January 21, 2024

Advanced vanadium developer, Technology Metals Australia Limited (ASX: TMT) (Technology Metals, or the Company), provides the following update on the proposed merger of TMT and Australian Vanadium Limited (AVL) via Scheme of Arrangement (Scheme), under which AVL will acquire 100% of the TMT shares on issue.

LODGEMENT OF COURT ORDERS AND SUSPENSION OF TRADING

TMT confirms that it has today lodged with the Australian Securities and Investments Commission (ASIC) a copy of the orders made by the Supreme Court of Western Australia (Court Orders) approving the Scheme.

A copy of the Court Orders lodged with ASIC is attached to this announcement.

The Scheme is now legally effective, and it is expected that TMT shares will be suspended from trading on ASX from close of trading today (22 January 2024).

PAYMENT OF SCHEME CONSIDERATION

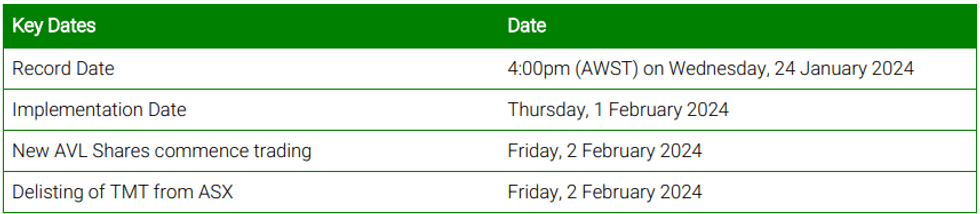

Eligible TMT shareholders who hold TMT shares at the Scheme record date, being 4:00pm (AWST) on Wednesday, 24 January 2024 (Scheme Record Date), will receive 14 AVL shares for every TMT share held at the Scheme Record Date (Scheme Consideration), in accordance with the terms of the Scheme.

It is expected the Scheme will be implemented, and the Scheme Consideration will be issued to TMT shareholders, on Thursday, 1 February 2024.

TIMETABLE AND NEXT STEPS

An indicative timetable is set out below

TMT will update TMT shareholders as to any material developments in relation to the Scheme as the timetable progresses.

If you require further information or have questions in relation to the Scheme, please contact the TMT Shareholder Information Line on 08 9321 8533 between 8:30 am and 5:00 pm (AWST).

Click here for the full ASX Release

This article includes content from Australian Vanadium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AVL:AU

The Conversation (0)

29 April 2024

Australian Vanadium

An Australian vanadium leader

An Australian vanadium leader Keep Reading...

09 February

Western Australia Implements 2.5 Percent Vanadium Royalty Rate

A royalty rate of 2.5 percent has been applied to all vanadium products in Western Australia as of February 4, 2026.In a joint announcement by Minister for Mines and Petroleum David Michael and Minister for Energy and Decarbonisation Amber-Jade Sanderson, the government said that the new rate... Keep Reading...

21 January

Vanadium Market Forecast: Top Trends for Vanadium in 2026

The vanadium market remained subdued in H1 2025, weighed down by persistent oversupply and weak usage from the steelmaking sector, even as new demand avenues like energy storage gained attention.Price data shows that vanadium pentoxide in major regions such as the US, China and Europe traded in... Keep Reading...

20 January

Carbon Black Substitute Memorandum of Understanding

Ferro-Alloy Resources Limited (LSE:FAR), the vanadium producer and developer of the large Balasausqandiq vanadium deposit in Southern Kazakhstan, is pleased to announce that it has entered into a non-binding, non-exclusive, memorandum of understanding ("MOU") for the supply of up to 360,000... Keep Reading...

25 July 2025

Top 5 Australian Mining Stocks This Week: Vanadium Resources Soars on DSO Offtake Deal

Welcome to the Investing News Network's weekly round-up of Australia’s top-performing mining stocks on the ASX, starting with news in Australia's resource sector.This week, gold companies continued to shine in Australia, joined by battery and base metals explorers and developers. In corporate... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00