May 30, 2023

Roscan Gold Corporation (TSXV: ROS) (FSE: 2OJ) (OTCQB: RCGCF) ("Roscan" or the "Company") is pleased to announce additional exploration results from 12 Reverse Circulation ("RC") holes totaling 1,963 meters at Kabaya (KB3).

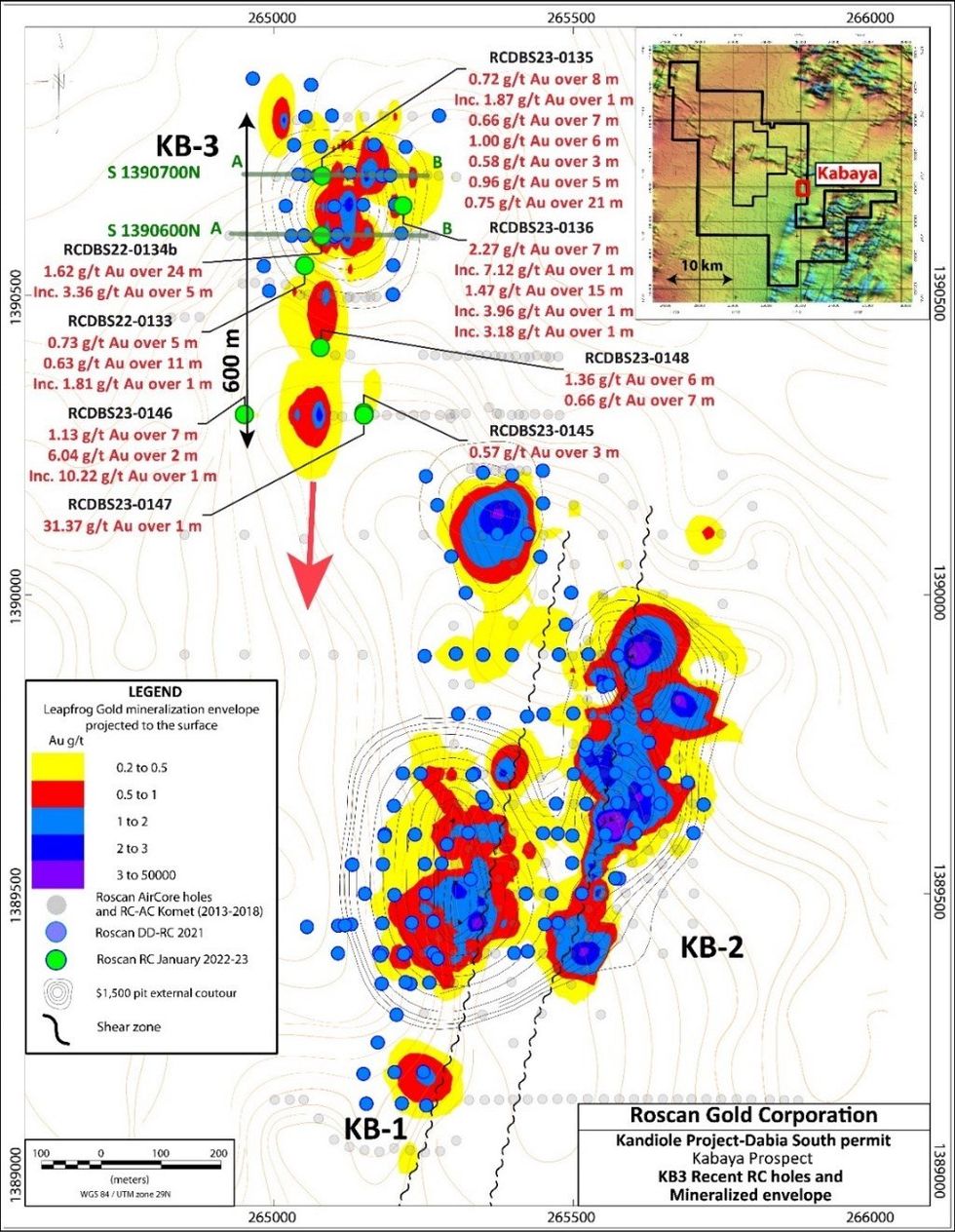

These step-out RC holes have expanded the strike length of mineralization at KB3 to 600 meters from 300m (Figure 1), with a width of 100 meters. It remains open at depth and laterally with a plunging angle of approximately 10° towards south. Additionally, these results indicate an increase in mineralization of about 70 meters below the existing 1,500-dollar pit shell. To fully capture the potential of the KB3 extensions of the gold mineralization, further infill and deeper drilling is required to enhance the resource estimation.

The cumulative gold strike length at KB1-KB2 and KB3 currently spans 1,800 meters, with a width ranging from 150 meters (KB1-2) to 100 meters (KB3). The mineralization extends to a depth of 150 meters to 250 meters at KB2.

A 500-meter gap exists between KB3 and KB1-2, and the primary gold mineralization in this area has not been thoroughly explored or tested to its full extent.

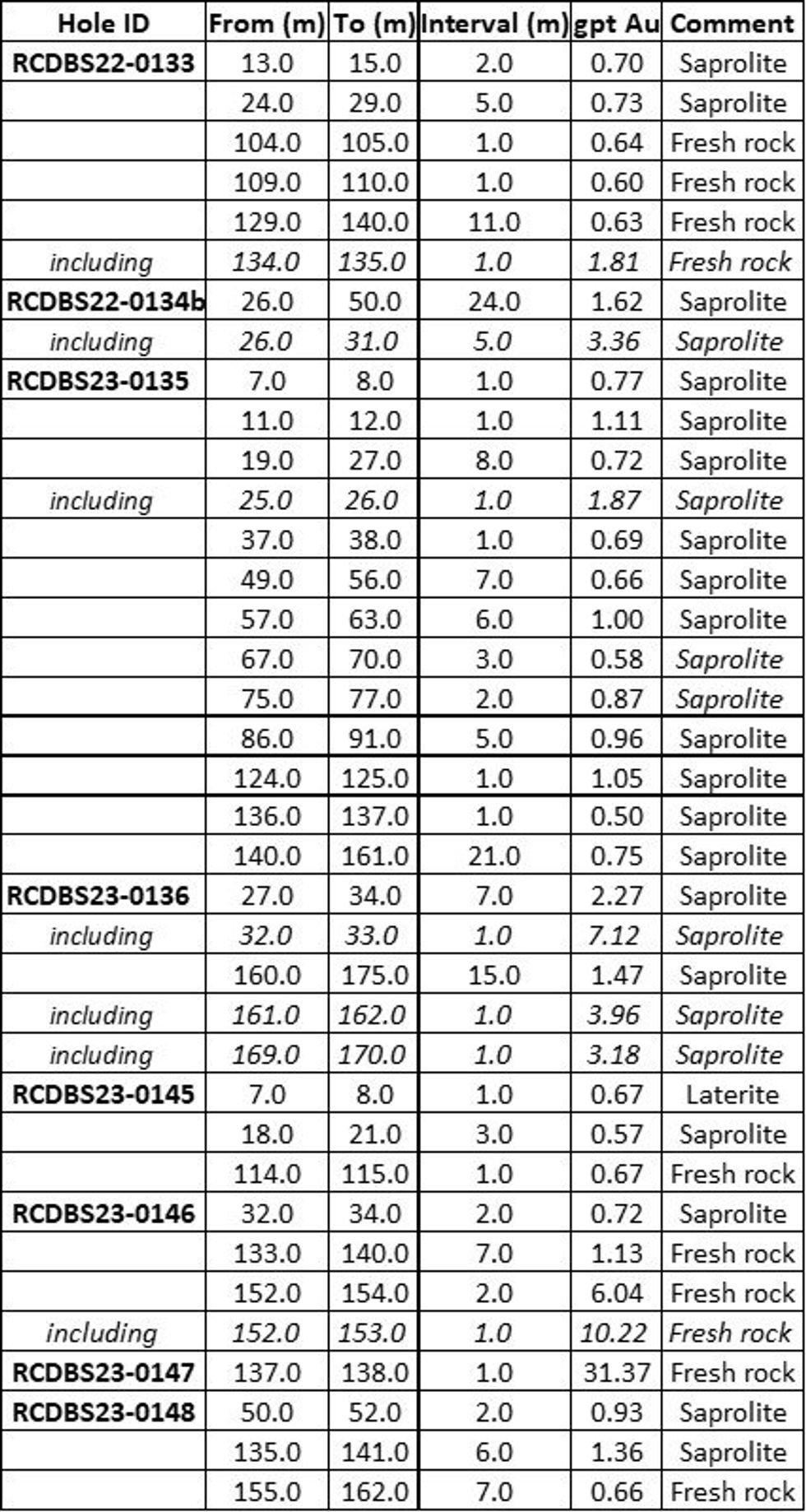

Drilling Highlights: KB3 Reverse Circulation Drill Holes

- 1.62 gpt gold over 24 m from drill hole RCDBS22-0134b from 26m

- Including 3.36 gpt gold over 5m from 28m

- 2.27 gpt gold over 7m from drill hole RCDBS22-0136 from 27m

- Including 7.12 gpt gold over 1m from 32m

- Including 3.96 gpt gold over 1m from 161m

- Including 3.18 gpt gold over 1m from 169m

And 1.47 gpt gold over 15m from 160m.

- 1.13 gpt gold over 7m from drill hole RCDBS23- 0146 from 133m

And 6.04 gpt gold over 2m from 152m

- 31.37 gpt gold over 1m from drill hole RCDBS23-0147 from 137m

Notes: 1: True width yet to be determined; 2: Table 1 – Assay Highlights, 3: 0.5gpt used as cut-off with 2m internal dilution, 4: No top-cut.

Nana Sangmuah, President and CEO, stated, "As part of our 2023 work program, we have completed approximately 17,000 meters of drilling in the main resource areas, as well as tested new targets outside the current resource footprint. These results should be available in the coming weeks.

Drilling at Kabaya continues to expand the footprint of the gold mineralization, which bodes well for further resource growth. The positive results obtained beneath the existing K3 pit shell, within the fresh rock, are particularly encouraging as they suggest the presence of a larger mineralized system. This development strengthens our confidence in the untapped potential of the area."

Figure 1: Kabaya gold deposit, KB3 drilling plan view, gold contouring envelopes projected to the surface and drill hole locations.

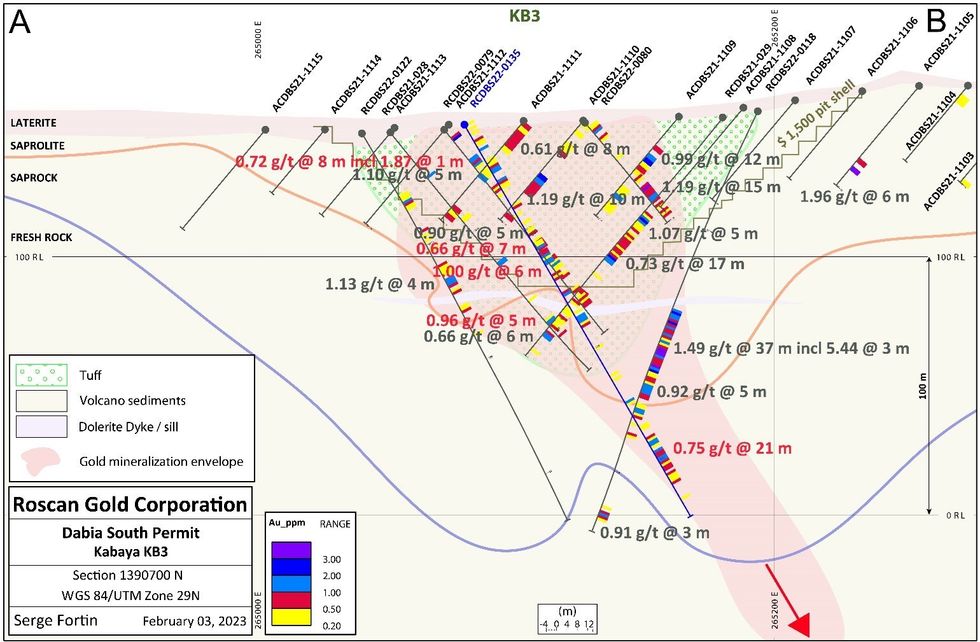

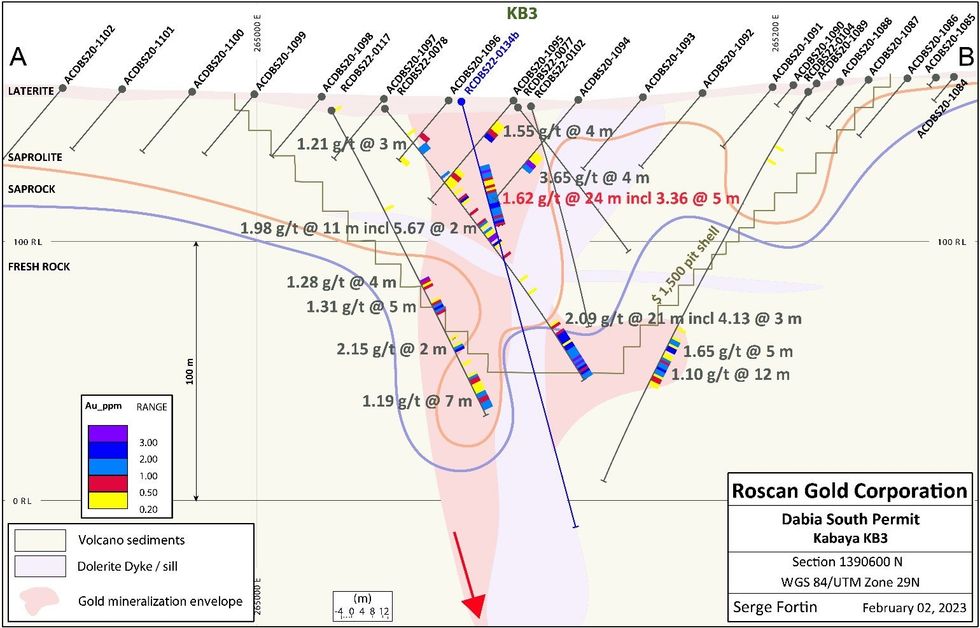

The Kabaya gold mineralization is disseminated and associated with a strong kaolinization. The gold host rock alternates between tuffaceous and greywacke facies crosscut by younger dolerite sills and dykes (Figures 2 and 3). At KB3, the higher-grade zone does not appear at the surface and, from the longitudinal section, the mineralization is plunging around 10-15° to the South. This relatively higher grade has not been captured in our resource estimation (Press Release June 8th, 2022).

Figure 2: Kabaya gold deposit, KB3 satellite North, section A 1390700N

Figure 3: Kabaya gold deposit, KB3 satellite North, section A 1390600N

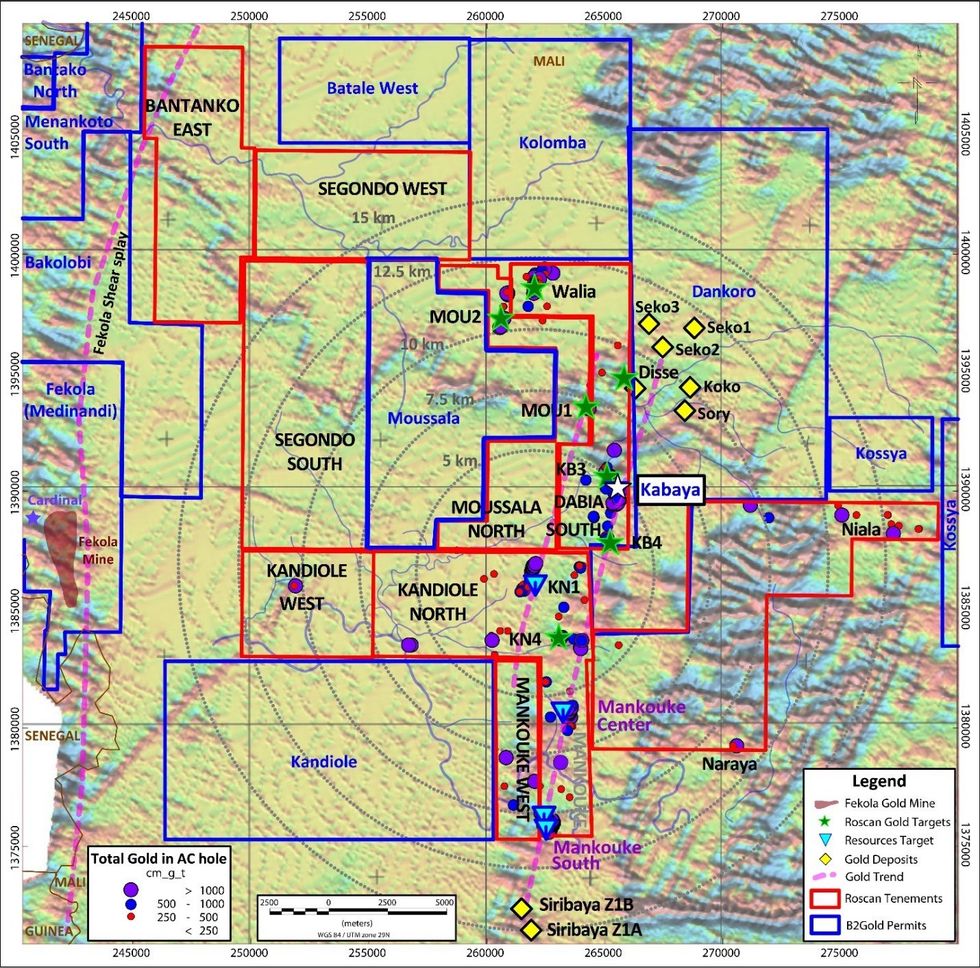

The Kabaya mineralization is part of the prolific regional Siribaya-Mankouke-Seko structural corridor (Figure 4). It is located on the Eastern edge of this major structure as well as Mankouke South gold body. Roscan's large land package has a strategic position covering a substantial portion of this significant structural corridor by over 25km, including the splays around the intrusive pluton of Disse, where several mineralized bodies were discovered.

Figure 4: Roscan permit map showing Airborne Magnetic geophysics, the resources zones, targets under development and nearby gold deposits

Drilling and Analytical Protocol

Roscan uses Geodrill Reverse Circulation (RC) to drill until maximum 170m to reach the target. In 2021, (holes RCDBS21-026 to RCDBS21-048), the samples were sent for preparation and 50g fire assays to Bureau Veritas Bamako laboratory and since January 2022, the samples are sent to the ALS Laboratories in Bamako, Mali and assayed at their analytical facilities to Ouagadougou for 2 kg Bottle Roll with atomic absorption finish including tail analysis by fire assays for results more than 0.05ppm. Roscan applied industry-standard QA/QC procedures to the program using reference materials, blanks, standards, and duplicates.

Table 1: Drillhole Highlights at Kabaya KB3 (Dabia South)

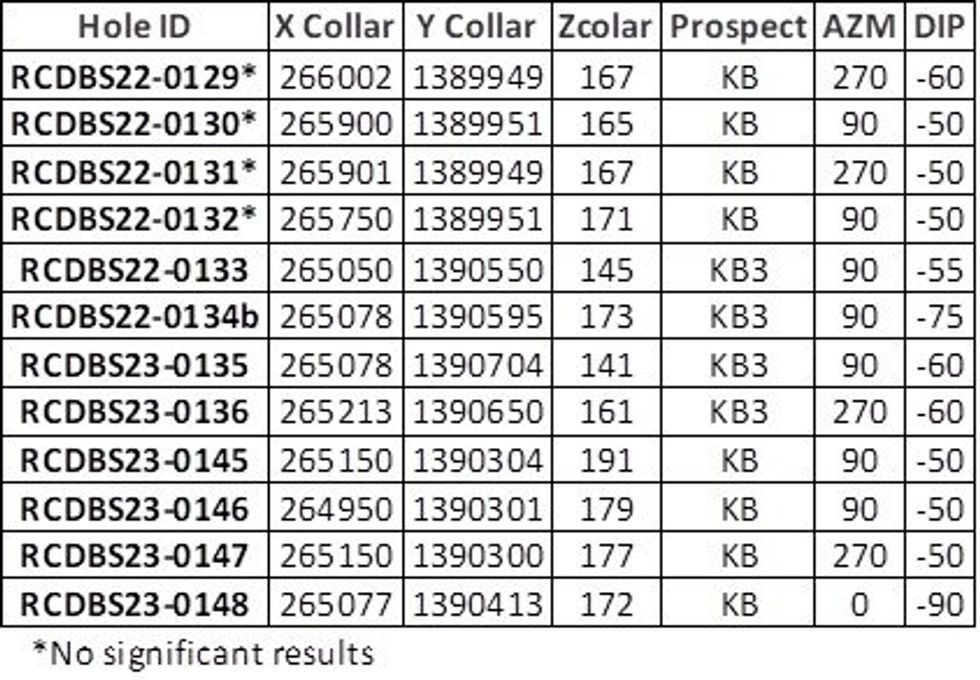

Table 2: Drillhole ID of Kabaya KB3 (Dabia South)

Qualified Person (QP) and NI 43-101 Disclosure

Greg Isenor, P. Geo., Director for the Company, is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 ("NI 43-101") and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same.

About Roscan

Roscan Gold Corporation is a Canadian gold exploration company focused on the exploration and acquisition of gold properties in West Africa. The Company has assembled a significant land position of 100%-owned permits in an area of producing gold mines (including B2 Gold's Fekola Mine which lies in a contiguous property to the west of Kandiole), and major gold deposits, located both north and south of its Kandiole Project in West Mali.

For further information, please contact:

Nana Sangmuah

President & CEO

Tel: (902) 832-5555

Email: info@Roscan.ca

Forward-Looking Statements

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, and other risks involved in the mineral exploration and development industry, including those risks set out in the Company's management's discussion and analysis as filed under the Company's profile at www.sedar.com. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including that all necessary governmental and regulatory approvals will be received as and when expected. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, other than as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

ROS:CA

The Conversation (0)

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00