recently OceanaGold (OGL) mined an open pit and extracted an additional 600koz of gold from lower grade remnant mineralisation around the historic Globe Progress mine. Collectively these mines produced 1.6Moz at 10g/t Au.

Click here for the full ASX Release

This article includes content from Siren Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

20h

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00