April 28, 2022

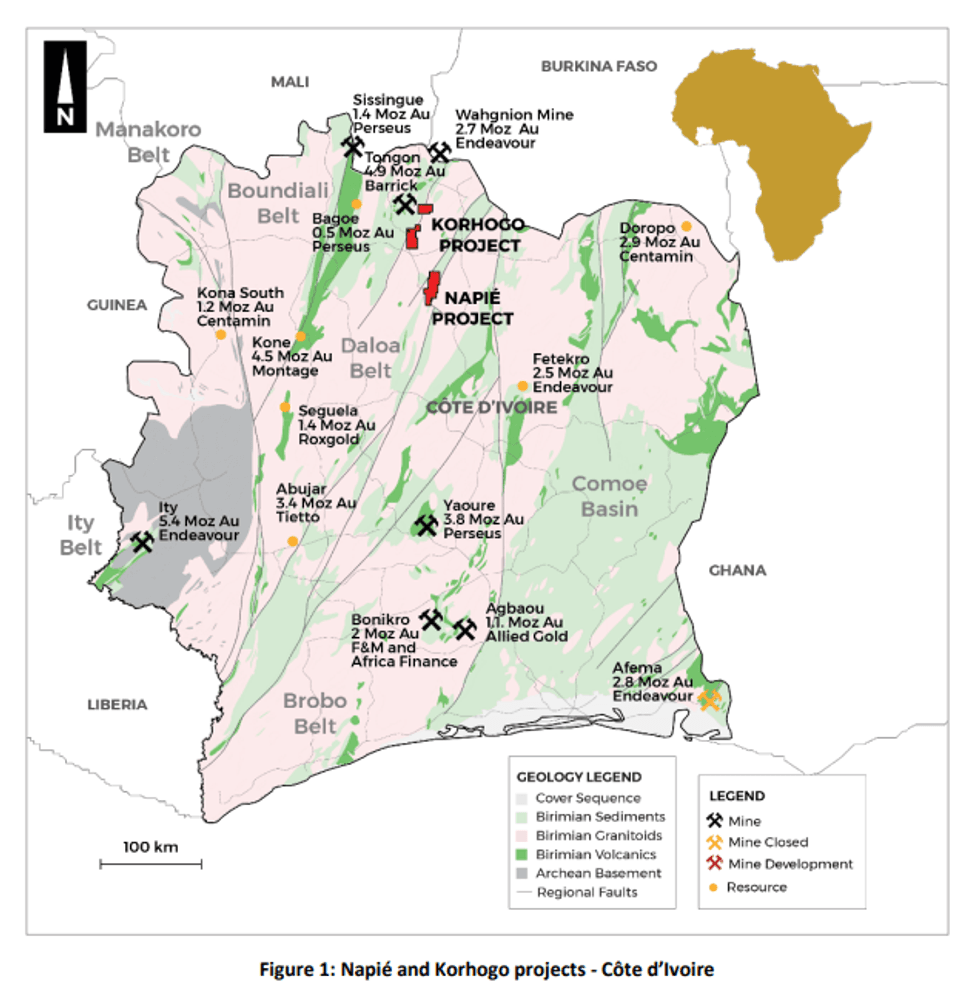

Mako Gold Limited (“Mako” or “the Company”; ASX:MKG) is pleased to present its Quarterly Activities Report for the period ending 31 March 2022. Activities are reported for exploration at the Company’s flagship Napié Project (“Napié”) and the Korhogo Project in Côte d’Ivoire (Figure 1).

HIGHLIGHTS – NAPIÉ PROJECT - 30,000M DRILLED IN QUARTER

GOGBALA PROSPECT- Drilling identifies two new mineralised zones outside of the current resource drill area returning 6m at 5.05g/t Au and 4m at 4.82g/t Au which includes more than 1km of undrilled Napié Fault providing pathways for resource growth following the maiden Mineral Resource Estimate (MRE) scheduled for Q2-CY22

- 109 of 139 reverse circulation (RC) and diamond drilling (DD) drill holes results reported intersected significant mineralisation, achieving a 78% success rate in drilling which will contribute to the size of maiden MRE. Notable results include:

- NARC660: 17m at 4.13g/t Au from 57m; including 5m at 12.02g/t Au from 62m

- NARC668: 7m at 1.26g/t Au from 22m; and

- 4m at 14.78g/t Au from 93m; including 2m at 27.83g/t Au from 93m

- NARC651: 10m at 1.63g/t Au from 69m; and

- 10m at 3.35/t Au from 102m; including 1m at 22.29g/t Au from 103m

- NARC579: 9m at 3.77g/t Au from 48m

- NARC569: 6m at 5.37g/t Au from 105m; including 3m at 9.61g/t Au from 106m

- NARC619: 1m at 30.89g/t Au from 46m

- NARC697: 6m at 5.05g/t Au from 79m; including 1m at 12.18g/t Au from 80m and 1m at 10.71g/t Au from 82m

- NARC703DD: 6m at 4.28g/t Au from 63m; including 1m at 14.65g/t Au from 68m

- NARC686: 4m at 4.82g/t Au from 113m

- NARC610: 5m at 4.61g/t Au from 158m; including 1m at 15.71g/t Au from 162m

- NARC642: 2m at 12.89g/t Au from 50m

- NARC643: 5m at 3.24g/t Au from 118m; including 1m at 8.17g/t Au from 119m

- NARC584: 1m at 28.93g/t Au from 115m

- NARC623: 15m at 1.17g/t Au from 109m; including 5m at 2.15g/t Au from 110m

- NARC632: 1m at 13.29g/t Au from 150m

TCHAGA PROSPECT

- Final (pre-maiden MRE) 17 RC/DD holes at Tchaga Prospect returned multiple high-grade intercepts, with 14 of 17 holes intersecting significant mineralisation. Notable results include:

- NARC621DD: 41m of mineralisation intersected over 7 zones averaging 2.85g/t Au, including:

- 6m at 1.24g/t Au from 48m; and

- 6.7m at 1.46g/t Au from 160.1m; including 1m at 6.87g/t Au from 160.1m; and

- 19.6m at 4.36g/t Au from 187.4m; including 2.2m at 23.49g/t Au from 189.8m

- NARC512DD: 14.6m of mineralisation intersected over 4 zones averaging 3.32g/t Au, including:

- 4.5m at 6.92g/t Au from 213.1; including 1m at 29.46g/t Au from 216.6m; and

- 5m at 2.28g/t Au from 256m

- NARC559DD: 63.1m of mineralisation intersected over 15 zones averaging 1.25g/t Au, including:

- 3m at 2.66g/t Au from 45m;

- 8.3m at 0.96g/t Au from 115.5m;

- 4.8m at 1.24g/t Au from 165.2m;

- 13m at 1.05g/t Au from 297m;

- 3.5m at 1.55g/t Au from 327.5m;

- 4m at 1.65g/t Au from 336m; and

- 5m at 1.66g/t Au from 361m; including 1m at 5.50g/t Au from 361m

- Results from Tchaga drilling to be included in upcoming maiden MRE scheduled for Q2-CY22

TCHAGA NORTH AND KOMBORO PROSPECTS

- Scout Aircore (AC) drill program completed on Komboro Prospect and partially completed on Tchaga North Prospect ahead of follow-up RC drill program

- Objective of program is to make new discoveries outside of the main Tchaga and Gogbala prospect areas as part of Mako’s overall strategy to define a multi-million-ounce resource on the Napié Permit

KORHOGO PROJECT

- 11,000m auger drilling program completed on high-priority structural and geochemical targets identified from previous work executed by Mako

- Maiden 5,000m RC drilling program planned following results from auger drilling

- The Korhogo Project has no previously recorded exploration and covers 296km2 of prospective tenure located within 15-30 km of Barrick’s 4.9Moz Tongon Gold Mine

CORPORATE

- $3.4M spent on exploration (drilling) this quarter to advance both Napié and Korhogo projects, with healthy $5.9M cash balance remaining at end of quarter

- Mako management was recently on-site to evaluate operations

During and subsequent to the reporting period 16,971m in 124 reverse circulation (RC) holes, 1,722m in 18 diamond drill (DD) holes, and 11,427m in 343 Aircore (AC) holes were drilled for a total of 30,120m drilled on the Napié Project.

The majority of drilling was conducted on the Gogbala Prospect during the reporting period to rapidly advance Gogbala in order to include it with Tchaga in the upcoming maiden MRE scheduled for Q2-CY22.

Click here for the full ASX Release

This article includes content from Mako Gold Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MKG:AU

The Conversation (0)

24 August 2021

Mako Gold

Exploring High-Grade Gold Deposits in Côte d'Ivoire

Exploring High-Grade Gold Deposits in Côte d'Ivoire Keep Reading...

20 February

Top 5 Canadian Mining Stocks This Week: Belo Sun is Radiant with 109 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.On Tuesday (February 17) Canadian Prime Minister Mark Carney announced the creation of... Keep Reading...

20 February

Gold and Silver Stocks Dominate TSX Venture 50 List

This year's TSX Venture 50 list showcases a major shift in sentiment toward the mining sector. The TSX Venture 50 ranks the top 50 companies on the TSX Venture Exchange based on annual performance using three criteria: one year share price appreciation, market cap growth and Canadian... Keep Reading...

19 February

Ole Hansen: Next Gold Target is US$6,000, What About Silver?

Ole Hansen, head of commodity strategy at Saxo Bank, believes US$6,000 per ounce is in the cards for gold in the next 12 months; however, silver may not enjoy the same price strength. "If gold moves toward US$6,000, I would believe that ... silver at some point will struggle to keep up, and... Keep Reading...

19 February

Kinross’ Great Bear Gold Project Accelerated Under Ontario’s 1P1P Framework

Ontario is moving to accelerate one of Canada’s largest emerging gold projects, cutting permitting timelines in half for Kinross Gold's (TSX:K,NYSE:KGC) Great Bear development in the Red Lake district.The province announced that Great Bear will be designated under its new One Project, One... Keep Reading...

19 February

Massan Indicated Conversion Programme Continues to Deliver

Asara Resources (AS1:AU) has announced Massan indicated conversion programme continues to deliverDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00