(TheNewswire)

TORONTO, ON TheNewswire - August 15, 2025 Silver Crown Royalties Inc. ( Cboe: SCRI,OTC:SLCRF, OTCQX: SLCRF, FRA: QS0 ) ( "Silver Crown" "SCRi" the "Corporation" or the "Company" ) is pleased to announce its interim financial statements and MD&A for the second quarter ended June 30, 2025 which have been filed on SEDAR+ and the Company's website today.

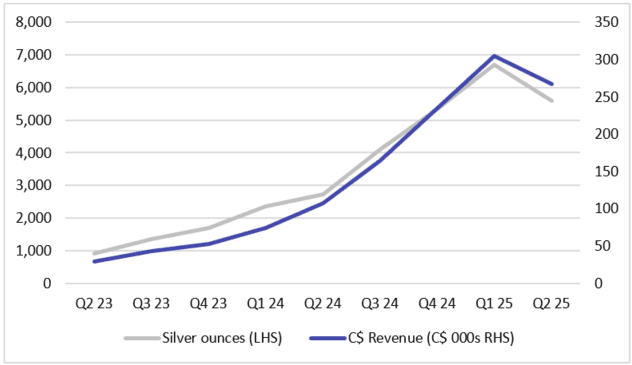

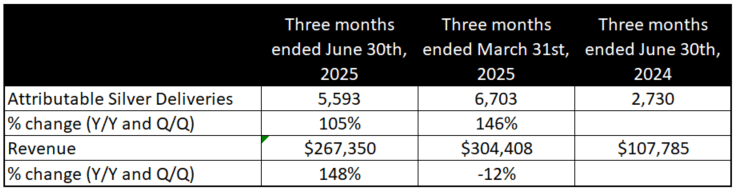

In the second quarter of 2025, SCRi recorded, based on the underlying production and/or minimum guaranteed payments, as applicable, a total of 5,593 silver ounces (C$267,350) as royalty income. This compares to the previous quarter ended March 31 st , 2025 of 6,703 ounces (C$304,408) and last year's comparable quarter ended June 30 th , 2024 of 2,730 ounces (C$107,785).

Peter Bures, Silver Crown's Chief Executive Officer, commented, "Q2 of 2025 brought 13-year high silver prices, challenges, and opportunities. In this environment, we were able to continue to execute on our strategy of adding silver ounces to our portfolio at an attractive price and rates of return. Alongside Kuya, which we continue to actively move forward, we have added a number of LOIs we aim to advance in the second half of 2025 and hopefully add to our portfolio before year end."

Silver Ounce and Revenue Growth Profile

Summary of Quarterly Results

Further to the Company's press release of August 1, 2025 announcing that Gold Mountain Mining Corp. (" Gold Mountain ") and its two subsidiaries, Bayshore Minerals Incorporated and Elk Gold Mining Corporation (" Elk Gold ") have been placed under receivership proceedings, the Company has confirmed with Gold Mountain and Elk Gold that the C$140,588.53 in outstanding payments owing under its silver royalty on the Elk Gold Mine cannot be paid at this time despite the parties best good faith efforts to achieve a settlement prior to the receivership proceedings being announced. The Company will continue to work in good faith with Gold Mountain, Elk Gold, the receiver and any potential purchaser of the Elk Gold Mine to facilitate payment of this amount in a fair, prudent, cooperative but timely manner, consistent with the Company's business practice of close partnership with each of its royalty counterparties. Additionally, further to the Company's prior disclosure, the Company has been provided with a further update from the senior management of Pilar Gold Inc. (" Pilar ") with respect to the PGDM Complex in Brazil, which the Comp