May 02, 2023

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to announce that scout drilling at its Quelon Project (the “Project”) in Chile, has intercepted anomalous copper, gold and molybdenum mineralisation over an intersection length of 450m.

HIGHLIGHTS

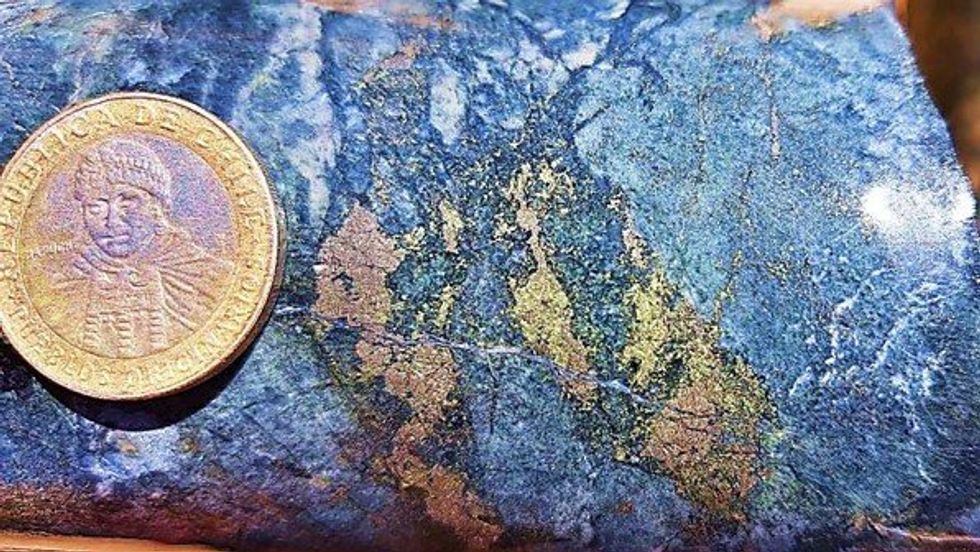

- Initial scout drilling shows anomalous copper, gold and molybdenum with individual assays of up to 0.77% Cu, 0.21 g/t Au and 30ppm Mo, 303-304m (Figure 1) at the Anico Prospect within the Quelon Project

- Geological logging and assay results has confirmed the presence of widespread alteration and disseminated copper sulphide mineralisation over 450m in the drillhole CMQDD001

- Surface mineralisation previously identified over an area 800m x 1,000m1 adjacent to the previously defined Induced Polarisation (“IP”) target2

- Analogous geological setting target to the El Soldado copper deposit, 200Mt @ 1.35% Cu3, which is located 130km to the south of Quelon and operated by Anglo American PLC

Culpeo Minerals’ Managing Director, Max Tuesley, commented:

“This is a promising start to drilling at the Anico Prospect and we are excited to have hit the target volcanic sequence in the first hole ever drilled at the Quelon Project which intersected elevated copper, gold and molybdenum mineralisation within a strong alteration zone, indicative of a fertile copper system.”

“These assay results are encouraging and confirm our exploration model providing a deeper understanding of the geology in the mineralised zones complementing our prospect targeting and prioritisation. The rocks, alteration and anomalous results indicate that Anico is a large copper rich system.”

Quelon Prospectivity

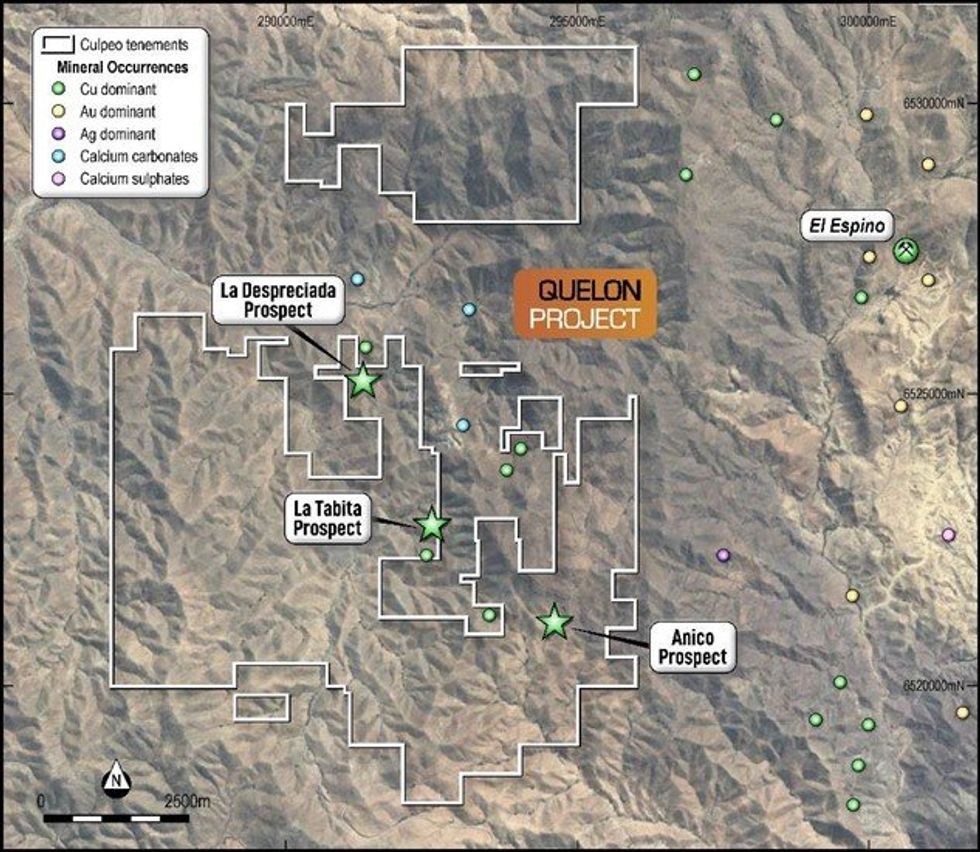

Three significant exploration targets; Anico, La Despreciada, and La Tabita Prospects, were identified at Quelon (Figure 2) from Culpeo’s recent geophysical surveys (ASX announcement 19 April 2022). The targets indicate potential for Iron Oxide Copper Gold (“IOCG”) or Manto hematite and sulphide style copper and gold mineralisation.

Anico Prospect Drilling Program

Drilling of a single diamond drill hole was completed during February 2023 (Figure 2) at the Anico Prospect, which enhances the prospectivity for IOCG/Manto style mineralisation given the presence of chargeability anomalies proximal to magnetic highs and mapped alteration in outcrop (ASX announcement 10 October 2022).

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

19h

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00