November 05, 2024

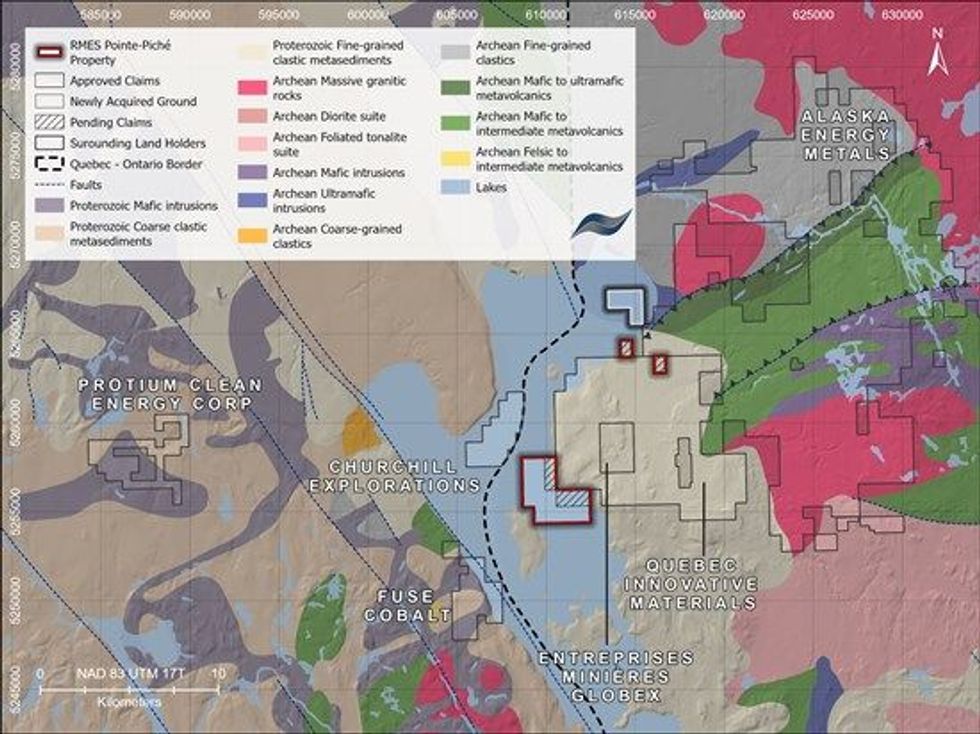

RED METAL RESOURCES LTD. (CSE: RMES) (OTC PINK: RMESF) (FSE: I660) ("Red Metal" or the "Company") is pleased to announce it has acquired a 100% interest in four additional mineral claims directly contiguous to Quebec Innovative Materials Corp.'s ("QIMC") recent expansion claims staking and in the area of its expansion of its natural renewable hydrogen discovery (See QIMC news dated October 3rd 2024).

The Company's four new claims are located to the North of QIMC's announced 11 km expansion of natural renewable hydrogen discovery. Recent soil gas measurements from QIMC's Line 13 recorded at 594, 543, and 463 ppm, are the highest levels detected outside of those previously reported from Line 7 on September 4th, 2024, press release. These new high readings by QIMC, located 11 km northwest of the 1,000 ppm samples collected on Line 7, highlight the district hydrogen-rich zone across the Ville Marie property.

This news release contains information about adjacent properties on which the Company has no right to explore or mine. Investors are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on the Company's properties.

Red Metal has now acquired 100% interest in four separate packages of mineral claims and mineral claim applications and is currently reviewing regional geological data to assist in the evaluation of potential additional acquisitions in the immediate area as well as the formulation of an initial exploration plan with further details to be provided in due course.

Red Metal Resources President and CEO, Caitlin Jeffs, stated, "We are aggressively expanding our geological footprint in this emerging natural hydrogen district and are actively evaluating additional acquisitions in the area. Recent natural hydrogen discoveries demonstrate the rich potential and uniqueness of this region and strategically positions Red Metal amongst first movers of sustainable energy solutions through renewable natural hydrogen. Red Metal is actively planning an initial exploration program directly next to QIMC's recent hydrogen discovery. This new property represents an exciting opportunity to expand our clean energy portfolio as we continue to advance our Carrizal Copper/Gold/Cobalt property in the Coastal Cordillera, Chile."

Red Metal's claim blocks now consist of four separate packages, covering 23 cells and totaling over 1,300 hectares to the North, Northeast and the Southwest of QIMC's Hydrogen-in-soil sample discovery. These claim blocks are contiguous on three sides to Quebec Innovative Materials Corp. and cover possible extensions in multiple directions. To date, 15 of the 23 cells have been approved by the Quebec Ministry of Natural Resources and Forests.

Terms of the Agreement

Under the terms of the Agreement to acquire a 100% interest in four mineral claims, Company has agreed to pay CA$5,000. No royalty is to be paid out of any potential future revenue. The Company's acquisition of the Property remains subject to customary conditions of closing, including the approval of the Canadian Securities Exchange (if required).

About Red Metal Resources Ltd.

Red Metal Resources is a mineral exploration company focused on growth through acquiring, exploring and developing clean energy and strategic minerals projects. The Company's current portfolio include the 100% owned Ville Marie claims in Quebec, Canada as well as Company's Chilean projects which are located in the prolific Candelaria iron oxide copper-gold (IOCG) belt of Chile's coastal Cordillera. Red Metal is quoted on the Canadian Securities Exchange under the symbol RMES, on OTC Link alternative trading system on the OTC Pink marketplace under the symbol RMESF and on the Frankfurt Stock Exchange under the symbol I660.

For more information, visit www.redmetalresources.com

Contact:

Red Metal Resources Ltd.

Caitlin Jeffs, President & CEO

1-866-907-5403

invest@redmetalresources.com

www.redmetalresources.com

Neither the Canadian Securities Exchange nor the Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements - All statements in this press release, other than statements of historical fact, are "forward-looking information" within the meaning of applicable securities laws. Red Metal provides forward-looking statements for the purpose of conveying information about current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities will not be achieved. These risks and uncertainties include but are not limited to the ability to raise adequate financing, receipt of required approvals, as well as those risks and uncertainties identified and reported in Red Metal's public filings under its SEDAR+ profile at www.sedarplus.ca. Although Red Metal has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Red Metal disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

RMES:CC

Sign up to get your FREE

Red Metal Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

16 October 2024

Red Metal Resources

Advancing high-grade copper assets in Chile’s Coast Cordillera Belt

Advancing high-grade copper assets in Chile’s Coast Cordillera Belt Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Sign up to get your FREE

Red Metal Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00