April 05, 2023

A Pre-Feasibility Study (PFS) is now underway at Impact Minerals Limited’s (ASX: IPT) advanced Lake Hope High Purity Alumina (HPA) Project in Western Australia.

The Project, in which Impact is earning an 80% interest, offers the Company the opportunity to become a low-cost entrant into the HPA chemical market, a high-margin business forecast to grow strongly over the next decade (ASX Release March 21st 2023).

Lake Hope contains a globally unique deposit of high-grade aluminium clay minerals in the top few metres of a playa salt lake, which has unique physical and chemical properties that will allow for low- cost mining and offsite metallurgical processing via a novel and cost-disruptive acid leaching process.

Preliminary economic studies indicate that the production of HPA and related products from Lake Hope will be cost-competitive with current producers and other developers in Australia and globally (ASX Release March 21st 2023).

Impact has appointed the following experienced companies to undertake the work programs for the PFS, which will be completed over the next 12 to 18 months, as well as the work required to lodge a Mining Lease Application in early Quarter 3 this year:

Maiden Resource Estimation: H and S Consultants, Brisbane. H and S are well-known resource estimation specialists with specific experience in resource calculations for deposits in Western Australian playa lakes.

Environmental and Approvals Process Consultants: Biota Environmental Services, Perth. Biota will complete flora and fauna surveys and also help coordinate the approvals process for the Mining Lease Application.

Metallurgical Consultants: Strategic Metallurgy, Perth. Strategic will help oversee and manage the optimisation test work programme for the novel acid leach process, which is currently already underway at ALS Laboratories in Perth. Strategic will also complete process flow sheet design and preliminary engineering studies.

Mining Studies: The Mining Engineer Mine Consulting (TME). TME will complete initial mine optimization studies for Lake Hope, which will likely be mined on a campaign basis every few years.

Financial Modelling: Platek Analytics. Platek Analytics will review Impact’s internal economic model for both the PFS and a Scoping Study, which will be released following the completion of the Mineral Resource Estimate.

The entire PFS will be managed by Roland Gotthard, who discovered the Lake Hope Project and has now joined Impact as Project Manager.

Impact's Managing Director, Dr Mike Jones, said: “We have hit the ground running since announcing the transformational joint venture at Lake Hope. At short notice, we have assembled a first-class team of consultants to complete the Pre-Feasibility Study work programs over the next 12 to 18 months and drive us towards production. In addition, this work will allow us to release a Maiden Resource and an initial Scoping Study over the next two months, as well as lodge a Mining Lease application in the third Quarter of this year. We have never been busier as we become the next "playa” in HPA.”

About the Lake Hope Project

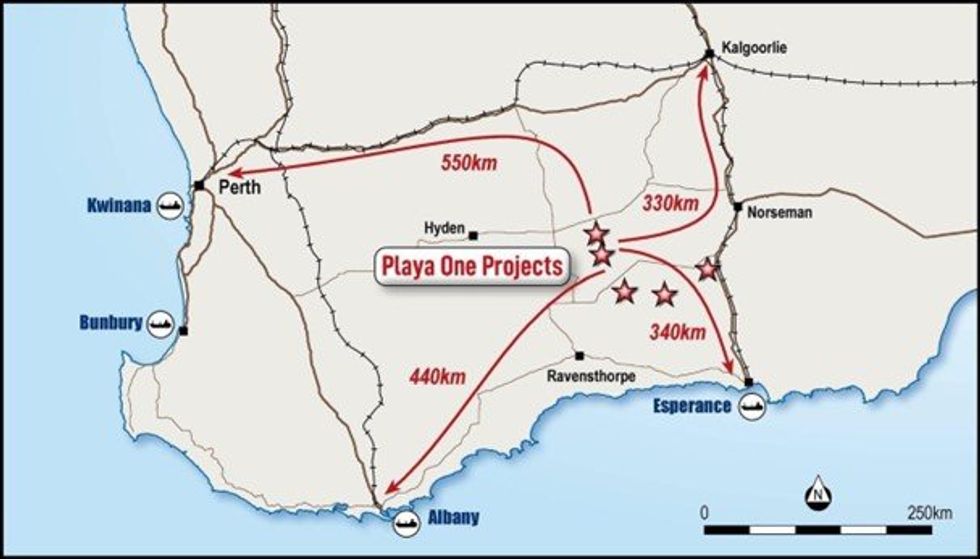

The Lake Hope Project covers numerous prospective salt lakes between Hyden and Norseman in southern Western Australia, a Tier One jurisdiction (Figure 1). It comprises one granted exploration licence (E63/2086), covering the Lake Hope deposit already discovered, together with five further exploration licence applications (ELA63/2317, 2318 and 2319, and ELA74/673 and 764) which are poorly explored. The tenements cover about 238 km2 and are all 100% owned by Playa One.

Geology

The salt lakes of Western Australia are well known for their unique and complex hydrogeochemistry, which has led to the formation of a wide variety of economic minerals and brines within the playa systems. These include the world-class Yeelirrie uranium deposit (>100 Mlb U3O8), significant potash brines, gypsum and lime-sand resources.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

16h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

17h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

17h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

22h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

01 February

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00