April 21, 2023

The Board of Directors of Sarama Resources Ltd. ("Sarama" or the "Company") (ASX:SRR)(TSX-V:SWA) has granted 6,809,999 options to directors, officers, employees and consultants of the Company. The option grant is the result of the Company's annual compensation review historically undertaken in January but delayed due to the restrictions imposed by the Company's Trading Policy. This granting of options is made in accordance with the Company's stock option plan which was approved by shareholders on December 21, 2022, and allows for the issuance of a number of options up to 10% of its rolling issued and outstanding common shares during any 12 month period. The Australian Securities Exchange ("ASX") Listing Rule 7.2, exception 13(b) provides an exception to ASX Listing Rule 7.1 such that issues of Equity Securities under an employee incentive scheme are exempt for a period of three years from the date on which the Shareholders approve the issue of Equity Securities under the scheme as an exception to ASX Listing Rule 7.1. ASX Listing Rule 7.1 provides that a company must not, subject to specified exceptions, issue or agree to issue more Equity Securities during any 12-month period than that amount which represents 15% of the number of fully paid ordinary securities on issue at the commencement of that 12 month period. The grant of options under the Company's stock option plan falls within the scope of ASX Listing Rule 7.2, exception 13(b) and therefore does not count towards the 15% threshold under ASX Listing Rule 7.1 described above.

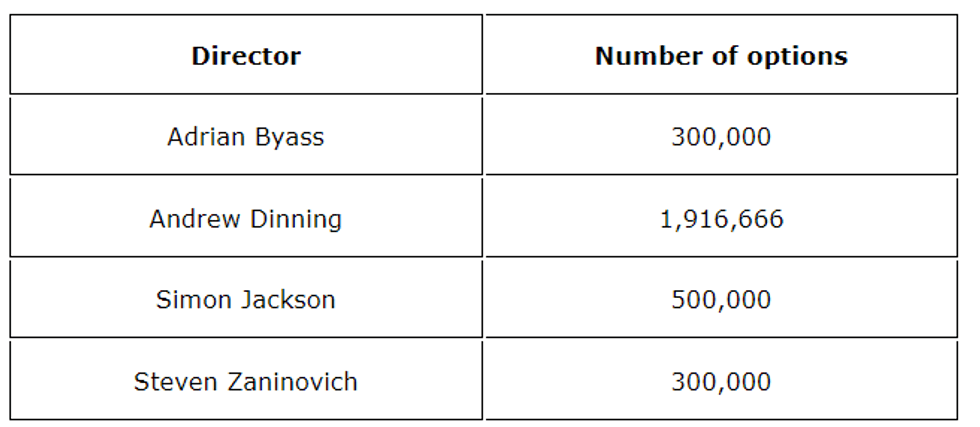

Options to be granted to Directors will require Shareholder approval under ASX Listing Rule 10.14 as it is an issue to a related party. Approval will be sought at the next AGM in June 2023. The Company is proposing to issue an aggregate of 3,016,666 options to directors (or their nominees) on the basis described below:

The options have an exercise price of A$0.16 each, 60% above the price of the last capital raise of A$0.10, and 33% above the 10-day VWAP of A$0.12 and the trading price of the last trading day of A$0.12 on the ASX prior to grant. The options will immediately vest and are exercisable for a period of 3 years from the date of the grant thereof.

On January 16, 2023, 3,599,999 options granted on January 16, 2020, and exercisable at C$0.21 had expired.

Total options outstanding is 13,190,000 subject to approval of the number of options that is to be granted to directors.

For further information on the Company's activities, please contact:

Andrew Dinning

e: info@saramaresources.com

t: +61 (0) 8 9363 7600

This announcement was authorised for release to the ASX by the Board of Sarama Resources Ltd.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SRR:AU

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 November 2025

Sarama Resources

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim.

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim. Keep Reading...

14 August 2025

Q2 2025 Interim Financial Statements

Sarama Resources (SRR:AU) has announced Q2 2025 Interim Financial StatementsDownload the PDF here. Keep Reading...

04 August 2025

Sarama Provides Update on Arbitration Proceedings

Sarama Resources (SRR:AU) has announced Sarama Provides Update on Arbitration ProceedingsDownload the PDF here. Keep Reading...

09 July 2025

Completion of Tranche 1 Equity Placement & Cleansing Notice

Sarama Resources (SRR:AU) has announced Completion of Tranche 1 Equity Placement & Cleansing NoticeDownload the PDF here. Keep Reading...

29 June 2025

A$2.7m Equity Placement to Fund Laverton Drilling Campaign

Sarama Resources (SRR:AU) has announced A$2.7m Equity Placement to Fund Laverton Drilling CampaignDownload the PDF here. Keep Reading...

25 June 2025

Trading Halt

Sarama Resources (SRR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00