April 12, 2022

Reach Resources Limited (ASX: RR1) ("the Company" or "Reach Resources") is pleased to provide an update in relation to its recent strategic investment into REEgenerate Pty Ltd (“REEgenerate”) as previously announced to ASX on 21 March 2022.

REEgenerate is an Australian private company that owns 100% of the Coconut Club REE exploration project in Quebec, Canada. REEgenerate also had an option to acquire 100% of REEcycle Inc (“REEcycle”), a US based Rare Earth Element (REE) separation and technology Company focussed on recovering REE from high powered permanent NdFeB magnets.

- The Company is pleased to inform shareholders that REEgenerate has now exercised its option to acquire REEcycle, giving Reach Resources direct exposure to this company, whose future is aligned with current global social and political thinking of a cleaner, greener future through the circular economy principle.

New CEO Jeremy Bower commented “Our shareholding in REEgenerate represents an exciting addition to our portfolio of exploration assets, particularly our REE projects. We will continue to update the market on this investment in parallel with the development of our resource projects”.

Highlights

- REEcycle has developed a process that has shown at pilot scale the ability to reclaim 15 of the 17 rare earth elements in discarded permanent NdFeB magnets, with a recovery efficiency in excess of 99%

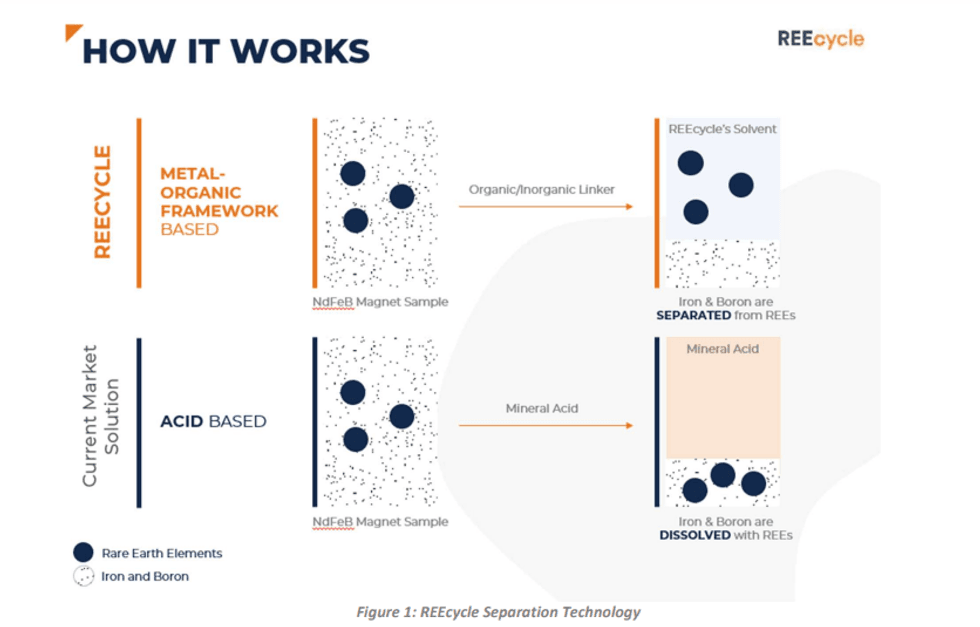

- The patented process developed at the University of Houston uses a proprietary solvent to safely and efficiently extract REEs from permanent magnets found in wind turbines, electric vehicles (cars, bikes, scooters), MRI machines and other electronic waste with low temperatures, low pressures, and minimal energy needs and waste

- REEcycle aims to provide an alternative option to traditional mined sources of rare earth metals as well as reduce supply chain uncertainty and geopolitical risk for companies reliant on these materials

- The global permanent magnet market size was valued at USD$17.85 billion in 2018 and is projected to reach USD$34.70 billion by 2026, exhibiting a CAGR of 8.7% during the forecast period 1 , with the rare earth metals component being valued at US$5.3 billion in 2021 with only 1% of REEs sourced from recycled end of life products 2

- Shanghai Metals Market (SMM) forecast recycling of NdFeB magnets is likely to be the largest growth of neodymium and dysprosium supply from 2021 to 2025

In pilot testing, REEcycle has been able to achieve up to 99.8% separation/recovery efficiency of pure rare earth elements from the other materials in the magnet (Iron and Boron). The process is carried out at atmospheric pressure, under mild temperatures, producing water (pH 6) which contains Iron and Boron at concentrations compliant with those specified by municipal sewage treatment systems. Rare Earth Oxide (REO) concentrate exists in carbonate form but can easily be converted to an oxide.

Click here for the full ASX Release

This article includes content from Reach Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

RR1:AU

The Conversation (0)

03 May 2022

Reach Resources Limited

Sourcing the Critical Minerals of the Future

Sourcing the Critical Minerals of the Future Keep Reading...

13 May 2025

Murchison South Increases to 67koz Gold Across Two Pits

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce the completion of a new Mineral Resource Estimate (MRE) for the Pansy Pit deposit at its Murchison South Gold Project. The estimate, prepared by independent consultants Mining Plus, reported above a... Keep Reading...

28 July 2023

Quarterly Activities/Appendix 5B Cash Flow Report

Reach Resources Limited (ASX: RR1) (“Reach” or “the Company”) provides its activities report for the quarter ended 30 June 2023. HIGHLIGHTS High-Grade Lithium Results at Yinnetharra (15 May 2023) Lithium mineralisation confirmed with rock chip samples reporting highly encouraging assays of up to... Keep Reading...

18 May 2023

Outcropping Copper Gossan Delivers 33% Cu Assays At Morrissey Hill Project, Yinnetharra

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce that it has received high grade copper, gold and silver results up to 33% copper, 0.2g/t gold and 142g/t silver from its recently completed rock chip sampling program at the Company’s Morrissey Hill... Keep Reading...

14 May 2023

Reach Resources’ Strategic Position Between Two of WA’s Mining Heavyweights

Reach Resources’ (ASX:RR1) strategic position with its Morrissey Hill project has placed the critical mineral explorer on the radar of two of Western Australia’s mining giants Delta Lithium (ASX:DLI) and Minerals 260 (ASX:MI6), according to an article published in The West Australian.“While... Keep Reading...

17 September 2025

Sulista Exploration Results Confirm a New High-Grade Rare Earth District

Brazilian Rare Earths Limited (ASX: BRE) (OTCQX: BRELY / OTCQX: BRETF) announces exploration results at the Sulista Project, located ~80km southwest of the Monte Alto project. The exploration program delivered outstanding outcomes across multiple targets, upgrading the Sulista Project to a... Keep Reading...

01 July 2025

Rare Earths Extracted from Ema ISR Field Trial

ISR leaching confirms commercial scale viability using low concentration MgS04

Brazilian Critical Minerals Limited (ASX: BCM) (“BCM” or the “Company”) is pleased to announce that it has now successfully leached, extracted and precipitated rare earths from its in-situ recovery (ISR) pilot field trial at the Ema project. HighlightsFirst REEs successfully recovered under... Keep Reading...

26 March 2025

High-Grade Discoveries Enhance Scale of Pelé Project

Brazilian Rare Earths Limited (ASX: BRE) (OTCQX: BRELY / OTCQX: BRETF) is pleased to report the results of exploration drilling at the Pelé Target 1 Project, located in Bahia, Brazil. New discovery of high-grade REE-Nb-Sc-Ta-U mineralisationHigh-grade diamond drill results at Pelé Target 1... Keep Reading...

26 February 2025

Ema Rare Earths Scoping Study Confirms Potential for Ultra Low CAPEX and OPEX Project, Showing Strong Financial Returns at Current Commodity Prices

Brazilian Critical Minerals Ltd (BCM or the Company) (ASX: BCM) advises of completion of a Scoping Study on its 100%-owned EMA Rare Earths Project (Ema Project) in southeastern Amazonas, Brazil. The Scoping Study was completed utilising industry recognised experts in the Australian engineering... Keep Reading...

01 November 2023

E-Tech Resources

Get access to more exclusive Rare Earth Investing Stock profiles here Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00