- Initial Probable Mineral Reserves for the La Plata project 2.51 Mt with an average grade of 1.59% Cu, 2.28 g/t Au, 30.41 g/t Ag, and 2.18% Zn.

- Updated Indicated Resources of 2.345 Mt with an average grade of 2.13% Cu, 2.98 g/t Au, 40 g/t Ag, 3.05% Zn and Inferred Resources of 380 Kt at average grade of 0.96% Cu, 1.75 g/t Au, 38 g/t Ag, 2.29% Zn.

- Average annual production of 9.71 Mlbs Cu, 15,929 oz Au, 226,299 oz Ag, and 13.25 Mlbs Zn in concentrates over 8.1 years Life of Mine ("LOM")

- Initial Capex of US$91 Million, including a 9.8% contingency

- Average AISC of US$2.70 1 per payable lb of Cu equivalent produced over LOM

- After Tax NPV of US$93M at a 5% discount rate and an IRR of 25.1%

- Underexplored VMS camp, currently identified resources are contained in only 1.6% of total land package

Fernando E. Ganoza, CEO and Director, commented, "Completion of this study is yet another important milestone that the Company has achieved this year as it provides for an important foundation upon which to continue building the La Plata project. As a next step, we have already commenced and advanced basic and detailed engineering where we continue to see significant opportunities yet to be captured." Mr. Ganoza continued, "The current reserves and resources at the La Plata project are a good starting point, however, historic and recent exploration work performed here tells us that these areas still provide significant exploration potential. We intend to test this hypothesis in the very near future. In addition, the currently identified resources are contained in only 1.6% of the total land package, where we see tremendous opportunities for further exploration success in the regional target areas."

Metallurgy and Processing

Metallurgical testwork has shown that the production of two concentrates provide the best economic performance for the operation, a zinc concentrate and a bulk concentrate. The testwork results are shown in Table 1 and were used in the estimation of the Mineral Reserve.

Table 1. Metallurgical Testwork Results

| Parameter | Algorithm | Models | | Parameter | Algorithm | Models |

| Bulk conc recovery, % - Au | | 58 | | Zn conc Recovery, % - Au | | 12 |

Bulk conc recovery, % - Ag

| Cu>=3.33 | 69.3 | | Zn conc Recovery, % - Ag

| Cu>=3.33 | 8.1 |

| Cu | 53.5 | | Cu | 21.1 |

Bulk conc recovery, % - Cu

| Cu>=3.33 | 92.64 | | Zn conc Recovery, % - Cu

| Cu>=3.33 | 1.73 |

| Cu | 79.53 | | Cu | 9.65 |

Bulk conc recovery, % - Pb

| Cu>=3.33 | 87.05 | | Zn conc Recovery, % - Pb

| Cu>=3.33 | 4 |

| Cu | max(0.6675-0.0639*(Cu/Zn),0.474) | | Cu | 12.9 |

Bulk conc recovery, % - Zn

| Fe>=9.34 | 59 | | Zn conc Recovery, % - Zn

| Fe>=9.34 | 33.1 |

| Fe | 18.2 | | Fe | 70.7 |

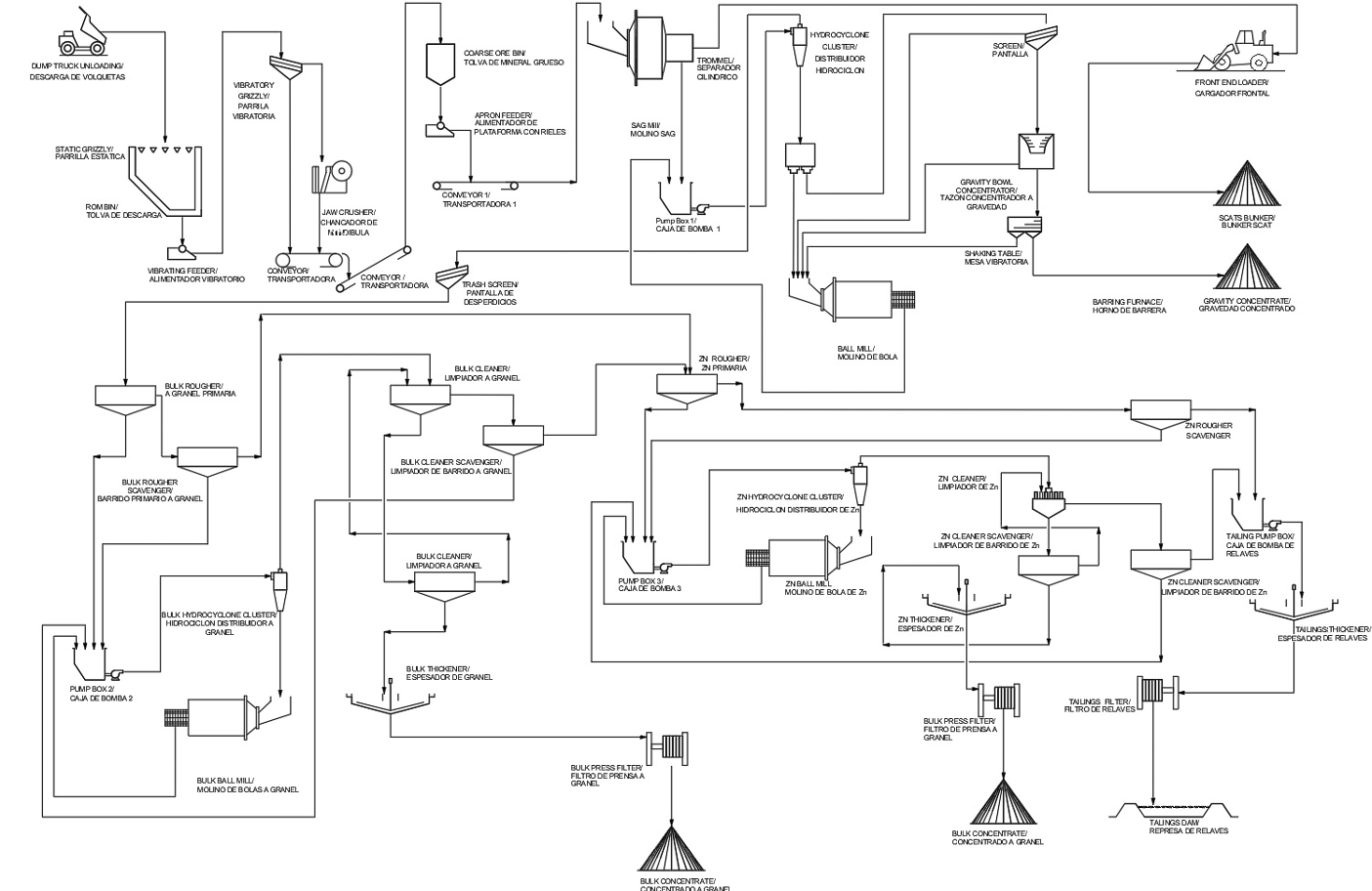

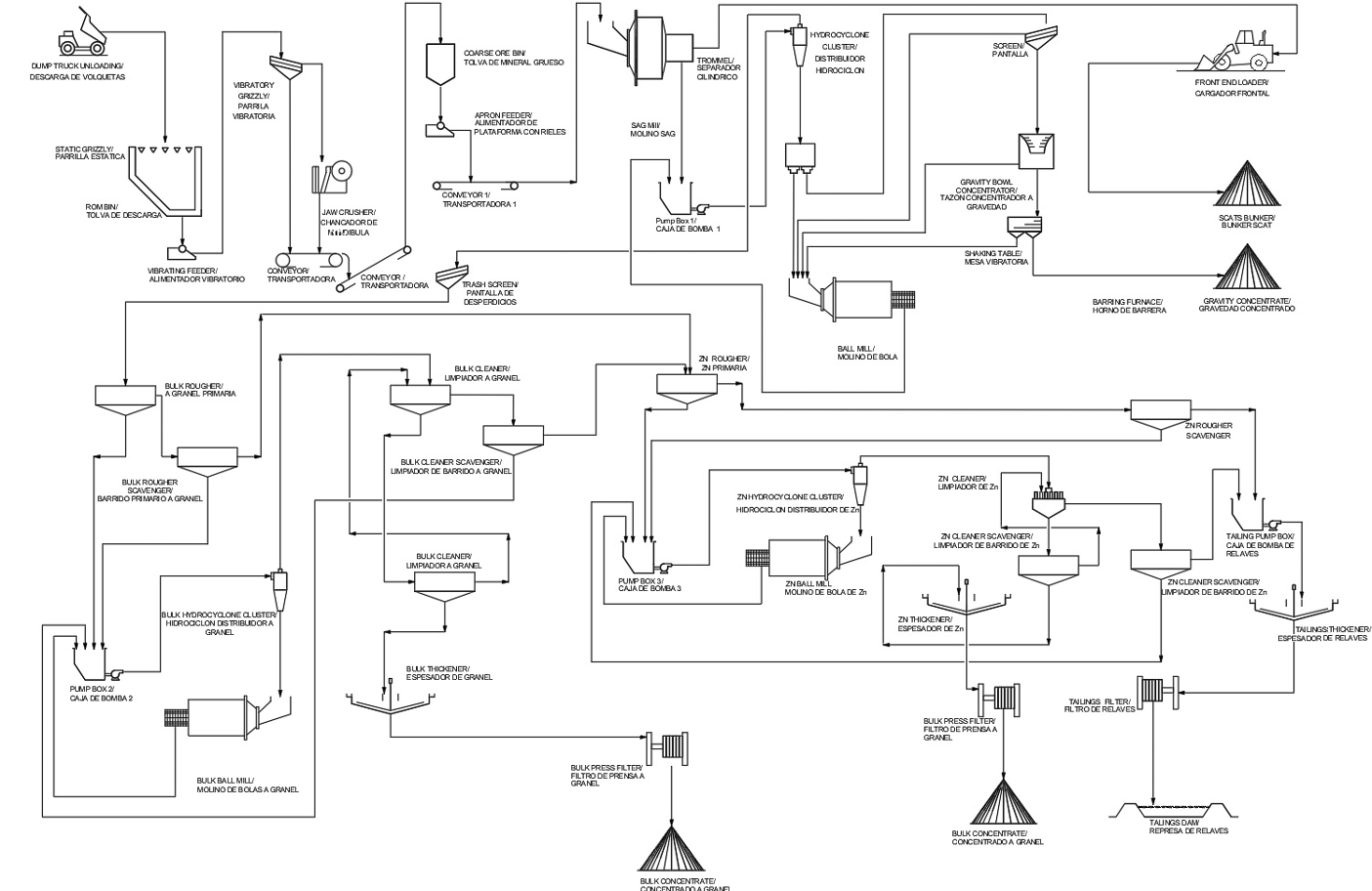

The process plant design for the La Plata Project is based on a conventional metallurgical flowsheet to treat sulphide ore to produce bulk copper and zinc concentrates. The flowsheet is based on metallurgical test work, industry standards and conventional unit operations.

The process plant will nominally treat 850 tonnes per day (t/d) of ore and will consist of comminution and flotation circuits. Flotation tailings will be dewatered to produce a filtered tailings for storage onsite. The figure below represents the overall flowsheet for the La Plata Project.

The key project design criteria for the process plant are listed below:

- Throughput of 310 kilo-tonnes per year (kt/y) of ore

- Crushing plant availability of 75%

- Grinding and flotation circuits availability of 92%

- Filtered tailings availability of 85%

- Comminution circuit to produce a particle size of 80% passing (P80) of 75 µm

- Bulk concentrate average mass pull of 12%

- Zinc concentrate average mass pull of 6%

- Equipment selection based on suitability for the required duty, reliability, and ease of maintenance

The Feasibility study proposes to construct, at a cost of US$1.6M, a 69kV transmission line for the power usage at the mine site using a new 8-kilometer connection to the power grid. Rain water will be collected from contact areas and fresh water will be pumped by pipeline from surface collection sumps. The company will also construct a filtered, stacked tailings impoundment facility to accommodate tails from the milling operations.

Mineral Resource Estimate

The Mineral Resource Estimate ("MRE") of the La Plata volcanogenic polymetallic massive sulphide ("VMS") project (the "Project" or "La Plata") presented herein represents an update from the previous MRE issued in the La Mina Preliminary Economic Assessment ("PEA") report, completed by SGS Canada Inc. ("SGS") in March 2019.

The current MRE is based on the updated drillhole database received on March 8, 2021, which includes additional data from the 2020 and 2021 infill drilling programs completed since the previous MRE. Since the 2019 PEA, there has been significant progress in the geological understanding of the deposit due to infill drilling programs conducted on the Project. Most of the drilling was dedicated to infill drilling to convert Inferred resources to Indicated category for inclusion in this Feasibility Study ("FS").

Table 2. La Plata Project Mineral Resource Statement as of August 1 st , 2023

| Resource Classification | Tonnes (t)

(Mt) | CuEq (%) | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) |

| Indicated |

| North Block | 1.148 | 5.21 | 2.61 | 30 | 2.44 | 0.36 | 2.66 |

| South Block | 1.014 | 6.00 | 3.79 | 56 | 1.84 | 0.70 | 3.85 |

| Guatuza | 0.183 | 2.66 | 0.75 | 9 | 1.78 | 0.10 | 1.04 |

| Total | 2.345 | 5.36 | 2.98 | 40 | 2.13 | 0.49 | 3.05 |

| Inferred |

| North Block | 0.022 | 3.43 | 2.16 | 29 | 0.97 | 0.43 | 2.54 |

| South Block | 0.308 | 3.24 | 1.81 | 42 | 0.91 | 0.44 | 2.45 |

| Guatuza | 0.051 | 2.51 | 1.16 | 17 | 1.23 | 0.19 | 1.24 |

| Total | 0.380 | 3.16 | 1.75 | 38 | 0.96 | 0.41 | 2.29 |

| *Notes on Mineral Resources: |

| 1. | The Mineral Resource described above have been prepared in accordance with the CIM Standards (Canadian Institute of Mining, Metallurgy and Petroleum, 2014) and follow the Best Practices outline by the CIM (2019). |

| 2. | The Qualified Person (QP) for this Mineral Resource Estimate is Christian Beaulieu, P.Geo. consultant for G Mining Services inc. Mr. Beaulieu is a member of the l'Ordre des géologues du Québec (#1072). |

| 3. | The lower cut-offs for reporting underground mineral resources are US$70 NSR for Long Hole and US$90 NSR for Cut and Fill/Room and Pillar projected mining methods. The NSR was calculated based on the following assumptions (described in detail in Section 15 and Table 15.3 of the ucoming Technical Report except for different commodity prices): |

| Commodity price assumptions: Gold = US$1,900 per ounce, Silver = US$26.50 per ounce, Copper = US$4.50 per lb, Zinc = US$1.40 per lb, Lead = US$0.92 per lb. |

| Various project related economic assumptions considered, including sale terms and conditions (% payables by metal and concentrate type, treatment and refining costs ($88/dmt, $0.09/lb Cu, $0.60/oz Ag, 0.8% Gold price with min $8/oz Au), penalties ($2/dmt min. for Pb and Zn)), transportation costs ($68/t). |

| 4. | Metal grades outlined above have not been adjusted for metallurgical recoveries. Copper Equivalent grade calculation (CuEq) is based on metal prices above and has not been adjusted for metallurgical recoveries or related economic assumptions as presented above. |

| 5. | The La Plata deposit has been classified as Indicated and Inferred Mineral Resources depending on drill spacing and estimation pass. No Measured Mineral Resources are quoted. |

| 6. | Known underground workings have been incorporated into the block model with a zero-density value within voids to exclude them from the resource tabulation. |

| 7. | Bulk Density has been estimated in the block model using ID2 from drill core measurements. Other geological units were assigned by lithology and weathering types. |

| 8. | A minimum thickness of 1.5 m was used when interpreting the wireframes. Areas of isolated clusters of blocks and where minimum thickness was not reached have been removed from the calculations. |

| 9. | The tonnages and grades outlined above are reported inside a block model with a parent block size of 5 m x 5 m x 3 m, and subblocks 1 m x 1 m x 1 m. |

| 10. | Tonnage and metal content have been expressed in the metric system, except for gold and silver metal content which is expressed in troy ounces. Tonnages have been rounded to the nearest 1,000 tonnes, and metal content has been rounded to the nearest 100 tonnes or 1,000 ounces. Differences may occur in totals due to rounding. |

| 11. | Mineral resources are not mineral reserves as they have not demonstrated economic viability. The quantity and grade of reported inferred mineral resources are uncertain in nature. The QP is not aware of any factors or issues that materially affect the MRE other than normal risks faced by mining projects in the country in terms of environmental, permitting, taxation, socio-economic and marketing factors, and additional risk factors regarding indicated and inferred resources. Political and social factors that may influence the MRE is the current instability in the country of Ecuador related to the recent events tied to drug trafficking, which may affect market perception of the project's risk profile; |

| 12. | There is no guarantee Mineral Resources will become Mineral Reserves and no guarantee that Mineral Resources will be mined. |

| |

Mineral Reserve Estimate

The mine design and Mineral Reserve estimate were completed to a level appropriate for feasibility studies. The Mineral Reserve estimate stated herein is consistent with the CIM definitions and is suitable for public reporting. As such, the Mineral Reserves are based on Measured and Indicated Mineral Resources and do not include any Inferred Mineral Resources. The Inferred Mineral Resources contained within the mine design are treated as waste.

The Mineral Resources estimate reported below are the basis for the Mineral Reserve Estimate. Only Measured and Indicated Resources are deemed to have sufficient confidence to be used for the Mineral Reserve estimate. Indicated Resources are the basis for the estimate of Probable Mineral Reserves.

The Mineral Reserves for the La Plata Project are estimated at 2.51 Mt, at an average grade of 1.59% Cu, 2.28 g/t Au, 30.41 g/t Ag, 0.36% Pb, and 2.18% Zn, as summarized in Table 3 below.

Table 3. La Plata Project Mineral Reserve Statement as of July 5, 2023

| Reserve Category | Tonnes (t)

(Mt) | CuEq (%) | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) |

| Probable |

| 2.51 | 3.51 | 2.28 | 30.41 | 1.59 | 0.36 | 2.18 |

| *Notes on Mineral Reserves: |

| 1. | Mineral Reserves are as defined by CIM definition Standards on Mineral Resources and Mineral Reserves 2014. |

| 2. | The Mineral Reserves were estimated from the Indicated Mineral Resource estimates. Inferred Mineral Resources were not considered to be converted into Mineral Reserve estimates. |

| 3. | Mineral Reserves are reported using an NSR breakeven cut-off value of 70 US$/t for bench and fill (Long Hole) and 90 US$/t for Cut and Fill/Room and Pillar projected mining methods; |

| 4. | Metal prices used were US$1,800.00/troy ounce Au, US$23.00/troy ounce Ag, US$4.00/lb Cu, US$0.92/lb Pb and US$1.30/lb Zn; |

| 5. | Metal grades outlined above have not been adjusted for metallurgical recoveries. Copper Equivalent grade calculation (CuEq) is based on metal prices above and has been adjusted for metallurgical recoveries. |

| 6. | The Mineral Reserve estimates were prepared by Mr. Thomas Kelly, RM-SME, president of Andes Colorado Corp., who is a Qualified Person for the estimate and independent of Atico Mining and its subsidiaries. The estimate has an effective date of July 5, 2023; |

| 7. | Modifying factors for conversion of resources to reserves included consideration for planned dilution which is based on spatial and geotechnical aspects of the designed stopes and economic zones, additional dilution consideration due to unplanned events, materials handling and other operating aspects, and mining recovery factors. Mineable shapes were used as geometric constraints; |

| 8. | Reserves are estimated based on mining material that can be mined, processed and smelted; |

| 9. | Values are rounded and may differ from those presented in the press release. Totals may not sum precisely due to rounding; |

| 10. | Inclusion of ore blocks in the Mineral Reserve does not guarantee that they will be mined; |

| 11. | Figures in the table are rounded to reflect estimate precision; small differences are not regarded as material to the estimate; |

| 12. | There is no guarantee that Mineral Reserves will be mined. |

| |

Capital and Operating Costs

Capital and operating costs for the La Plata Project were estimated by KCA and Atico Mining, with input from G-Mining for material take-offs and Sinco for infrastructure costs. The scope of these costs includes expenditures for all mining equipment, process facilities, and infrastructure for the project. The estimated capital and operating costs are considered to have an accuracy of +/-15%, and are discussed in greater detail in this Section.

The total capital cost for the Project is US$138 million including VAT (US$121 million without VAT); all VAT is assumed to be fully refundable. The table below presents the capital requirements for the La Plata Project.

Capital Cost Summary

| Capital Costs (Excluding VAT) | | |

| Initial Capital | $91 | million |

| LOM Sustaining Capital | $30 | million |

| Total LOM Capital | $ 121 | million |

| Working Capital & Initial Fills | $2 | million |

| Closure Costs | $1 | million |

The total life of mine operating cost for the Project is US$91.03 per tonne of ore processed, excluding preproduction. The table below presents the operating cost requirements for the La Plata Project.

Operating Cost Summary

| Operating Costs (Average LOM) | | |

| Mining (moved) | $34.38 | /Tonne moved |

| Mining (processed) | $44.39 | /Tonne processed |

| Processing & Support | $32.40 | /Tonne processed |

| G&A | $14.24 | /Tonne processed |

| Total Operating Cost | $ 91.03 | /Tonne processed |

VAT is not included in the operating costs.

Mining Methods

There will be three mining methods used for stoping at La Plata. Given the amorphous shape of the deposit and the associated geotechnical conditions, the stoping methodology will change to adapt to changes in the characteristics of the deposit. The three methods are bench-and-fill (Avoca), room-and-pillar and cut-and-fill.

Avoca mining will be used where the structure is steeply dipping, wider than 2.5 meters, and the RMR is over 40; additionally, each Avoca block requires access from both ends of each block on the drilling sublevel. Bench heights are variable from 10-m to 20-m. A long hole (bench) drill will be used for drilling and the mucking will be by remote controlled scoops. This method is high productivity with low operating costs.

Drift-and-fill mining will be applied in the relatively flat parts of the deposit. Stoping is with the same equipment as mine development (jumbos, scoops, haul trucks) with breasting the faces for high productivity. Pillars of cemented rock fill (CRF) will be left to support the hangingwall and rock mass above the stope blocks. After the first stage of stoping the pillars are mined and the overlying load from the rock mass is transferred to the CRF pillars.

Cut-and-fill mining will be applied to areas where the deposit is too flat to allow for Avoca mining and too steep for room-and-pillar mining. In addition, if the RMR is less than 40 cut-and-fill mining will be used. As with drift-and-fill mining, the equipment fleet for room-and-pillar is the same as the mine development fleet. Lifts advance as breasting lifts after the initial lift which uses a pull round. The fill medium may be waste rock from mine development or CRF, depending upon local circumstances.

Project Economics and Sensitivities

The life of mine production data for the La Plata project is presented in Table 6 below.

Table 6. La Plata Production Data

| Production Data | | |

| Life of Mine | 8.1 | Years |

| Mine Throughput per day | 850 | Tonnes/day |

| Mine Throughput per year | 310,250 | Tonnes/year |

| Total Tonnes to Crusher | 2,506,009 | Tonnes |

| Grade Au (Avg.) | 2.28 | g/t |

| Grade Ag (Avg.) | 30.41 | g/t |

| Grade Cu (Avg.) | 1.59 | % |

| Grade Zn (Avg.) | 2.18 | % |

| Total Gold Produced | 128,474 | Ounces |

| Total Silver Produced | 1,825,143 | Ounces |

| Total Copper Produced | 78,297,363 | Pounds |

| Total Zinc Produced | 106,869,075 | Pounds |

| Total Payable Gold | 114,935 | Ounces |

| Total Payable Silver | 1,383,519 | Ounces |

| Total Payable Copper | 66,691,030 | Pounds |

| Total Payable Zinc | 66,700,898 | Pounds |

| LOM Underground Strip Ratio (W:O) | 0.29 | |

The financial analysis for the base-case, which evaluates a stand-alone owner's operation and indicates an after-tax NPV at a 5% discount rate, of US$93M with an IRR of 25.1% and a payback period of 3.4 years 2 . In this scenario the project is expected to generate US$212M pre-tax operating cash flow.

Table 7 and Table 8 below present the financial analysis for the La Plata project.

Table 7. Base Case Financial Analysis

| Base-Case | | |

| Gold Price Assumption | $1,920 | | /Ounce |

| Silver Price Assumption | $23 | | /Ounce |

| Copper Price Assumption | $4.05 | | /Pound |

| Zinc Price Assumption | $1.50 | | /Pound |

| Average Annual Cashflow (Pre-Tax) | $38 | | million |

| Average Annual Cashflow (After-Tax) | $31 | | million |

| Internal Rate of Return (IRR), Pre-Tax | | 32.9% | | |

| Internal Rate of Return (IRR), After-Tax | | 25.1% | | |

| NPV @ 5% (Pre-Tax) | $137 | | million |

| NPV @ 5% (After-Tax) | $93 | | million |

| Pay-Back Period (Rears based on After-Tax) | | 3.4 | | Years |

Table 8. Sensitivity analysis to current metal prices.

| June 2024 Average Prices | | |

| Gold Price Assumption | $2,325 | | /Ounce |

| Silver Price Assumption | $29 | | /Ounce |

| Copper Price Assumption | $4.45 | | /Pound |

| Zinc Price Assumption | $1.27 | | /Pound |

| Average Annual Cashflow (Pre-Tax) | $46 | | million |

| Average Annual Cashflow (After-Tax) | $35 | | million |

| Internal Rate of Return (IRR), Pre-Tax | | 41.8% | | |

| Internal Rate of Return (IRR), After-Tax | | 31.3% | | |

| NPV @ 5% (Pre-Tax) | $184 | | million |

| NPV @ 5% (After-Tax) | $123 | | million |

| Pay-Back Period (Rears based on After-Tax) | | 2.8 | | Years |

Qualified Person

The definitive feasibility study was prepared by leading independent industry consultants. The Qualified Persons who prepared the June 2024 NI 43-101 Technical Report are:

- Travis Manning

- Thomas Kelly

- Christian Beaulieu

- Neil Lincoln

- Donald Hickson

- Felipe Riquelme

- Adam Johnston

The QPs have reviewed and approved the content of this news release.

The following consultants participated in the Study:

- Kappes, Cassiday & Associates

- Andes Colorado Corp.

- G Mining

- Envis

- Transmin

- IMSS

- Sinco

The NI 43-101 Technical Report will be filed on SEDAR+ within 45 days of this press release.

About Atico Mining Corporation

Atico is a growth-oriented Company, focused on exploring, developing and mining copper and gold projects in Latin America. The Company generates significant cash flow through the operation of the El Roble mine and is developing its high-grade La Plata VMS project in Ecuador. The Company is also pursuing additional acquisition of advanced stage opportunities. For more information, please visit www.aticomining.com.

ON BEHALF OF THE BOARD

Fernando E. Ganoza

CEO

Atico Mining Corporation

Trading symbols: TSX.V: ATY | OTC: ATCMF

Investor Relations

Igor Dutina

Tel: +1.604.633.9022

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

No securities regulatory authority has either approved or disapproved of the contents of this news release. The securities being offered have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the ‘‘U.S. Securities Act''), or any state securities laws, and may not be offered or sold in the United States, or to, or for the account or benefit of, a "U.S. person" (as defined in Regulation S of the U.S. Securities Act) unless pursuant to an exemption therefrom. This press release is for information purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company in any jurisdiction.

Cautionary Note Regarding Forward Looking Statements

This announcement includes certain "forward-looking statements" within the meaning of Canadian securities legislation. All statements, other than statements of historical fact, included herein, without limitation the use of net proceeds, are forward-looking statements. Forward-looking statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; uncertainty of estimates of capital and operating costs; the need to obtain additional financing to maintain its interest in and/or explore and develop the Company's mineral projects; uncertainty of meeting anticipated program milestones for the Company's mineral projects; the world-wide economic and social impact of COVID-19 is managed and the duration and extent of the coronavirus pandemic is minimized or not long-term; disruptions related to the COVID-19 pandemic or other health and safety issues, or the responses of governments, communities, the Company and others to such pandemic or other issues; and other risks and uncertainties disclosed under the heading "Risk Factors" in the prospectus of the Company dated March 2, 2012 filed with the Canadian securities regulatory authorities on the SEDAR+ website at www.sedarplus.ca

Non-GAAP Financial Measures

This press release refers to All In Sustaining Cost (AISC) a non-GAAP financial measures which is used by the Company for project evaluation and operating performance. These measures are widely reported in the mining industry but do not have a standardized meaning and may differ from methods used by other companies with similar descriptions. The Company believes that certain investors use these non-GAAP financial measures to evaluate the Company's operations. Accordingly, non-GAAP financial measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Readers should refer to Non-GAAP Financial Measures in the Company's Management's Discussion and Analysis for the year ended December 31, 2023, as filed on SEDAR and as available on the Company's website for further details.

______________________________

1 * Alternative performance measures; please refer to "Non-GAAP Financial Measures" at the end of this release.

2 Calculated from the date of declaration of commercial production which is after plant commissioning and production ramp-up to full nameplate capacity.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9b60f552-92ee-4110-94bf-f516e54f6fb6