Pampa Metals Corp. ("Pampa Metals" or the "Company") (CSE:PM)(FSE:FIRA)(OTCQB:PMMCF) is pleased to launch a non-brokered private placement offering (the "Offering") of up to 5,333,334 units ("Units") at a price of $0.15 per Unit for gross proceeds of up to $800,000. Proceeds will be used to support the previously announced ~2,100m diamond drill program of 3 deep holes at the Buenavista target and the Block 4 Project more broadly. Scheduled to commence in early April 2023, with preparatory works already underway, the program is expected to be completed within 2 months and assay results received in June

Non-Brokered Private Placement

The Company is pleased to launch a non-brokered private placement offering (the "Offering") of up to 5,333,334 units ("Units") at a price of $0.15 per Unit for gross proceeds of up to $800,000. Each Unit will consist of one fully paid common share one purchase warrant (a "Warrant"). Each Warrant shall entitle the holder to acquire an additional common share at a price of $0.21 for a period of 3 years after the closing of the Offering.

In connection with the Offering, the Company will pay finder's fees of up to 7% in cash and 7% in finder's warrants from the sale of Units to third parties sourced by finders. Finder's warrants will be on the same terms as those issued under the Offering and entitle the holder to purchase one common share of the Company at a price of $0.21 per share for a period of 3 years from the closing date.

In addition to supporting drill testing of the Buenavista target and the Block 4 Project more broadly, proceeds of the Offering will be directed towards due diligence on the identification and possible acquisition of large porphyry copper-molybdenum targets capable of complementing the Company's existing portfolio (which acquisition will not be a "significant acquisition" for securities law purposes, as defined in National Instrument 51-102 - Continuous Disclosure Obligations), as well as general corporate purposes.

Units will be offered by way of the "listed issuer" exemption under National Instrument 45-106 - Prospectus Exemptions in all the provinces of Canada with the exception of Quebec. A potential investor resident in Canada (except Quebec) is not required to be an "accredited investor" under applicable Canadian securities laws to participate in the Offering. The securities forming part of the Units are expected to be immediately freely tradeable under applicable Canadian securities legislation if sold to purchasers resident in Canada.

There is an offering document related to this Offering that can be accessed under the Company's profile at www.sedar.com and at the Company's website. Prospective investors should read this offering document before making an investment decision.

The closing of the Offering may occur in one or more tranches with the final tranche expected to occur on or before May 1, 2023, and is subject to receipt of all necessary regulatory approvals.

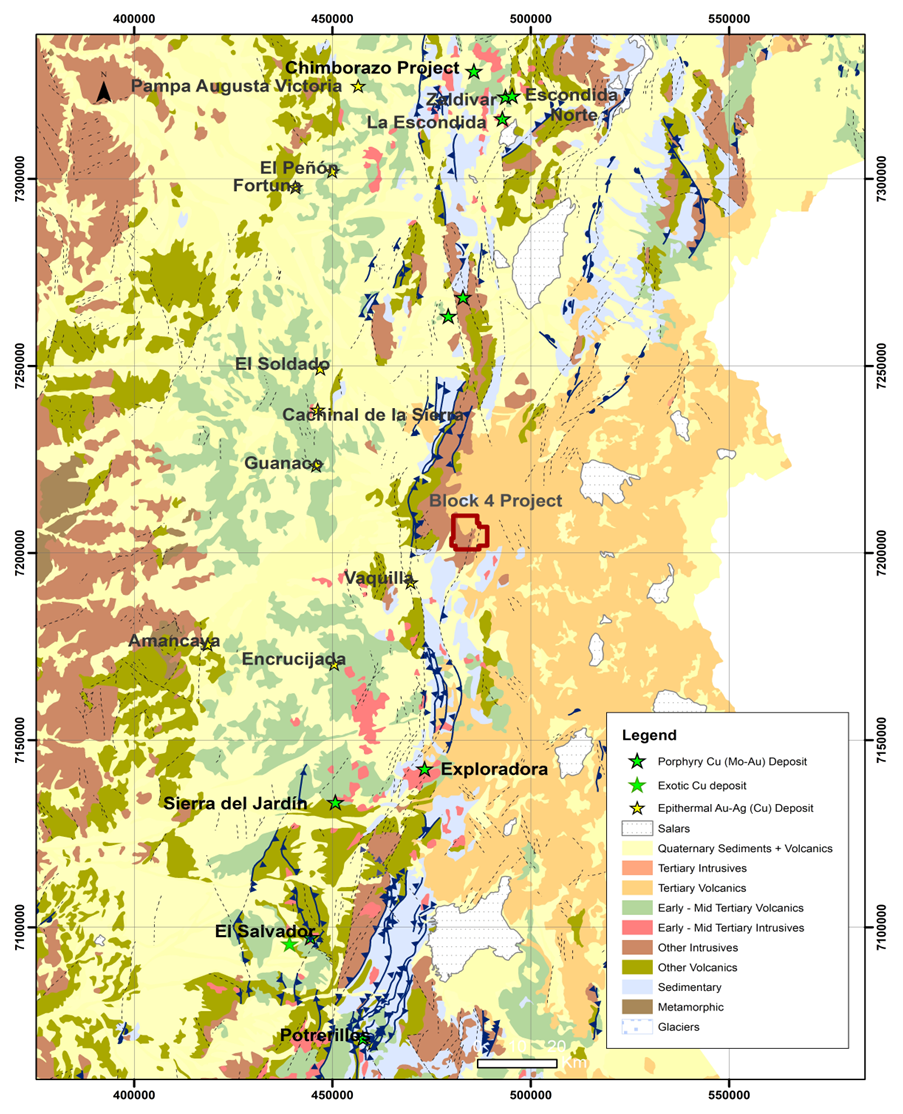

Block 4 - Regional Location Along the Domeyko Cordillera Porphyry Copper Belt

ABOUT Pampa Metals

Pampa Metals is a Canadian company listed on the Canadian Stock Exchange (CSE: PM), Frankfurt (FSE: FIRA) and OTC (OTCQB®: PMMCF) exchanges which wholly owns a 47,400 hectare portfolio of seven projects highly prospective for copper, molybdenum and gold located along proven and highly productive mineral belts in Chile, one of the world's top mining jurisdictions. The Company is actively advancing its projects through systematic exploration and drill testing of the highest priority targets, with a current focus on the Buenavista target and the Block 4 Project more broadly.

The Company's vision is to create significant value for shareholders and stakeholders through the application of its technical and commercial expertise towards exploring for a major copper discovery along the prime mineral belts of Chile. For more information, please visit Pampa Metals' website www.pampametals.com.

The latest Company Presentation can be accessed at https://pampametals.com/investor/.

Note: The reader is cautioned that Pampa Metals' projects are early-stage exploration projects, and reference to existing mines and deposits, or mineralization hosted on adjacent or nearby properties, is not necessarily indicative of any mineralization on Pampa Metals' properties.

ON BEHALF OF THE BOARD

Joseph van den Elsen | President & CEO

INVESTORS CONTACT

Joseph van den Elsen | President & CEO

joseph@pampametals.com

Neither the CSE nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENT

This news release contains certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that Pampa Metals expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects" and similar expressions, or that events or conditions "will" or "may" occur. These statements are subject to various risks. Although Pampa Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance and actual results may differ materially from those in forward-looking statements.

SOURCE: Pampa Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/744877/Pampa-Metals-Launches-Non-Brokered-Private-Placement