July 02, 2024

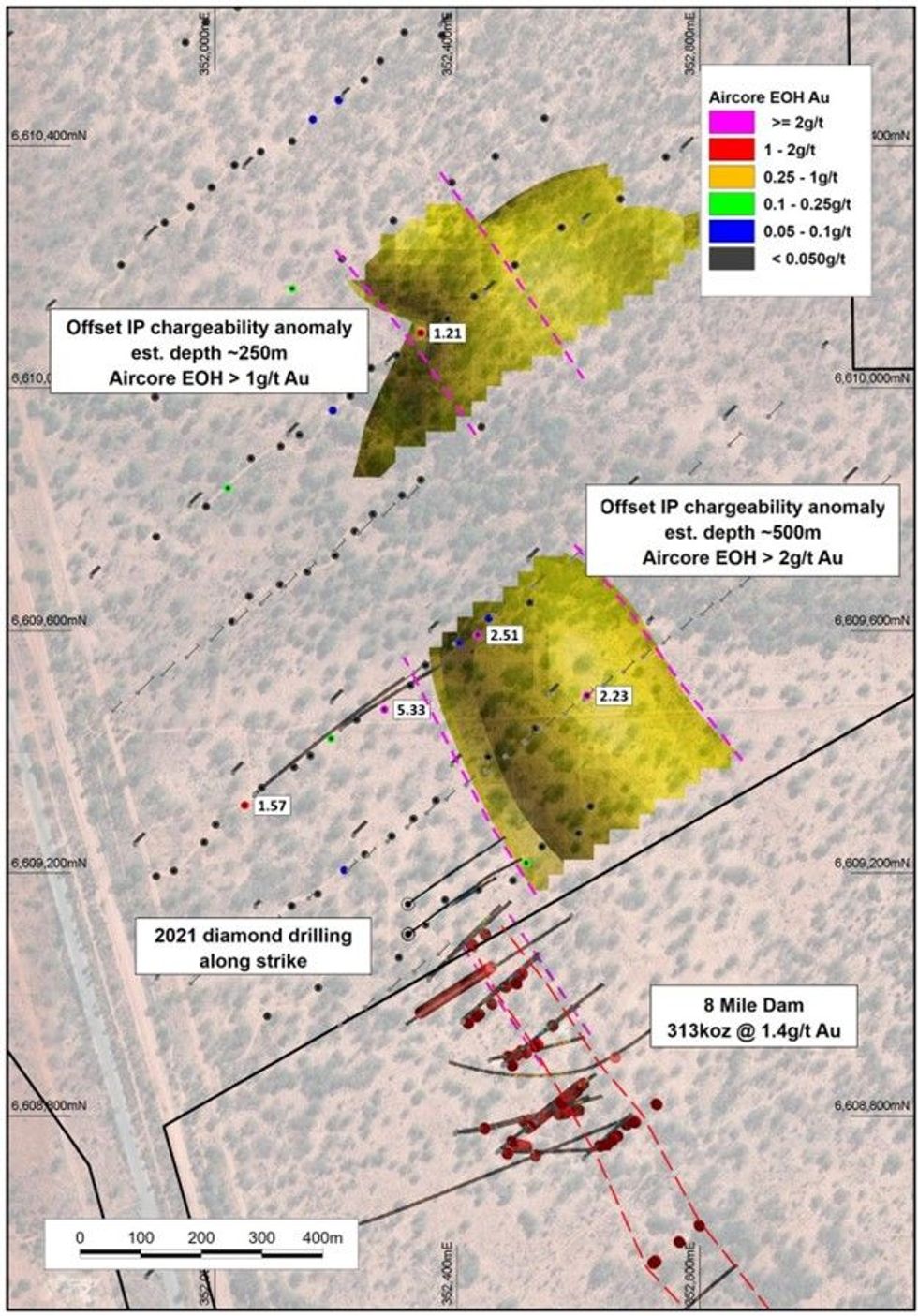

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to advise that Induced Polarisation (IP) surveys have upgraded the high-priority “8-Mile” Target within the Company’s 80%-owned Gidji JV Project and adjacent to Northern Star Resources Limited’s 313koz “8 Mile Dam” gold deposit.

- IP survey outlines potential extensions to 313koz 8 Mile Dam gold deposit

- Significant aircore EOH gold results above IP anomalies offset by faulting

- Drill testing at 8-Mile planned after maiden Bangemall Ni-Cu-Co-PGE drilling campaign

A recently completed IP survey at the 8-MileTarget (Figure 1) has extended the chargeability anomaly offset from the northern end of the 8 Mile Dam gold deposit and which underlies multiple significant aircore end of hole (EOH) gold results (Figure 2).

Miramar’s Executive Chairman, Mr Allan Kelly, said the new IP anomaly was shallower than expected.

“It appears the 8 Mile Dam deposit could continue for some distance to the north but has been offset by faulting, including at the tenement boundary,” he said.

“The fact that we have multiple aircore holes ending in elevated gold over the IP anomalies strengthens this theory,” he said.

“It’s also pleasing to see that the northern part of the IP anomaly is shallower than expected,” he added. “We look forward to drill testing this high priority target later in the year,” he said.

Background

According to publicly available data, the 8 Mile Dam gold deposit (7Mt @ 1.4g/t Au for 313,977oz1) comprises shallow supergene and deeper primary gold mineralisation hosted in:

- Quartz-carbonate-sulphide veins within hanging wall sediments; and

- A hydrothermally altered mafic unit cut by quartz veins with sphalerite, chalcopyrite and visible gold

Figure 3 shows a cross section through the deposit, approximately 60m south of the tenement boundary.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

4h

Is Now a Good Time to Invest in Copper? Experts Tout Bullish Fundamentals

Copper prices surged to an all-time high in January after a tumultuous 2025. Although there was some panic buying in the sector at a couple of points last year, prices began to trade on market fundamentals in the third and fourth quarters, driven by significant supply disruptions.At this year's... Keep Reading...

10 February

Nine Mile Metals Intersects 44 Meters of Copper Mineralization and Provides Drill Program Update

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to provide the details of drill hole WD-25-05 in addition to a summary of the 2025 drill program completed in December at the Wedge Project.Drillhole WD-25-05:DDH WD-25-05 collared... Keep Reading...

09 February

Rio Tinto and Glencore Walk Away from Mega-Merger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination have been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00