April 25, 2022

New team to undertake strategic technical review and prioritise key assets

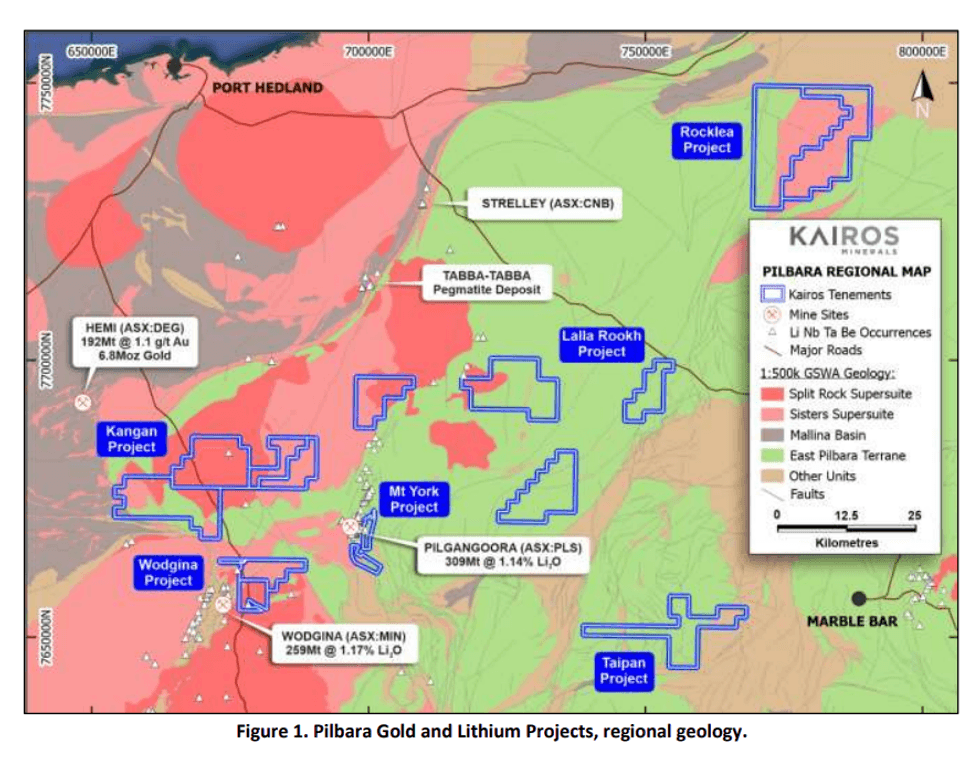

Kairos Minerals (ASX: KAI) ("the Company" or "Kairos Minerals ") is pleased to report on its Quarterly activities for the period ending 31 March 2022.

Highlights

- Cash position at the end of March of $7.5M.

- Experienced executives Mr Phil Coulson and Mr Zane Lewis appointed to board

- Company undertaking a thorough strategic and technical review of all lithium and gold projects

- Executive search underway for CEO/Managing Director

- New gold target identified at Mt York with anomalous rock chip samples up to 4.6g/t

- Lithium targets identified at Lalla Rookh Project • Large surface lithium and caesium anomaly defined at Roe Hills Project

- Large number of assays in laboratory – results expected Q2:

- Mt York (RC): over 4,000 single-metre samples and over 400 four-metre composite samples

- Mt York (Aircore): over 400 four-metre composite samples

- Kangan (Aircore): over 500 four-metre composite samples

- Kangan (Aircore): over 80 single-metre samples

- Croydon (Soil samples): over 300 samples

- Roe Hills (Soil samples): over 3,000 samples

CORPORATE

During the quarter, Mr Terry Topping and Mr Bruno Seneque tendered their resignations as directors. As a result of these resignations, the 249D notices received by the Company referred to in the ASX announcement on 8 March 2022 were withdrawn and Messrs Phil Coulson and Zane Lewis have been appointed as Directors effective 24 March 2022.

Upon appointment, Messrs Coulson and Lewis have initiated a strategic and technical review of the Company’s gold and lithium projects with a view to optimising exploration expenditure to match strategic objectives and exploring all opportunities to enhance shareholder value.

CASH ON HAND

At the end of the March 2022 quarter, the Company had cash and cash equivalents of $7.52million. In addition the company holds $432K of investments in ASX listed entities.

During the March 2022 quarter, there was a net increase in cash and cash equivalents of $2,449K as a result of 157,185,104 shortfall shares being issued to clients of CPS Capital in accordance with the Underwriting Agreement to raise $3.9 million before costs. Transaction costs of $357K relating to the issue of the shortfall shares was paid in the quarter.

Expenditure of $1,486k related to payments for exploration activities conducted on the Company’s Pilbara and Eastern Kalgoorlie (Roe Hills) exploration projects as detailed in the activities report below.

Administration costs increased for the quarter due to the termination payments for Messrs Topping and Seneque, legal fees and other operating activities.

The Company is reviewing all corporate expenditure with a view to minimising overheads where applicable.

EXPLORATION

PILBARA GOLD PROJECT, PILBARA REGION (KAIROS: 100%)

Click here for the full ASX Release

This article includes content from Kairos Minerals , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

KAI:AU

The Conversation (0)

14 February 2022

Kairos Minerals

Developing Highly Prospective Gold Projects in a World-Class Gold District

Developing Highly Prospective Gold Projects in a World-Class Gold District Keep Reading...

15h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00